Toyota eyes Nascar America

Sunday will mark the last time the Daytona 500 will be for Detroit's Big Three only, as Toyota makes a play for Nascar's checkered flags and fans.

NEW YORK (CNNMoney.com) - As if the Big Three automakers didn't already have enough competition from Toyota, this Sunday will mark the last all-American Daytona 500. Starting with the 2007 season Toyota (Research) will have cars in the nation's premier Nascar auto race, as the Japanese automaker tries to make further gains in U.S. auto sales. Only Chevrolet, Ford and Dodge had cars in this year's race.

Toyota has already been advertising on Nascar races -- it had two new commercials debuting during this weekend's race. And it has been participating in Nascar's Craftsman Truck series for the past three seasons, but that circuit is still minor league compared to Nascar's Nextel Cup circuit, which it will join next year. Nascar is the nation's No. 2 spectator sport behind football. An American brand

With its entry into the Nextel Cup races next year, Toyota is attempting to portray itself as an American brand, with the hope of stealing market share from General Motors (Research), Ford (Research) and DaimlerChrysler (Research). "No question we're trying to make sure the population of the country in general, and Nascar fans in particular, know that Toyota is committed to this country," said Les Unger, national motorsports manager for Toyota Motor Sales USA. "We have about 130,000 to 150,000 Americans directly employed by Toyota and its dealers. It's our No. 1 market in the world, and we hope to make further inroads." Even GM admits that the move should give Toyota access to some car buyers who weren't looking at the brand in the past. "If you look at the fact that Nascar fans prefer to purchase products of sponsors and participants, you would have to say that any company new to Nascar will be more attractive to its fans," said Dave Hederich, spokesman for GM Motorsports, although he added that doesn't necessarily mean that GM will be hurt by Toyota's entry. "When you go up against a tough competitor, you expect to win some and lose some," he said. "Let's put it this way, you don't get into professional auto racing if you're afraid of tough competition." Toyota's move into Nascar wasn't a shock -- it had been seen as moving in that direction for several years. David Cole, chairman of the Center for Automotive Research, said Toyota may be the first Asian automaker in Nascar, but it likely won't be the last. "I would expect we'll see Honda (Research), Hyundai, Nissan (Research), maybe some of the Europeans," he said. "Nascar has been so attractive as a sporting event, any manufacturer who ignores it is making a big mistake. I guess my question for Toyota would be what's taken them so long." Nascar fans already open to Toyota

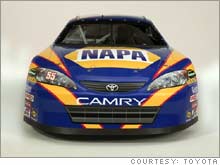

You would think that Nascar fans will be a tough sell for Toyota. While the sport today does have a nationwide fan base, about 38 percent of Nascar fans are still concentrated in the Southeast -- not the strongest region of the country for Toyota sales. "Going in, there will be a segment of the fan base that may not be as open to Toyota," Toyota's Unger admitted. "But I think our teams will be very successful over time in convincing the segment that views us with some skepticism today. The fans who attend and watch the trucks race have accepted the fact that Toyota is helping to build that series." And Toyota may not have as far to go in winning over Nascar fans as one might think. The Simmons National Consumer Survey in 2005 showed that about 10 percent of Nascar's 75 million fans already own Toyotas, compared to Toyota's overall U.S. market share of 13.3 percent for 2005. "Many of our fans are automobile enthusiasts. They understand automakers are global," said Roger VanDerSnick, vice president of marketing for Nascar. "There's no backlash against Dodge being owned by the (German-based) DaimlerChrysler." Toyota has already got three teams committed to racing a Nascar version of the Camry next season. One new team will be owned by energy drink Red Bull, one by Bill Davis Racing, and another by veteran driver Michael Waltrip. The success on the track of those and of future Toyota Nascar teams will probably be more important to its sales opportunities than a non-Nascar fan might think. Even though Nascar fans know there's barely a passing resemblance between the on-track Camry and the one in dealers' showrooms, the race version is a high profile demonstration of the capabilities of Toyota's engineers. For a brand that has thrived on a reputation for reliable, reasonably-priced, and fuel-efficient vehicles, having Camrys on the track could help convince Nascar fans that the company is capable of making a performance vehicle. And that, says the Center for Automotive Research's Cole, could be the biggest edge that Toyota gains from this new effort. ____________________________________________________________ For a look at the curse of the Daytona 500 for its winner's sponsor, click here. For more on the problems facing GM and Ford, click here. For more on the business of sports, click here.

For more news on autos and automakers, click here. |

| |||||||||||||||