|

Shakeup at the top at struggling Viacom Media giant taps board member to succeed MTV pioneer Freston as president and CEO. NEW YORK (CNNMoney.com) -- Media conglomerate Viacom said Tuesday president and CEO Tom Freston has resigned, a move that Viacom Chairman Sumner Redstone said stemmed partly from frustration with Viacom's Internet strategy - and lagging stock price. Shares of Viacom tumbled more than 6 percent in early morning trading on the news.

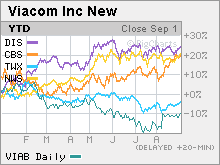

Freston will be replaced by Philippe Dauman, a member of the Viacom board of directors. Freston is probably most known for making MTV and its related networks, such as VH1 and Nickelodeon, into global brands. Freston served as chairman and chief executive officer of MTV Networks since 1987, according to Viacom (Charts). In a statement, Freston said he would do "all I can to insure a smooth transition." The surprise announcement comes after Sumner Redstone, Viacom's executive chairman and founder, praised Freston's leadership when Viacom announced its second-quarter results on Aug. 9. "Tom and the Viacom management team have an unmatched track record of repeatedly and successfully leveraging emerging technologies, which gives us great confidence that we can continue to outperform the competition in this rapidly changing environment," said Redstone at the time. Redstone on Tuesday thanked Freston for his contributions to Viacom and also offered his support for new CEO Dauman. "I have worked closely with Philippe Dauman for many years, and I have a comfort level with him and high regard for his leadership abilities, strong financial and operational skills, and superb judgment," Redstone said in a statement. Viacom, which also owns Nickelodeon, Comedy Central and the Paramount movie studio, spun off its CBS (Charts) unit, with its broadcast TV, radio and book publishing divisions, last January. Left behind in the rally Viacom shares have suffered since the breakup, falling nearly 11 percent, making it the worst performing media stock in the U.S. this year. Shares of CBS, meanwhile, are up more than 10 percent since the split. Shares of rivals News Corp. (Charts) and Walt Disney (Charts) have each jumped more than 20 percent in 2006. During a conference call Tuesday morning to discuss Freston's departure, Redstone said that the underperformance of Viacom's stock did play a role in the board's decision to name Dauman as the company's new CEO. He added that the board felt that Wall Street may have lacked confidence in Freston. Redstone also said that there are no plans to reunite Viacom and CBS. Some on Wall Street have criticized Viacom for not moving as quickly to adapt to the changing media world as other companies such as News Corp., which last year acquired social networking firm MySpace, and Disney, which was the first entertainment company to begin selling videos on Apple's iTunes. One analyst said it was a little "unfair" to make Freston the scapegoat for Viacom's problems. Andy Baker, an analyst with Cathay Financial, argued that weak demand for cable ad slots during the so-called upfront sales period has hurt Viacom as well as other cable networks, and added that Viacom is faced with the unique challenge of trying to grow when it already is a leader in many cable categories. "The cable upfronts were weak and it's a tough situation. Viacom's networks are already number one with kids and music. The question is where do you go from there?" Baker said. But Redstone said during the call that Viacom needs to do more in emerging areas such as the Internet and that Dauman was the right person to lead the company in the digital era. He also said several times that he felt Dauman would be more entrepreneurial and aggressive than Freston. "There isn't any time to waste. The landscape is changing rapidly and those who don't move quickly will be left behind," Redstone said. Baker conceded this was a valid criticism of Freston, especially since his counterpart at CBS, Leslie Moonves, has made several interesting Internet moves, such as airing games of the popular NCAA men's basketball tournament online during March for free. "The rate at which they embraced new tech lagged at Viacom," Baker said. Dauman added during the call that the company was not going to undergo a radical shift in strategy under him. But he said that Viacom would "be alert and quick to seize financially prudent opportunities, especially in young, cutting edge businesses that could flourish as part of Viacom." Cruise no factor Almost two weeks ago, Viacom's Paramount Pictures unit announced a break with one of its biggest stars, Tom Cruise. Redstone cited Cruise's controversial behavior over the past year as the reason for the split in an interview with The Wall Street Journal. Cruise's production company tried to characterize the split as more of a mutual decision. During the conference call, Redstone said that Freston and other Viacom executives all agreed to end Paramount's ties with Cruise and that this decision had nothing to do with Freston's departure. In addition to Dauman, Viacom announced it appointed another director, Thomas Dooley, to the newly created post of senior executive vice president and chief administrative officer. Dauman and Dooley serve as co-chairmen and chief executive officers of DND Capital Partners LLC, a private equity firm with a media and telecommunications focus, according to Viacom. Dauman said during the call that he intended to use $5 million of his own money to buy Viacom stock and that Dooley was going to spend $4 million to purchase Viacom shares. He added that both he and Dooley would have shareholder friendly compensation packages, which usually means low cash salaries but bonuses tied to the stock performance of Viacom. Dauman also said during the call that he did not expect any other major executive shakeups at Viacom. He added that Viacom would need to take a one-time charge to reflect the severance package for Freston. But Dauman said that after excluding this charge, he saw no reason why Viacom would not be able to meet Wall Street's financial targets for the year. Analysts expect Viacom to report sales of $10.8 billion and earnings of $1.98 a share. Cathay's Baker does not own shares of Viacom and his firm has no investment banking relationships with the company. |

|