Who's Your Go Daddy?With shrewd marketing and in-you-face tactics, Bob Parsons made his company the hottest thing in the Internet domain world. Now he's about to see how his act plays on a much grander stage.(Business 2.0 Magazine) -- To get a sense of how Go Daddy CEO Bob Parsons leads his life, just ask for a ride in Mad Max. That's the vehicle he keeps at his office, deep in a nondescript business park amid the sprawl that is Scottsdale, Ariz. Max, as Parsons affectionately calls it, is a customized Jeep Rubicon Unlimited: Quarter-inch armor lining makes brushes with boulders a nonissue. A steel bar on Max's front end prevents somersaulting on steep drops. Fifty-degree inclines? Bring 'em on. Parsons is weaving among the evening commuters on a busy Scottsdale thoroughfare when, barely tapping the brake, he swerves off the road, jumps the curb, and swiftly leaves the orderly world in his rearview mirror. "This is Botswana style," mutters the 56-year-old Parsons, in a voice gruff from decades of hard living that include a combat stint in Vietnam. He plows through the shrubs, weaves between patches of mesquite and sage, and then barrels into a ditch before swerving around a 12-foot cactus in search of another path.

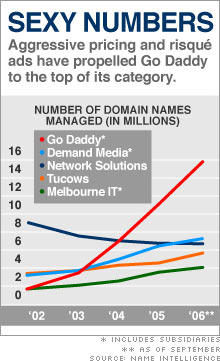

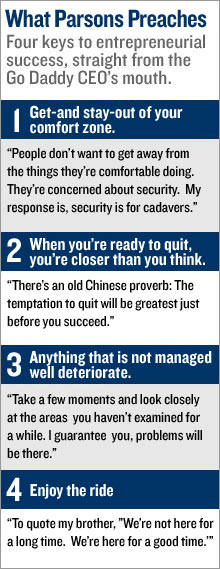

Bob Parsons, you see, is a risk taker. Howard Stern lite To some, it was even a risk when he hired the buxom brunet and occasional porn actress Candice Michelle to appear in Go Daddy's first Super Bowl commercial, in 2005. (Advisers wanted him to hire a blond.) The ad created a minor furor over its raciness, and the attention catapulted the Go Daddy brand into public awareness and earned Parsons accolades as a brilliant marketer. Since then Go Daddy has become intimately tied with its tireless and polarizing leader. When Parsons sees something that ticks him off, he speaks up, on his blog or during his weekly satellite radio show, Life Online. He's gotten into fights with political bloggers about interrogation methods at Guantánamo Bay. ("I just said that I supported the government," he says now.) Last spring he uncovered problems with the European Union's launch of URLs ending in ".eu," helping set off court battles that are still ongoing. ("The whole thing was a sham.") He pokes fun at companies he doesn't like ("Just what does Yahoo do, anyway?"), and he interviews Go Daddy customers on a radio segment called "Strange Domains." He also features entrepreneurs and offbeat guests, such as the guy who paints canvases with his rear and sells the work on ButtPrintArt.com. ("So, are you making a lot of tulips?") Parsons's sign-off at the end of each program: "I just may bump with the fat woman tonight." The show is sort of Howard Stern Lite. Parsons's antics have made him some enemies. Beefy security personnel patrol his corporate headquarters, and he once appeared at a tech conference with bodyguards in tow. But at bottom, the showmanship and bombast are simply props in a remarkable life story, and in a high-spirited tale of unorthodox business tactics and entrepreneurial triumph. Suffocating quiet period A self-taught coder, Parsons sold the first company he ever started, a personal-finance software maker, for $64 million. He's built Go Daddy into far and away the market leader when it comes to managing Web domain names and related products, leaving all competitors in the dust. Go Daddy's 4 million customers have registered almost 17 million domain names, more than twice its closest rival. Go Daddy adds a domain name every 2.4 seconds. It expects 2006 revenue of $240 million, up 71 percent from last year and more than triple 2004 levels. Go Daddy says it is profitable. Parsons says his operating cash flow, a key measure of a company's cash-generating capacity, will hit $52 million this year, up 70 percent from 2005. "Everyone fears Bob," says Andreas Gauger, who runs 1&1 Internet, a German-based registrar and Web hosting company that once hoped to buy Go Daddy. "If he doesn't do anything wrong, nobody in the domain business can touch him." And Parsons has set his sights high. He pulled Go Daddy's planned IPO in August, blaming a lousy market for new issues; he described the quiet period mandated by the Securities and Exchange Commission, in which he went off the radio for three months, as "suffocating." He says he'll come back to Wall Street eventually, though. Parsons makes the case that in four or five years, Go Daddy will be up there with Google (Charts) and eBay (Charts) among the leading Internet companies. It's tall talk. A lot of what Parsons says is. But he's had a knack for walking the walk, sometimes on very tough trails. And whatever happens, he will not fold. "That's just not the way I'm wired," he says. Parsons learned his most important business lesson while sitting on a wall in Vietnam with the unshakable conviction that he was about to die. After nearly flunking out of high school, he had enlisted in the Marine Corps. He was still a raw recruit when he met up with his squad in the Quang Nam province in 1969 and learned that he was a replacement for one of four guys killed a couple of days earlier. Panic nearly paralyzed him. It was only after he accepted that his life would end in 'Nam that he could function, and he made surviving until each day's mail call his goal. "That attitude's gotten me through all the spooky stuff in business," he says. One BASIC step Parsons left Vietnam in 1970 with shrapnel in his legs and a purple heart. He landed a job in a steel mill near his hometown of Baltimore until the prospect of a lifetime in a mill made him do something he had never considered: attend college. He enrolled at the University of Baltimore, where he