NEW YORK (CNN/Money) -

Independence Air will attempt to become the next big thing in discount airlines by flying small jets.

|

|

| Independence Air, the newest low-fare airline, will start operations June 16 using 50-seat regional jets never tried before by a discount carrier. |

Owned by regional feeder airline operator Atlantic Coast Airlines Holdings (ACAI: Research, Estimates), Independence starts flying Wednesday using the 50-seat regional jets it has been flying under the names "United Express" or "Delta Connection."

The airline's plans will bring the first taste of discount air fares to a number of secondary markets in cities from Columbia, S.C., to Lansing, MI, to Portland, ME -- where it doesn't make sense to use the larger aircraft the other discount carriers fly.

The smaller jets also allow Independence to have a greater frequency of flights, something desired by business travelers who pay somewhat of a premium for making last-minute reservations.

"Business travelers make the decisions based on schedule, leisure travelers do it based on price," said Independence Air spokesman Rick DeLisi. "We think we can be very competitive in both areas."

Not so fast

But many analysts have doubts about Independence Air's strategies, wondering if the smaller aircraft can work in the low-cost, low-fare model. The regional jets, or RJ's as they're known, have a higher cost per mile flown by each paying passenger due the smaller capacity. And some customers prefer not to fly on the smaller aircraft.

"I think it's pretty risky what they're doing," said Ray Neidl, airline analyst with Blaylock & Partners. "I'm a real fence sitter here -- I'm real skeptical you can run a low cost carrier using regional jets."

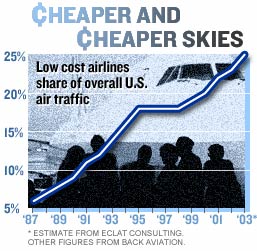

If Independence Air is a success, it will change the assumptions about the business model for low-fare airlines, and could bring the lower fares to much more of the country than now served by the discount carriers.

And even if it ultimately proves a failure, Independence Air is likely to shake up the airline industry, especially on the East Coast, for much of the next year or two, as competitors react to its fares and the sudden increase in capacity with their own round of fare cuts.

"Atlantic Coast's metamorphosis into Independence Air is one of the most interesting developments in the industry today and will be a highly disruptive event," said UBS airlines analyst Robert Ashcroft.

It's not just the smaller markets that are gaining a bigger discount carrier presence with Independence's debut.

It will serve such major airports such as Newark Liberty Airport in the New York area and Chicago's O'Hare International Airport, neither of which has much in the way of low-fare service, as well as major airports with only limited low-fare airline operations such as Boston Logan Airport and Dulles International Airport outside of Washington D.C., which will serve as its hub. And it could start transcontinental service soon after it gets some bigger jets later this year.

Losses projected

Independence will start by reaching five cities out of its Dulles hub, but by Sept. 1, as it moves to end its feeder services, it plans to be reaching 35 cities with 300 departures a day at the airport using its 87 regional jets.

| Related stories

|

|

|

|

|

It has orders with Airbus Industrie for 27 A319 jets, which are roughly comparable in size to jets used by discount competitors such as Southwest Airlines and JetBlue Airways. But it will only have four of these planes delivered this year and another 18 in 2005, meaning the regional jet fleets will carry the bulk of the traffic during its first years of operation.

The airline is projecting losses through the second quarter of next year, a change from the profits it's been able to post in the face of the post-Sept. 11 industry downturn.

Click here for a look at airline stocks

However, analysts, who are generally bullish about low-fare airlines' competitive advantages over older carriers, have doubts Independence can return to profitability by the third quarter 2005.

Neidl has a 'hold' recommendation on Independence Air, which makes him one of the more bullish analysts on the stock. The First Call consensus 12-month price target for Atlantic Coast Airlines is $5.00, or roughly 18 percent below current prices. And shares are down about 40 percent over the last six months, making it one of the worse performers in the battered airline sector during that time.

One key factor that even skeptics admit works in favor of Independence Air is a strong balance sheet. The holding company had $350 million in cash and cash equivalents on the balance sheet in its most recent earnings report, more than twice the reserves that JetBlue had at its launch. Even some of those with 'sell' recommendations on the stock expect the company to use its reserves to eventually reach profitability.

"Atlantic Coast has got cash, clever and motivated management and (we project) staying power -- but also many competitors trying to strangle it at birth," wrote Ashcroft, who has a "reduce 2" rating on the stock.

Analysts quoted in this report do not own any shares of Atlantic Coast and their firms do not have any investment banking relationships with the company. This is an updated version of a story that first ran June 9.

|