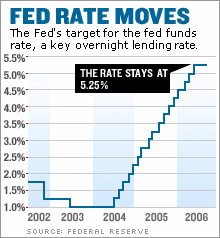

Fed holds rates steady Central bank keeps key interest rate at 5.25% for 2nd straight meeting, cites slowing economy. NEW YORK (CNNMoney.com) -- The Federal Reserve held interest rates steady Wednesday and acknowledged the economy was slowing, a sign the central bank may not need to raise rates further anytime soon. Fed policy-makers held their federal funds rate, an overnight bank lending rate that affects rates on credit cards, auto loans and home equity lines of credit, at 5.25 percent. It was the second straight meeting where the Fed decided to leave rates alone after raising them 17 straight times starting back in June 2004.

The decision was widely expected on Wall Street. And with the housing market slowing and inflation showing signs of cooling, some economists say the Fed could start cutting rates as early as next year. But other analysts said calls for Ben Bernanke & Co. to start cutting rates soon are probably premature. Stocks, which were trading broadly higher before the meeting, held most of their gains after the Fed's announcement. Bonds gave up most of their gains, leaving the yield on the 10-year Treasury at 4.73 percent. A cut in 2007... Investors are now betting on more than a 90 percent chance that the Fed would keep rates at 5.25 percent at its next two meetings in October and December, according to futures contracts on the Chicago Board of Trade. And traders were pricing in a little less than a 10 percent chance that the Fed would cut rates at its meeting in January 2007. After the meeting, several market observers said they still expected rate cuts next year, but maybe not as soon as January. "The market is betting on the economy slowing enough for the Fed to cut rates but we don't see anything in the immediate future to indicate that," said Steve Van Order, chief fixed income strategist with Calvert Funds in Bethesda, Md. But the Fed did appear to admit in its widely watched statement that it's now more concerned with a slowing economy than inflation. "The moderation in economic growth appears to be continuing, partly reflecting a cooling of the housing market," the Fed said, adding that "inflation pressures seem likely to moderate over time, reflecting reduced impetus from energy prices, contained inflation expectations, and the cumulative effects of monetary policy actions." (Read the statement). One economist said it's more important to focus on economic data than the language of the Fed statement. And based on that, the logic for a rate cut next year still stands. "It's not so much what the Fed says but how the numbers are coming in. Housing is weaker than anticipated," said David Wyss, chief economist with Standard & Poor's. Wyss said he thinks the Fed will start cutting rates, but not until the middle of next year. The Fed's had a tough job trying to try to slow the economy enough to keep inflation at bay without killing off growth. But some analysts say the Fed may already have raised rates too far, setting the stage for much slower growth, or even a recession, especially with the housing market slowing. Still, the recent drop in oil prices could make things a bit easier for the central bankers. It will probably lessen the risk of a pickup in inflation as well as reduce the risk of consumers cutting back on spending due to high energy prices. "The Fed is always going to sound very vigilant on inflation. Their bark is always going to be worse than their bite," said Brian Stine, investment strategist with Allegiant Asset Management in Cleveland. "They'll talk about inflation again at the next meeting but they'll do nothing. They are probably finished with this tightening cycle." ...or a long pause? But at least one board member is still more worried about inflation. Richmond Federal Reserve president Jeffrey Lacker voted for a quarter-point rate hike at Wednesday's meeting. Lacker also voted for a rate increase at the Fed's last meeting in August. And the Fed did not rule out more rate hikes in the future. In its statement, the Fed noted that "readings on core inflation have been elevated" and that "some inflation risks remain." That wording is identical to what the Fed said about inflation in its August statement and may spark concerns that the Fed is not done raising rates even though the economy is slowing. "When you look at what's happened since August, clearly the economy has taken a turn for the worse. But the Fed had little choice but to indicate that it's still concerned about inflation risks and that they are willing to do something about it if the risks persist," said David Resler, chief economist with Nomura Securities International. But Resler added that he did not think inflation would remain a major concern for much longer and that the Fed could soon lower rates. But he said it was too soon for the Fed to signal that its next move is a rate cut since it needs to keep its options open. "It's premature for the Fed to be talking about lowering rates but it's not premature for us in the forecasting game to start talking about the consequences of current monetary policy," he said. Subodh Kumar, chief investment strategist with CIBC World Markets, said the Fed could maintain what he called a "plateau policy" of leaving rates alone for an extended period of time since neither higher inflation nor the threat of a housing-led recession is that big of a worry. ---------------------------------------------------- |

| ||||||||||||