|

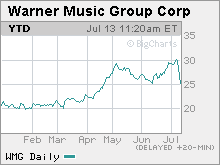

Pressing pause on an EMI-Warner deal A European court's surprise decision to overturn the Sony BMG merger makes it less likely that EMI and Warner Music will ever make sweet music together. NEW YORK (CNNMoney.com) -- The chances of a deal between Warner Music Group and EMI Group happening anytime soon took a serious blow Thursday morning. In a surprise move, a European court rejected the 2004 merger of Sony's (Charts) music division with the music business of German media conglomerate Bertelsmann that created Sony BMG, the world's second largest music company. That raises questions about whether or not an EMI-Warner deal would pass muster with regulators. Investors, who have bid up the stocks of both EMI and Warner Music for the past few months due to merger speculation, dumped shares of both companies on Thursday. Shares of EMI tumbled 9 percent on the London Stock Exchange while Warner Music Group's stock plunged 15 percent on the New York Stock Exchange. EMI and Warner Music (Charts) have been engaged in a bizarre bidding war (each company has made offers to buy the other) and a combination of the two firms would mean that there would be only three major music companies left. Universal Music, owned by French media firm Vivendi (Charts), is the world's largest record company. Independent record labels have argued that consolidation in the music industry is making it more difficult for them to compete and also is a bad thing for consumers since it limits choice. Although the court's decision won't lead to the immediate undoing of the Sony BMG deal, Sony and Bertelsmann will have to resubmit their merger plan to the European Commission. Deal on hold...or dead? In a press release Thursday morning, Warner Music said that it was reviewing the European court's decision to "determine what impact it might have on a potential combination of Warner Music Group and EMI Group." EMI said in a separate release that the case would "require detailed study before any wider conclusions can be reached." The company added that it still felt its current takeover offer of $31 per share for Warner "could be very attractive to the shareholders of both companies." But analysts and merger experts said that the court decision will probably make it a lot more difficult for the two companies to make sweet music together. In a research note Thursday morning, American Technology Research analyst P.J. McNealy wrote that the court decision would "likely cause the back-and-forth in merger talks between Warner Music Group and EMI to slow down." And the talks may do more than just slow down. Some expect the two companies to just walk away from a deal for good. After all, EMI and Warner tried to merge in 2000 but that merger was derailed by regulatory scrutiny. "If Sony BMG is not allowed to go through then EMI-Warner probably won't be allowed as well," said Christopher Kummer, a professor with Webster University and director of the Institute of Mergers, Acquisitions and Alliances, a research firm focusing on M&A activity. And if that's the case, the recent big gains for both stocks could wind up being the Wall Street equivalent of a one-hit wonder. EMI's stock had been up nearly 30 percent this year while Warner, led by media mogul Edgar Bronfman, Jr., had soared about 60 percent. "There is a serious risk that the momentum for a deal just fades away so there would be short-term pressure on the share prices," said Conor O'Shea, an analyst who follows EMI for London-based brokerage Teather & Greenwood. "They may decide to plow on but it would be very risky to do so and the market is now pricing in the fact that the deal won't happen." The sounds of struggle The music industry is undergoing a difficult stretch. One compelling reason for the two companies to merge is that a deal should allow them to significantly reduce expenses. But if Warner and EMI remain independent, Kummer said they likely will still be faced with shareholder pressure to cut costs. In addition, sales of compact discs have fallen during the past few years as more consumers buy music online ... or get it illegally through file sharing. Although digital sales have expanded at a rapid clip for the world's largest music firms, online sales are still just a small portion of the industry's overall sales. What's more, the price of albums from online music stores like Apple's iTunes are much lower than what it costs to buy a compact disc and Apple (Charts) has refused to cave into the industry's demands to raise prices. McNealy, wrote, however, that although the new uncertainty regarding a merger would definitely have a negative effect on Warner's stock in the near-term, he thinks the company could actually do well on a standalone basis thanks to strong digital music sales. But O'Shea is not so sure that investors will be interested in the companies if a merger falls through. "This removes the one thing that people were excited about and it looks like it may condemn them to separate existences," he said. "The recorded music industry hasn't grown for a decade. The balance of power has shifted to digital retailers like Apple." With that in mind, Kummer said that even if EMI and Warner successfully merged, it's still uncertain how much that would help the two companies. "There is a question about whether an EMI-Warner Music merger will solve the problems in the music industry at the moment," he said. ----------------- Analysts quoted in this piece do not own shares of the companies mentioned and their firms have no banking ties to the companies. Related: EMI-Warner: A sad song Related: A big hit for Bronfman Related: Warner Music: The remix |

|