Not a 'sweet' tune for the other Harlem basketball team

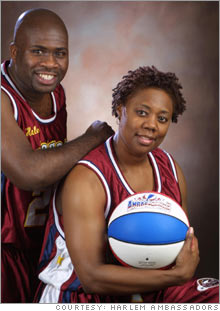

The Harlem Ambassadors claim that the Harlem Globetrotters have unfairly locked them out of bigger arenas and are taking their case to the FTC.

NEW YORK (CNNMoney.com) - The Harlem Globetrotters are known for many things, but fair competition isn't one of them. You don't reel off 22,000 wins against hapless teams like the Washington Generals unless the cards are pretty much stacked in your favor. Nonetheless, the 80-year old team is one that most adults have fond memories of: few would call the Globetrotters the Microsoft (Research) of sports.

But the team has been hit with an unfair restraint of trade complaint filed by the Harlem Ambassadors, a team similar to the Globetrotters. The Federal Trade Commission is reviewing the complaint. The Ambassadors claim that it is being blocked from many public arenas around the country by a clause the Globetrotters require in their lease agreements which prevents other exhibition basketball team from playing in the same venue around the same time the Globetrotters are scheduled to appear. That has kept the Ambassadors in high school and college gyms, playing before an average of maybe 1,500 fans, even though team executives say they are ready to move up to the next level in terms of ticket sales. The Ambassadors play most of their games as a fundraising effort by a local group such as the Girl Scouts or Rotary Clubs in the market where they are booked. They play a different team every night, made up of alumni players from a nearby college or local media personalities. And even though their opponents are actually trying to win, the Ambassadors have never lost a game. (Then again, a team of media personalities probably makes the Washington Generals look like the Jordan-era Chicago Bulls). But the show is similar to that of the Globetrotters and other exhibition basketball teams that have come and gone over the years, such as ball handling tricks and distracting the other team when they're trying to shoot. "We continue to get good reviews. We're really proud of the quality," said Dale Moss, the 49-year old president and founder of the eight-year old Ambassadors.. There are two Ambassadors traveling teams that play 220 games a year between them. Veteran players get between $25,000 to $35,000 for the year, rookies get less. "The more you play, the more you get paid," said Moss. He said the team had revenue of just under $1 million and when asked if the team is profitable said that the team "scrapes by." The Globetrotters refused to comment on the FTC complaint. But Michael McCann, a professor with the Mississippi College School of Law and an expert in sports business law, says that the FTC complaint is an uphill battle for the Ambassadors. "The FTC may look at this and say the exclusivity agreements are used by circuses and other forms of entertainment, so what's the problem," said McCann. He added though that the fact that few have tried to challenge the Globetrotters in the exhibition basketball arena does "lend credence to the Ambassadors' argument." McCann also believes that the lease clauses are probably not the best idea for the Globetrotters in the first place. "There's a real risk when you create your own David vs. Goliath story when you're the Goliath. I think the clauses are unnecessary and they would continue to do well without them," he said. "It could be the best thing for them to have a little competition." Sure, it wasn't that long ago that the Globetrotters were anything but a Goliath. As recently as 1993 the team was drawing only 300,000 fans annually and had revenues of $6 million with a net loss of $1 million. It was purchased that year by former Globetrotter player Mannie Jackson, who considered having the team filing for bankruptcy or even halting operations and trying to recoup what he could from marketing. But a 2005 press release from the team said that during the first 10 years under Jackson's ownership, sponsorship revenue rose by almost 300 percent while operating profits increased by nearly 400 percent. What's more, the team reported annual attendance of 1.3 million in 2004, a record for the franchise. The team's success allowed Jackson to sell an 80 percent interest in the team last year to an investment entity run by Roy Disney, the nephew of the founder of Walt Disney Co. (Research), for an undisclosed price. All that suggests that the Globetrotters are doing well enough now to face a little fair competition for a change. Will the NBA's new suits and ties be a slam dunk? Click here.

For a look at basketball's full court press in China, click here. |

| |||||||||||||