NEW YORK (CNN/Money) -

Stocks surged Wednesday, rallying across the board as investors cheered a sharp drop in oil prices.

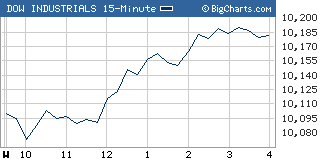

The Dow Jones industrial average (up 83.11 to 10,181.74, Charts) and the Standard & Poor's 500 (up 8.77 to 1,104.96, Charts) index both rose around 0.8 percent.

The Nasdaq composite (up 23.83 to 1,860.72, Charts) jumped 1.3 percent.

Helping the markets was a drop of nearly 4 percent in oil prices.

U.S. crude for October delivery tumbled $1.74 to settle at $43.47 a barrel on the New York Mercantile Exchange. It was the fourth straight session oil prices have fallen after hitting all-time highs last Thursday.

Oil had edged higher earlier in the session after U.S. weekly data showed weaker-than-expected crude oil inventories, but it turned around in the afternoon as traders focused on gasoline inventories that held steady instead of falling. That, in turn, triggered a wave of stock buying.

The advance was broad based, with 27 of 30 stocks in the Dow industrials gaining.

The biggest winner in the Dow was Boeing (BA: up $1.59 to $52.50, Research, Estimates), up more than 3 percent. Singapore Airlines announced plans to buy up to 31 long-range Boeing planes in a deal that could be worth around $7.35 billion.

"The tone is positive, and I think that will continue for the next few days," said Peter Brodie, senior vice president and director of investments at Bryn Mawr Trust Wealth Management.

But he cautioned that low summer volume means it's uncertain how long the rally might last.

Market breadth was positive, and volume was light. On the New York Stock Exchange, advancers beat decliners by 11 to five as 1.18 billion shares changed hands. On the Nasdaq, winners topped losers by two to one as 1.30 billion shares traded.

Volume is likely to stay light through next week's Republican National Convention (RNC) in New York, analysts said. The RNC starts Monday and runs through Thursday, Sept. 2.

"After the convention, after Labor Day, volume should pick up and we'll go from there," said Mark Bryant, senior vice president at Brean, Murray & Co.

After the close of trade Wednesday, Starbucks (SBUX: up $0.38 to $46.04, Research, Estimates) said that sales at stores open a year or more rose 8 percent in August from a year ago. Analysts were expecting a gain of around 10 percent. Shares fell 4 percent in after-hours trade.

Also likely to be of interest Thursday: earnings from Krispy Kreme. The retailer's stock is hardly a market mover, but it is one that many investors keep an eye on. The company is expected to have earned 22 cents per share, versus 21 cents a year ago.

The weekly jobless claims report is due before the open Thursday. The number of Americans filing new claims for unemployment is expected to have risen to 335,000 last week from 331,000 the week before.

New home sales slip

Morning reports offered mixed reads on the state of the economy, doing little to dispel concerns that the recovery has stalled.

Released shortly after trading began, a government report showed July new home sales fell 6.4 percent versus forecasts for a fall of just 2 percent.

The June read was revised lower as well, suggesting that the buoyant housing market is indeed slowing a bit. A report Tuesday showed a decline in existing home sales.

In a separate report released before the bell, orders for durable goods -- items meant to last three years or more -- rose 1.7 percent in July from the previous month, after rising 1.1 percent in June. The increase was the strongest since March and beyond what economists were expecting.

The report provided a much-needed sign of optimism about business spending at the end of a tough summer.

A variety of tech issues gained, lifting the Nasdaq. Among the day's advancers, Intel (INTC: up $0.28 to $21.95, Research, Estimates) and Microsoft (MSFT: up $0.31 to $27.55, Research, Estimates) both added more than 1 percent.

Among other active issues, Gap (GPS: down $0.41 to $19.52, Research, Estimates) shed 2 percent after Merrill Lynch downgraded the stock to "neutral" from "buy," due to concerns about potential weak sales and earnings growth going forward.

Banknorth Group (BNK: up $3.18 to $34.88, Research, Estimates) is in talks with Toronto Dominion Bank (TD: down $1.03 to $34.16, Research, Estimates) to potentially accept a multibillion dollar buyout offer by the fellow bank. Shares of Banknorth rose more than 10 percent, while Toronto Dominion fell nearly 3 percent.

OmniVision Technologies (OVTI: down $0.40 to $11.17, Research, Estimates) lost 3 percent after warning late Tuesday that current-quarter results will miss analysts' expectations. The maker of image sensors used in digital cameras also reported stronger quarterly results.

Treasury prices edged higher, pushing the yield on the 10-year note to 4.26 percent from 4.27 percent late Tuesday. Treasury prices and yields move in opposite directions.

In currency trading, the dollar gained against the yen and was little changed versus the euro.

COMEX gold rose $5 to settle at $410 an ounce.

|