|

Wall Street: Desperately seeking relief Soaring oil prices and Mideast violence swamped stocks. Can the onslaught of earnings change the tide? NEW YORK (CNNMoney.com) -- Record oil prices. Escalating violence in the Mideast. The nail-biter over interest rates. A consumer trying to hang in despite a slowing economy. Who needs summer action movies? Wall Street's been serving up more drama than most investors crave.

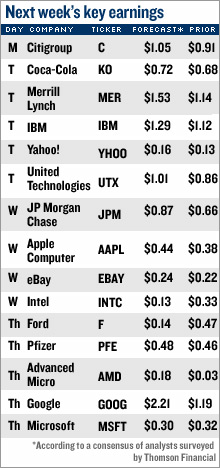

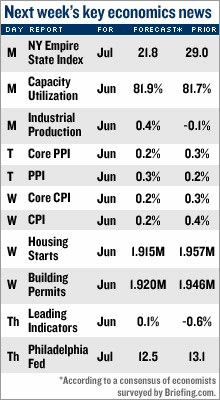

And the week ahead is about to throw one more element into the mix: the first big surge of second-quarter corporate earnings. Among the highlights: Citigroup on Monday, IBM and Yahoo! on Tuesday, Apple Computer and Intel on Wednesday and Microsoft on Thursday. (For more details, see the chart). The good news is the outlook is still healthy for the second quarter - analysts are expecting earnings to grow 12.4 percent from a year earlier, according to Thomson Financial. The bad news is that the mood on Wall Street may be too gloomy for strong earnings to help. "The issue is if the market is negative, even if the focus moves to earnings, those earnings will be (seen) through a fairly negative prism," said Douglas Altabef, a money manager at Matrix Asset Advisors. Altabef isn't optimistic that the onslaught of earnings will be enough to distract Wall Street from its current concerns. "I can hope we focus on earnings next week," he said. "But that's not what the market has been about lately. It's been about macro, geopolitical anxieties." And until those worries ease, stocks may not be able to recover much ground. End of the bull? Since peaking in the spring, the major stock gauges have been falling, capped by three brutal sessions in the week just ended in which the Dow tumbled nearly 400 points. The selloff was sparked by intense fighting between Israel and Lebanon's Hezbollah, record crude oil prices and some lackluster earnings forecasts. Investors are also still worried about a slowing economy and rising interest rates. Those worries spark the first stage of the selloff, in May. Since topping out May 10 near its all-time high, the Dow has skidded 8 percent, prompting some investors to say the 3-1/2-year bull market may be over. Those focused on the threat of a slowing economy will be watching the slew of June economic reports due next week, including consumer and producer prices, housing and regional reads on manufacturing. (For details, see chart). Investors will also be looking to news from Federal Reserve Chairman Ben Bernanke, who will give his semi-annual congressional testimony on the economy Wednesday and Thursday. In addition, minutes from Fed's last policy meeting in June will be released Friday. As is often the case, Bernanke is not expected to say anything too surprising. But his testimony, more than earnings, could be the surprise factor that helps a beaten-down market stabilize next week, said Donald Selkin, director of research at Joseph Stevens. "If Bernanke hints the Fed is almost done raising rates, that could help," Selkin said. The central bank has raised its key short-term interest rate 17 straight times, from 1 percent to 5.25 percent. Its next meeting is August 8th. "Maybe the market is so oversold now that it's set for a bounce, and maybe Bernanke will be the catalyst," Selkin said. Earnings galore Ideally, strong earnings and forecasts could also serve as a catalyst for an oversold market, but that may not be in the cards just yet. The number of companies warning that second-quarter earnings won't meet estimates has been about in line with recent and historic averages, said John Butters, senior research analyst at earnings tracker Thomson Financial. But there's been a lower-than-usual number of positive pre-announcements - heads-ups from CEOs and other execs that soon-to-be reported earnings are going to beat forecasts. Yet, it's unclear as to whether that's a bad omen for the earnings, Butters said. "Usually, companies will only guide higher when they are fairly positive they can make those numbers," he said. "On the other hand, the lack of positive pre-announcements hasn't hurt overall growth expectations so far." Energy remains the sector poised for the biggest year-over-year quarterly earnings growth - around 34 percent. The energy sector has posted the strongest growth since 2004, reflecting the jump in oil prices. Next week, 112 companies - or about 22 percent of the S&P 500 index - are due to report, including 11 Dow components. A number of banks and industrial companies will report, but big names are also due in tech - a sector in particular need of good news, both in terms of earnings and stock performance. When tech stocks stop getting crushed on mixed-to-bad news, that could mean the market is ready for a bounce, said Michael Sheldon, chief market strategist at Spencer Clarke. "If we should see some influential stocks do well, even if their earnings aren't that great, that could be a good sign," he said. Related: Trading could hurt 3 biggest banks |

|