NEW YORK (CNN/Money) -

A surge in the March payrolls number next week would be a good sign for the broad economic recovery, but is unlikely to provide the spark that recharges the stalled stock market rally, analysts say.

"If you get a big number next week, people will say great, the labor market is finally recovering, this is the last piece in the economic recovery," said Joshua Shapiro, chief U.S. economist at economic consulting firm Maria Fiorini Ramirez Inc. "But they'll also say, well maybe now the Federal Reserve will raise interest rates sooner."

"The scenario goes both ways," he added. "Higher interest rates are not good for the stock market in general, but an improving economy is good, an increase in hiring and corporate profits, all of that is good for the health of the economy and the stock market."

By all accounts, first-quarter earnings are expected to be good. With results assumed to be upbeat, the focus of many market watchers has turned to the March payrolls report, due next Friday, just before the start of earnings season.

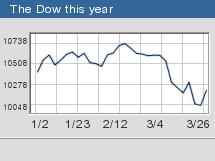

The U.S. stock market's more than two-week selloff was to some extent sparked by the surprisingly weak payrolls in February, when only 21,000 new jobs were added to the economy, when economists were expecting 125,000.

The hope is now that if the March payrolls number is particularly strong, the rally of 2003 and early 2004 may be revived. Analysts currently believe employers added 100,000 jobs to their payrolls last month. On Friday, a few firms even raised their estimates to the 120,000 to 130,000 range.

But the perception that a strong payrolls number will revive the stock market rally is perhaps overly optimistic, some analysts said.

"Everyone has talked about employment being the missing link in the recovery, but as the weekly jobless claims have made clear for some time, employment is moving in the right direction, it's just moving very slowly," said Brett Gallagher, head of U.S. equities at Julius Baer. "At whatever point a substantial recovery in jobs really takes hold, that's probably going to be a difficult time for the stock market."

Corporate profits are at an historic high, Gallagher said, in part because businesses have cut costs by having fewer people on their payrolls. Outsourcing, increased worker productivity, and the benefits of the low interest rate environment have all had an impact as well. But that's bound to change sooner or later, and the new period will be hard for the stock market, he said.

"Companies will eventually run out of ways to squeeze more efficiency from the existing workforce," Merrill Lynch chief North American economist David Rosenberg wrote in a recent note. "When that happens, they'll step up the pace of hiring."

In such an environment, Gallagher said, corporate profit margins are going to move lower. In addition, rising interest rates will put a crimp on many of the factors that have supported consumer spending over the last few years -- including the boom in mortgage refinancing, the rise in bond prices, low rates on credit cards and other means of borrowing, not to mention the Bush administration's tax cuts.

Still, no one expects the Fed to jump in and raise rates at the first sign corporate hiring managers are getting busy again.

"The Fed is not going to raise rates right away, even if the March numbers are really strong," said Shapiro. "They are going to wait until they get several months of very strong numbers, and for people to start really feeling that the labor market is improving before they raise rates."

Fed officials Donald Kohn and William Poole this week issued differing views about inflation and the length of time interest rates will remain at their current lows, signaling to some that the Fed's consensus on these subjects is starting to dissolve.

YOUR E-MAIL ALERTS

|

Follow the news that matters to you. Create your own alert to be notified on topics you're interested in.

Or, visit Popular Alerts for suggestions.

|

|

|

|

But the analysts don't necessarily think so. "I don't see the comments from these two representing a change in the Fed's policy," Shapiro said. "Everyone knows that rates this low can't last, but the same issues remain -- 'When do you raise rates? What is the right timing'?"

There is a belief that the Fed would be reluctant to raise rates ahead of the presidential election in November for fear of having an impact on its result. Whether Friday's numbers are strong enough to raise hopes of a labor market recovery and concerns about higher interest rates before the election remains to be seen.

Shapiro says the coming week's consumer confidence numbers from the Conference Board will be particularly telling, due to the fact that last month, the weak payrolls report was preceded by a surprising drop in consumer confidence. For a look at this report and other factors that are likely to influence trade in the week ahead, see the list below.

Key events in the week ahead

- Tuesday brings the Conference Board's March tally on consumer confidence. It's expected to dip to a read of 86 from 87.3 in February, according to Briefing.com forecasts.

- Retailers Best Buy (BBY: down $0.34 to $48.19, Research, Estimates) and Circuit City (CC: down $0.23 to $10.70, Research, Estimates) will report their quarterly earnings results before the start of trade Wednesday. Best Buy is thought to have earned $1.39 per share, up from $1.16 per share a year earlier, according to a consensus of economists surveyed by First Call. Circuit City is thought to have earned 36 cents per share, unchanged from a year earlier.

- Two reports on the manufacturing sector are due during the week. Wednesday brings the Chicago PMI, a regional read thought to have fallen to 61.0 in March from 63.6 in February. Thursday brings the Institute for Supply Management's read on the manufacturing sector. The index is expected to have fallen to 59.8 in March from 61.4 in February, as per Briefing.com.

- Wednesday also brings the February read on factory orders, thought to have risen 1.4 percent after falling 0.5 percent in January.

- Friday's monthly unemployment report is the week's biggest piece of news. Employers likely added 100,000 jobs to their payrolls in March, economists surveyed by Briefing.com expect. That would be up from 21,000 new jobs added last month. The unemployment rate is forecast to hold steady at 5.6 percent.

|