Baseball ticket prices: Supply, not millionaires

Tighter supply of tickets, and continued popularity of game, driving ticket price increases far more than millionaire players' salaries.

NEW YORK (CNNMoney.com) - Baseball fans love to blame players' multi-million dollar salaries for rising ticket prices. They're wrong. Sure, the average pay of a major league player is now $2.9 million, up about 25 percent in the last five years. At first blush it would seem to correspond quite nicely to ticket prices, which are up 26 percent over the same period, or about twice the rate of inflation.

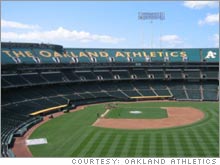

But cost of labor has very little to do with the cost a company can command in the market place. If it did, the General Motors, Ford and the U.S. airline industry wouldn't be in the shape they're in. No, what's at work here is supply and demand. Demand is up. Baseball set an attendance record last year even with the rise in ticket prices, and overall attendance is up 3 percent over the last five seasons. But more importantly, baseball management is finally figuring out supply. Perhaps the clearest example of this can be found in the upper deck of McAfee Coliseum in Oakland this year. The Athletics have stopped selling any tickets there, covering the entire level with huge tarps with the team's logos. The move has cut the supply of seats by about 10,000, or nearly a quarter of last year's capacity, and given the A's the smallest number of seats of any team in the majors. But the team hopes that it will help it sell more tickets, not less, this year. Part of the reason is atmosphere; the upper deck seats at McAfee were among the worst in baseball. "Our goal was to create a more intimate ballpark atmosphere in a cavernous ballpark setting," said team spokesman Jim Young. "There's times you could get crowds of 20,000 in the park, and in our stadium it looks like 12,000 the way they were spread out." But perhaps more important, the team also hopes that by limiting the supply of tickets, it will create some scarcity and give fans the incentive to buy tickets in advance. As long as the 10,000 lousy seats were available upstairs, fans knew they could always show up and find the better seats available for sale at the last minute. "There wasn't demand to purchase seats in advance," said Young. "It was not unusual to have 12,000 to 14,000 in walk-up sales on game night. We led the majors in walk-up sales." And walk-up sales are the sales that are most at risk of being lost due to weather, or bad performance by the team. The restricted supply of seats is one reason the Athletics have the largest percentage increase, about 25 percent, in average ticket prices so far this year, according to Team Marketing Report, a trade publication that tracks ticket prices. And the remaining seats are also showing a healthy 7.24 percent increase, according to the team's figures. The A's aren't the first. The Chicago White Sox cut their capacity by 6,600 seats before the 2004 season through a renovation of the park that eliminated the top rows of their upper deck, where the game was essentially a rumor for fans anyway. Even with a smaller park, the team's attendance essentially held solid, with more lower deck sales replacing lost upper deck sales. But the supply side is more than trimming lousy seats. A more significant cut in capacity is coming from the construction of new stadiums over the last 14 years, since Camden Yards opened in Baltimore in 1992. During that time 14 of the 26 teams that started that season have moved into new stadiums, and those new stadiums have an average of 21 percent less capacity than did their old homes. The new stadiums also have more seats positioned in the infield, and in the lower deck, which can get premium prices. And it's the explosion of those new stadiums, more than free agency or player salaries, that have driven up average ticket prices so much. A study of tickets prices and salaries in the Baseball Prospectus' new book "Baseball between the numbers: Why Everything You Know about the Game is Wrong," found there was little correlation between ticket prices and player salaries from the start of free agency in 1977 through the end of the 1980s, even as average salaries soared roughly 500 percent, adjusted for inflation. Ticket prices were little changed over the same period in constant dollars. It was the 1990s building binge, with the tighter supply of tickets, that helped raise the price of tickets. The smaller capacity for new stadiums isn't all due to an effort to drive up demand for tickets. After years of trying to build the biggest stadiums possible, team owners and facility architects have become sophisticated enough to realize adding more seats in the upper deck just isn't justified, even if the team is having enough demand for the seats to fill them. That's why the St. Louis Cardinals, one of baseball's best-supported teams, just opened a new stadium with 11.5 percent fewer seats than their old home. And the Yankees plan to trim capacity of their new stadium set to open in 2009 by 10 percent. "When you're adding those extra 5,000 seats, you have to build more ramps, more bathrooms, more plumbing, and it gets very expensive to build those extra seats," said Marc Ganis, an industry consultant who is working on the new Yankee Stadium plans. "The number of times you sell the last 4,000 to 5,000 seats and the fact that they're going to be the less expensive seats, does not offset the cost of operating a larger facility." And Ganis also agrees that scarcity, more than salaries, is the important driver in ticket price increases. "When you have more sellouts, there's a perception of scarcity, people are more likely to buy early, such as season ticket plans or advance ticket sales," he said. "That's the heart of psychology of ticket buying. If they feel they can always walk up and buy tickets, that's a bad thing for the team." For a look at whether the Oakland Athletics' "Moneyball" philosophy can survive, click here. For a look at baseball's improving economics, click here.

For more news about the business of sports, click here. |

| |||||||||||||