|

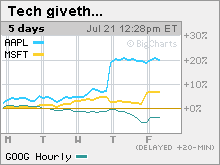

Tech investors accentuate the negative Despite strong results from a slew of tech bellwethers, investors only have eyes for bad news. NEW YORK (CNNMoney.com) -- Google glowed. Apple astonished. eBay excited. Even Microsoft (up $1.13 to $23.98, Charts) made its beleaguered investors happy, delivering news of better-than-expected earnings, an upbeat forecast and a plan to buy back $40 billion in stock, which sparked a rally in the long-suffering shares.

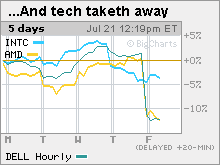

But despite the solid report cards from some of the biggest names in tech, investors seem to insist on accentuating the negative. Of course, the gloomy Gus's have plenty of fodder in their camp. Dell (down $2.55 to $19.55, Charts) warned that profits will come in a stunning 10 to 11 cents a share below what analysts had been expecting and that revenue will miss as well, sending its stock tumbling 13 percent in heavy trading Friday. And Yahoo (Charts) lost a fifth of its market value in one session this week as nervous investors jumped ship after the company reported sales on Tuesday that were shy of estimates and issued a tepid forecast. Meanwhile, Intel (up $0.05 to $17.15, Charts) and AMD (down $2.77 to $18.88, Charts), the No. 1 and No. 2 chipmakers, gave reports on Wednesday that underscored the tough times facing much of the tech sector. While AMD's sales surged 53 percent they fell short of forecasts, as did earnings. Though Intel beat earnings estimates, earnings plunged 57 percent from a year earlier and sales came in shy of expectations. Still, with just as many tech heavyweights beating expectations as falling short of them, it's worth looking at what's behind the gloom-and-doom outlook. "It's a little odd that when you have three bellwethers coming in with good results, the market is still tainted overwhelmingly negative," said Gene Munster, an analyst for Piper Jaffray. Psychology, economics play a role One factor may be simple psychology. "Stocks are biased greater toward negative news in general," said Munster. "People get spooked." Another factor may be that the losers lost bigger than the winners won. Microsoft beat estimates by just a penny when excluding a one-time legal charge, and a big reason it revised its earnings outlook higher is because with its share buyback program, the company will have fewer shares outstanding. As for Google (up $1.27 to $388.39, Charts), its good numbers were thanks in part to high demand for online search advertising, and it posted earnings that were well ahead of Wall Street expectations. But its sales were just slightly higher than forecasts, and its stock tapered off after an initial rally following the report. It was flat in midday trading Friday. On the negative side, Dell's warning came from fundamental problems including the fact that it's had to price aggressively to move PCs in a slowing market. Its warning was the biggest miss of the tech bellwethers. AMD is also suffering from fundamental factors, saying its shortfall came from price cuts to battle archrival Intel. It missed earnings estimates by four cents. Also, the stocks may be reacting to the current economic uncertainty, fueled by rising interest rates, high energy prices and the escalating violence in the Middle East, leading investors to be more skittish. While the link between higher fuel prices and weakness in the software sector may not seem immediately obvious, Munster noted that investors tend to become more defensive in times of uncertainty. Simply put, when the going gets tough, the tough take their money out of highly volatile sectors such as technology. "Over the past month, tech has been hit a lot harder than the rest of the market," said Munster. "If I was going to guess what might cause that, I'd guess it's portfolio managers making the call that they need to be more defensive." Shaw Wu, an analyst with American Technology Research, agreed. "Rising interest rates and rising energy prices are definitely causing uncertainty with spending patterns, both consumer and corporate," he said. "That's common sense but it does impact those companies." He noted that such an environment creates a "flight to quality. There is very little tolerance, particularly in this tough macro environment, for mistakes," said Wu. That may be what's sending investors into the arms of Apple (up $0.13 to $60.63, Charts), Wu added. "Investors might even be hiding in this name because it's 'safer' - they've reported, they gave their outlook, and the pre-announcement risk is gone," he said. Bad news brings buying opportunities Munster of Piper Jaffray pointed out that investors will look for firms with the best defenses or those that can use the current economic environment to their advantage. "In a tough market you have to be smart, and the companies that have been smart have been doing okay," he said. Wu of American Technology Research agreed. "Everyone's been impacted; it's a question of who's been able to weather the storm," he said. "Some have been able to do these company-specific things to shield themselves" such as Microsoft's buyback plan, he said. The question now is when will investors start to look for bargains. "At some point the selloff is going to be overdone and people have to put their money somewhere," he said. "It's creating some valuations that are getting far more interesting." Related: Techs drag down Wall Street |

|