NEW YORK (CNN/Money) -

Stocks managed to cut losses by the end of an otherwise down session Thursday, in which record-high oil prices put an end to the markets' four-day winning streak.

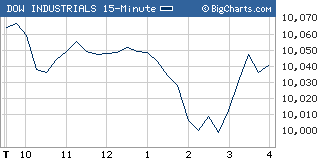

The Dow Jones industrial average (down 42.33 to 10,040.82, Charts) and the Standard & Poor's 500 (down 3.94 to 1,091.23, Charts) index both lost about 0.4 percent.

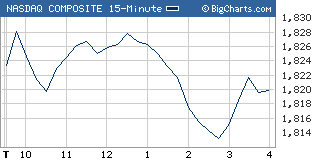

The Nasdaq composite (down 11.48 to 1,819.89, Charts), which had gained the most over the previous four sessions, fell about 0.6 percent.

In the session's biggest corporate news, Google (GOOG: up $15.34 to $100.34, Research, Estimates) made its long-awaited market debut at around noon, jumping to more than $100 after pricing its initial public offering at $85 a share late Wednesday, the low end of its revised range. For more on Google, click here.

Worries about oil prices and a second-half slowdown pummeled stocks for most of the summer. But after hitting new 2004 lows during trading last Friday, stocks rose for four straight sessions.

Thursday's pullback ultimately ended up being pretty mild, with stocks recovering from steeper midafternoon losses. In the very short-term, analysts say, the selling may be over. But they also don't see an incentive to rally.

"It was great that we had three or four days of a healthy bounce," said Douglas Altabef, managing director at Matrix Asset Advisors. "But our take is that the market is being unduly punitive right now."

Tim Heekin, head of stock trading at Thomas Weisel Partners said that the market probably put in a good short-term low during last Friday's session, but that for now it "feels like we're not going to get anywhere fast."

"There's no economic news out Friday or Monday, and the economic news the rest of next week is not hugely influential," Heekin added.

The week after next brings the Republican National Convention (RNC) in New York. The RNC runs between Monday Aug. 30 and Thursday Sep. 2. Volume that trading week is likely to be particularly light, even for the summer.

"I don't think we're going to be able to see anything much until we at least get past Labor Day," Heekin.

Altabef said he suspects that in September a sense that business spending is picking up and that economic activity has not slowed as much as many investors thought may help the market make a more sustained push higher.

The oil factor

In the commodity market, crude oil for September delivery settled at $48.70 a barrel on the New York Mercantile Exchange, a new high and a gain of $1.43.

Prices have hit record highs in 15 of the last 16 sessions on continued concern about strong global demand and possible supply shortages. Thursday's spike followed news that Iraqi militants had set fire to Iraq South Oil Company buildings.

Many analysts are expecting crude to soon surpass $50 a barrel and perhaps go even higher. Long term, higher energy prices negatively impact corporate profits by raising company costs. They also hit consumer demand, all of which is bad for stocks.

Alternately, there is a risk that crude will keep hitting all-time highs for a little bit longer, then start to fall steadily, which would be ugly for stocks, Altabef said. Some economists and market watchers have recently highlighted concerns that oil prices could plunge in the next year or more.

Synopsys warns, plunges

Elsewhere, Synopsys (SNPS: down $6.63 to $14.65, Research, Estimates) tumbled more than 31 percent in active trading after warning that reduced licensing bookings for its software will hurt results in the current quarter and fiscal 2005.

The maker of software for microchip design also reported fiscal third-quarter earnings that fell from a year earlier, due to the weak bookings. The earnings were a penny a share more than what analysts were expecting.

The company joined a list of tech companies recently warning of declining demand, which adds to concerns about a tech spending slowdown.

Continuing the trend, after the close of trade, Novell (NOVL: Research, Estimates) reported earnings of four cents per share, twice what it earned a year earlier and two cents short of analysts' estimates. The company does not provide forecasts, however, Novell's CEO said that results were hit by weakness in tech spending for infrastructure software and that this weakness would likely continue.

A number of heavily weighted big-cap techs also declined, including Intel (INTC: down $0.21 to $22.01, Research, Estimates) and Microsoft (MSFT: down $0.34 to $27.12, Research, Estimates), both of which are Dow components and trade on the Nasdaq.

Shares of Nortel Networks (NT: up $0.14 to $3.74, Research, Estimates) gained nearly 4 percent after it said it would cut 3,500 jobs, or about 10 percent of its workforce. The embattled telecom gear maker is also restating results due to accounting problems that go back to 2001.

Market breadth was negative. On the New York Stock Exchange, decliners beat advancers by more than 8 to 7 as nearly 1.25 billion shares changed hands. On the Nasdaq, volume stood at almost 1.40 billion shares, and losers topped winners by more than 3 to 1.

After the close of trade, apparel retailer Gap (GPS: Research, Estimates) reported earnings of 21 cents per share, a penny shy of a year ago and in line with expectations.

Philly Fed, LEI disappoint

Economic news released Thursday was disappointing, but it didn't seem to have much impact on trading.

Released at noon, the Philadelphia Fed index, a reading on manufacturing in three mid-Atlantic states, fell to 28.5 in August after hitting 36.1 in July. Analysts expected a reading of 30.8.

Earlier in the morning, a report showed that the index of leading economic indicators (LEI) fell 0.3 percent in July, after falling an upwardly revised 0.1 percent in June. Economists surveyed by Briefing.com were expecting a 0.1 percent decline.

Released before the open, a report showed that 331,000 Americans filed new claims for unemployment last week, down 3,000 from the revised reading the previous week. That was roughly in line with forecasts.

Treasury prices gained, pushing the 10-year note yield down to 4.21 percent from 4.23 percent late Wednesday. Bond prices and yields move in opposite directions.

In currency trading, the dollar declined versus the yen and euro.

COMEX gold rose $2.70 to settle at $409.30 an ounce, rising with other dollar-traded commodities.

|