|

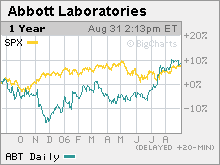

Abbott's Humira: More uses, more money Drugmaker continues to find new uses for blockbuster drug but is it over-reliant? NEW YORK (CNNMoney.com) -- Abbott Labs' fast-growing flagship drug Humira is grabbing market share and making money ... and now the company is trying to win the blessings of the FDA to make more. Abbott (down $0.50 to $47.85, Charts) markets Humira as a treatment for three forms arthritis: rheumatoid, psoriatic and spinal. Sales for the injectable inflammatory drug jumped 64 percent last year, totaling $1.4 billion.

Abbott, the third-largest U.S. drug company behind Pfizer (down $0.01 to $27.83, Charts) and Johnson & Johnson (down $0.16 to $64.15, Charts), has built up a sturdy pipeline of more potential uses for Humira. Abbott spokeswoman Elizabeth Shea said the company is getting ready to file a Humira application to the Food and Drug Administration this fall for treatment of Crohn's disease, a common inflammatory bowel disease that causes swelling of the intestines. The Illinois-based company is also testing the drug as a treatment for psoriasis, a skin condition, and juvenile rheumatoid arthritis and plans to file applications for these indications for the FDA in 2007. Also next year, Abbott plans to begin late-stage studies for treatment of yet another inflammatory digestive disease: ulcerative colitis. How can Humira be used to treat diseases in so many parts of the body, including the joints, the digestive lining and the skin? Shea of Abbott said the drug works by blocking a protein produced by the immune system, called the anti-tumor necrosis factor, that causes these diseases. Analysts are bullish on Humira sales going forward. Jan David Wald, analyst for A.G. Edwards & Sons, said Humira's top competitors are Remicade from Johnson & Johnson and Enbrel from Amgen (down $0.50 to $68.76, Charts), the world's biggest biotech. Wald said Humira's recent growth suggests that it's taking market share from these rivals. Assuming that Humira is approved by the FDA for more indications, Wald expects Humira sales to grow to $2 billion this year, and to $2.4 billion in 2007. Glenn Novarro, analyst for Bank of America, also expects Humira sales to reach $2.4 billion in 2007, with the assumption that the FDA will approve more indications. "Senior management remains optimistic that Humira will fare particularly well in the treatment of dermatologic and gastrointestinal conditions, where the drug has amassed compelling data," wrote Novarro in a published report, noting that Abbott is studying no less than seven indications for the drug. Also, Abbott recently won approval for its Humira pen, a more convenient way of taking the drug than traditional injections. Bear Stearns analyst Rick Wise wrote in a published note that, because of the newly-approved pen and the indications expected for 2007, his estimate of $2.6 billion in 2007 sales for Humira "may prove to be conservative." Drug companies that are heavily dependent on a single product, however promising that product may be, are often considered vulnerable and they don't always win such glowing reviews from analysts. But Novarro of Bank of America said in his report that Abbott was "firing on all cylinders," with its Humira performance backed by blockbuster drugs like the cholesterol-lowering TriCor, expected to reach $1.3 billion in 2006 sales, and the anti-HIV treatment Kaletra, projected to total $1.3 billion. Also, Novarro said the company's recent acquisition of Guidant's vascular business provides it with a "the significant opportunity to penetrate the $5-6 billion drug-eluting stent market." The analysts quoted in this story do not own shares of Abbott stock, but Bear Stearns does make a market with Abbott and an affiliate of Bank of America has conducted non-investment banking with Abbott. |

|