NEW YORK (CNN/Money) -

Oil prices ended at new record highs on Friday, underpinned by fresh evidence of strong Chinese demand, worries about sabotage in Iraq and fears of unrest in Venezuela, where President Hugo Chavez faces a referendum this weekend on his presidency.

News of an explosion at BP's Whiting, Indiana refinery also helped push U.S. light crude more than a dollar higher than the previous close.

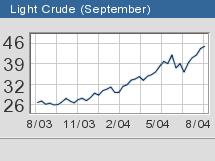

U.S. light crude for September delivery settled at $46.58 on the New York Mercantile Exchange, up from a record close of $45.50 on Thursday.

Prices have hit new records in all but one of the last 11 trading sessions, buoyed by world oil demand growth that is running at the fastest rate in 24 years and on concerns about stretched world production capacity.

In London, Brent crude for October contract also reached a record $42.91 a barrel, up $1.37 on the session.

"None of the fears about supply have gone away and demand growth shows no sign of slowing," said independent London oil analyst Geoff Pyne. "That makes it a difficult market to sell."

On Friday, China said crude imports into the world's second biggest consumer held strong in July at a growth rate of 40 percent over the same period last year. China's crude imports averaged 2.49 million bpd in the first seven months of 2004, also up 40 percent compared to the matching period in 2003, the official Xinhua news agency said.

The import figures suggest China's demand for oil has not been dented yet by Beijing's efforts to rein in its strongly growing economy, or by high prices.

Chinese officials say high refinery runs by state oil company Sinopec continue to attract heavy crude imports.

"Sinopec had planned higher second-half refinery production versus the first half, which means high crude imports will stay," said an official with China's top oil refinery Zhenhai Refining & Chemical Co.

In the United States, BP said a blast at its 420,000-barrel-a-day Whiting, Indiana refinery, the nation's third biggest, had closed a petroleum product processing unit.

Iraqi oil exports flowed normally from the country's southern fields to offshore terminals after pumping resumed through a main pipeline sabotaged on Monday, an official from Iraq's South Oil Company said.

But traders worry that Iraqi rebels loyal to Shi'ite Muslim cleric Moqtada al-Sadr will attack oil infrastructure after U.S. forces stormed the holy city Najaf to quell a week-long uprising by Sadr supporters.

There were also concerns that Sunday's referendum in Venezuela may lead to violence if Chavez is defeated, and put the country's oil shipments at risk.

"Anything less than a clear answer will likely perpetuate the country's political turmoil," Washington consultants PFC Energy said in a report.

Energy Minister Rafael Ramirez gave reassurances on Thursday that Caracas would guarantee supplies to the world market whatever the outcome of the vote.

Uncertainty also remains over oil exports from Russia's Yukos, which continues to battle bankruptcy but has so far avoided any disruption to its 1.7 million bpd of production.

U.S. production in the Gulf of Mexico was cut back this week due to a tropical storm, while government data showed a hefty and unexpected drop in national crude inventories.

-- Reuters contributed to this report

|