Get real

Author John Reed debunks real estate gurus and the get-rich-quick fantasies they sell.

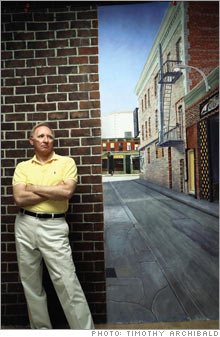

NEW YORK (MONEY Magazine) - Who's gotten rich in real estate? Many homeowners, for sure, but another group is doing just fine, thank you: the countless gurus who, in hotel meeting rooms, late-night infomercials or the pages of best-selling books, deliver the inspirational message that anyone can get rich in real estate.

Perhaps nobody spends more time scrutinizing the message - and the messengers - than John Reed. A veteran landlord, the author of 20 real estate books and a longtime newsletter publisher, Reed has been rating the experts for 25 years. On his Web site, Johntreed.com, he critiques more than 125 books, seminars and infomercials - and finds most lacking. The problem, he contends, is that it's harder to make money in real estate than most gurus would have you believe. You may not agree with his tough talk, but as the real estate bull market slows down, it's worth listening to his cautionary take. Q: Are you saying you can't get rich in real estate? Reed: Real estate is a way to get rich, but slowly, not fast, and that's if you're lucky and good. It's like any other business. You have to know what you're doing. The bad gurus teach real estate techniques that sound good to the beginner but that don't work in the real world. Q: Like what? Reed: These guys promote "get rich quick with no money down." They skip any mention that this business requires capital. You've got to have it or borrow it. For the little guy, it's like riding a raft in the ocean with a small sail and a tiny paddle. If interest rates go up, you get creamed by bigger mortgage payments. It doesn't matter how competitive, skilled, smart or good-looking you are. Gurus don't tell this to those who read their books, watch their infomercials and pay big bucks to attend their seminars. "Nothing down" is not a strategy that works. I prefer the "save for the down payment" strategy. Gurus pitch "bird-dogging" as an entry-level technique. This is new jargon used to describe a finder's fee - you find a good deal and pass along the lead for a few hundred bucks. But this is an activity for a licensed real estate agent. If something goes wrong, you could be in legal trouble in some states. They also push flipping. Flipping is to real estate investment what brain surgery is to the medical profession. The folks who make money on quick deals usually own real estate brokerages with a staff to find cheap properties and a team of contractors to bring the property up to snuff. An individual doesn't have the man-hours to do this fast enough. Q: Can't you make money fixing up a house and selling it? Reed: Cosmetic renovations don't pay. The costs are so high that you can't recoup them when you sell. To profit from fixing up a property, it must be a wreck when you buy. Fix the worst problems and sell it as a fixer-upper. People will overpay for one because they underestimate the costs of renovating. Q: But you'll make money if you buy and hold, right? Reed: This is probably the way most money in real estate has been made, but it's not an investing strategy. If you cannot forecast or control something you invest in, then you are speculating. No one can forecast or control market appreciation. Q: Aren't there any gurus you like? How can you tell a bad one for a good one? A: In 1990 I wrote the b.s. artist detection checklist - a list of traits exhibited by many of these so-called experts. They tend to talk about luxurious lifestyles. Their bios are full of words like innovative and spectacularly successful. Gurus I respect talk about their failures and successes. They're people who have been in the business and love it and want to help people be successful investors, like columnist Bob Bruss [inman.com/bruss] or author John Schaub [johnschaub.com]. The b.s. artists rarely mention the dangers of their styles. Virtually all the b.s. artists say, "I don't just teach these techniques, I use them every day." Smoke them out by asking for the addresses of properties they've owned. Q: You say the bad ones cross the line into unethical behavior. How so? Reed: They prey on the most gullible people, advocating strategies like nothing down because the people they prey on don't have a pot to piss in. The worst use high-pressure techniques to sell books, tapes and personal mentoring for thousands of dollars. One tactic is to count the crowd that's gathering and remove chairs from the meeting room to make it look like a packed house. The speaker often has a Marine drill sergeant demeanor, saying things like, "Go ahead and leave, this room is for winners!" Q: What makes your opinion worth listening to? Reed: I don't ask people to accept my opinion. I give them facts and links to laws, data and regulators. I'm the clearinghouse.

I hear every day from victims. Some of the experts are afraid to speak up because they are afraid they won't be asked to the next big real estate convention. If we don't speak up, no one will. |

| ||||||||||||