NEW YORK (CNN/Money) -

U.S. stock markets rallied sharply Tuesday, extending morning gains, after the Federal Reserve raised interest rates another quarter-percentage point, as had been widely expected.

However, stocks were headed for a weaker open Wednesday, led by some technology declines, as investors took a mixed reaction to Cisco Systems' after-hours report, and a profit warning from National Semiconductor.

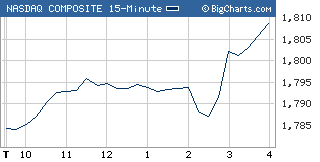

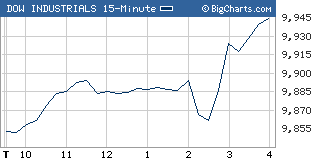

On Tuesday, the Nasdaq composite (up 34.06 to 1,808.70, Charts) rallied 1.9 percent, and the Dow Jones industrial average (up 130.01 to 9,944.67, Charts) and the Standard & Poor's 500 (up 13.82 to 1,079.04, Charts) index both rose 1.3 percent.

All three indexes had started the session with gains, ahead of the announcement, then briefly cut their gains in half in the immediate aftermath of the Fed statement, before returning to rally mode, ultimately closing at the highs of the session.

"The Fed announcement was no surprise, so you're seeing the market breathe a sigh of relief," said Doug Sandler, an equity strategist at Wachovia Securities.

At the conclusion of its interest-rate policy-setting meeting, the central bank opted to boost its target for the fed funds rate, an overnight bank lending rate, by a quarter percentage point to 1.50 percent.

In the statement, the central bank's policymakers acknowledged the impact of higher energy prices on economic output and improvement in the labor market. But they added that the economy "nevertheless appears poised to resume a stronger pace of expansion going forward."

This was taken as a positive, analysts said, reiterating remarks by policymakers that recent economic softness is seen as temporary.

The initial stock dip may have reflected some disappointment on the part of some market participants who were hoping the Fed would hint it won't boost rates at its September meeting, due to the recent economic weakness -- including last week's weak July jobs report.

"The Fed confirmed expectations, which was for them to raise, but the language was very minimal regarding the economy, which in this environment, is positive," said Michael Darta, chief economist at MKM Partners.

Stock investors are wary of higher rates since they tend to slow the economy, and corporate earnings growth.

Wednesday's open could be less jubilant, however.

After the close of trade, Cisco Systems (CSCO: up $0.41 to $20.46, Research, Estimates) reported earnings that rose from a year earlier and topped expectations. However, investors pushed the shares lower in after-hours trade on concerns about sales and gross margins. Other techs retreated along with Cisco.

In addition, National Semiconductor (NSM: up $0.08 to $15.70, Research, Estimates) shares fell 7 percent, dragging down other chip stocks, after the company warned that current-quarter revenue will come in short of expectations, due to a steeper-than-expected decrease in orders.

Walt Disney (DIS: up $0.50 to $22.44, Research, Estimates) also reported earnings after the close. The Dow component earned 29 cents per share, versus 24 cents a year earlier. Results surpassed First Call estimates by 2 cents per share. However, the stock was nearly unchanged in after-hours trading.

What moved?

Gains were broadly based, with 28 out of 30 Dow components rising, led by Honeywell (HON: up $0.86 to $35.47, Research, Estimates), United Technologies (UTX: up $1.81 to $91.28, Research, Estimates) andJP Morgan (JPM: up $0.92 to $36.99, Research, Estimates).

During the session, ahead of its earnings, Cisco rose 2 percent and led the list of heavily-weighted Nasdaq stocks boosting the composite. Microsoft (MSFT: up $0.54 to $27.72, Research, Estimates) and Oracle (ORCL: up $0.23 to $10.60, Research, Estimates) added 2 percent as well.

The major indexes tumbled last week and for most of July on a combination of worries about higher oil prices and slower economic growth, setting stocks up for a bit of a snap back this week.

"I think we were due for a bounce regardless of the Fed news today," Wachovia's Sandler added, "The announcement just provided the incentive."

Also bolstering the market was a government report released before the open that showed business productivity rose at a 2.9 percent annual rate in the second quarter, versus expectations for a pace of 2 percent. Productivity rose 3.8 percent in the first quarter.

Oil prices remained not far from record highs. However, the Fed news distracted investors from the negative implications.

U.S. light crude for September delivery touched an all-time high of $45.04 a barrel Tuesday morning as unrest in Iraq disrupted some crude output, exacerbating worries about a global supply crunch.

But prices eased through the afternoon, with NYMEX light crude futures eventually ending down 32 cents at $44.52 a barrel.

Among other movers, May Department Stores (MAY: up $1.00 to $25.90, Research, Estimates) rose 4 percent after reporting earnings of 36 cents per share, a penny more than expected and an improvement from a loss a year earlier.

AmeriCredit (ACF: up $3.44 to $20.97, Research, Estimates) rose nearly 20 percent in active New York Stock Exchange trade after the company reported a quarterly profit late Monday, versus a year-earlier loss and boosted its earnings-per-share forecast for fiscal 2005.

Graphics design chipmaker nVidia (NVDA: up $0.78 to $10.63, Research, Estimates) rose after saying Monday that it would repurchase $300 million of its own stock. Stock buybacks often boost the shares of a company because they are seen as a sign of corporate confidence.

Market breadth was positive. On the New York Stock Exchange, advancers topped decliners by close to three to one on volume of 1.23 billion shares. On the Nasdaq, winners beat losers by eleven to five on volume of 1.44 billion shares.

Treasury prices tumbled after the announcement, reversing course after having been higher all session.

The 10-year note fell about a quarter point, boosting its yield to 4.27 percent, having been at 4.24 percent before the announcement. It was at 4.26 percent late Monday. Treasury prices and yields move in opposite directions.

The dollar recovered from morning weakness versus the euro and extended its gains against the yen.

COMEX gold fell 70 cents to settle at $402.30 an ounce.

|