majored in accounting. "I didn't even know you needed a major," he says. "I just chose the first one listed in the book." His entrée into the tech industry was also largely happenstance. An accounting assignment sent him to the San Francisco Bay Area, where, to kill some time, he strolled into the bookstore at Stanford University. He picked up a book on programming in Basic, read it on the flight home, and began experimenting with a computer at work. Ultimately he wrote a program for managing personal finances and launched Parsons Technology, setting up shop to sell software in his basement in Cedar Rapids, Iowa. Twice he went broke, rebounding mainly by incurring more credit card debt. By the mid-1990s, Parsons Technology had 1,000 employees and a 4 percent share of the North American software market. But the Web was beginning, and Parsons believed early on that the era of shrink-wrapped software like his was about to end. He sold his company to Intuit in 1994 and moved to Arizona to retire, then discovered that he was not the retiring type. He started a software company for building websites and rolled out the product amid the dotcom craziness of 1999. No one paid any attention. A brainstorming session with his small staff resulted in a name change from Jomax Technologies to Go Daddy, but even the flashier name didn't move software. He then decided to branch out. The system for registering domain names was ripe for low-cost competition. The big player, Network Solutions, was charging upwards of $35 a year for a single name. And as Parsons saw it, customer service was abysmal. So Go Daddy became a registrar in late 2000, offering domain names for $9 a year and what soon became around-the-clock customer support. Better service Go Daddy's model, then as now, was to sell cheap to a lot of customers. Snag them with a bargain-priced domain name, and then sell add-on products like e-commerce shopping carts. While plenty of small discount registrars sprouted up about the same time as Go Daddy, nobody attacked the market like Parsons, especially on the service front. One example: Every first-time customer receives a phone call from a Go Daddy rep the next day. "Attributing their success only to price really sells them short," says Elliot Noss, CEO of Tucows, a domain-name wholesaler that competes with Go Daddy. "Bob took advantage of the fact that the largest players didn't offer high-quality service or features." In many ways, the domain-name registrar business looks foolish. There's huge money to be made in owning high-traffic domain names; indeed, a whole new industry based on accumulating valuable domains has exploded during the past year. But the margins in simply registering names for their owners are thin, thanks partly to Parsons driving down prices but also to an unusual structure. A single company, VeriSign (Charts), runs the entire back-end system for .com names, which make up the bulk of the 105 million domains now registered around the world. VeriSign charges the registrars $6 a year for each name (a fee it's now fighting to raise). On top of that, the registrars pay 25 cents to ICANN, the nonprofit Internet Corporation for Assigned Names and Numbers. So if you pay $6 to register a name - and that's what some companies charge these days - the registrar isn't making a penny. That's why the add-on products are critical. Hosting is an obvious add-on for any registrar, and Go Daddy's shared hosting business has quickly become the largest in North America. (Shared hosting means that the space you rent for your business is on a server also used by other customers.) And Parsons was the first to sell private domain-name registrations, which keep a customer's identity out of the public database. Go Daddy was awarded a patent on this feature in November. The idea came to Parsons after he got a call from a frantic customer who said she needed to close her Web store because she was terrified of a stalker. The Wild West The opportunities shift constantly, and Go Daddy and its competitors try to squeeze pennies out of every twist in the game. Go Daddy, for instance, last year jumped into the auction business to take advantage of the lucrative aftermarket for domain names. Any Go Daddy name that a customer fails to renew drops into its auction system; the company then sells these names to the highest bidder. Other tactics are less seemly. Go Daddy struck a deal a year ago with Google so it could sprinkle undeveloped sites with pay-per-click ads, something its customers don't always realize. If you have a dotcom name with Go Daddy but haven't built a site for it, Go Daddy will "park" it, filling it with third-party ads as well as ads for Go Daddy itself. If someone lands on your page and clicks on an ad, Parsons and Google make money. Parsons downplays parking - which, to be fair, is a common practice among registrars - and says Go Daddy now makes about $12,000 a day from it. The problem is that the person who actually registered the name makes nothing. "It's sort of a Wild West atmosphere in some ways," says Rich Miller, an analyst with Netcraft, which tracks the business. "And a lot of people work the opportunities and gray areas pretty aggressively. Go Daddy is more restrained than most." (In June, a month after Go Daddy filed to go public, the company rolled out a parking product where, for example, paying $4 a month gets a customer a 60 percent cut of Go Daddy's share.) Even so, Go Daddy also routinely gets high marks in customer satisfaction, and Parsons credits his success to his unorthodox and somewhat unfashionable approach. He refuses to outsource anything. Virtually all of the company's technology is built in-house. And its call centers, whose staffs have doubled in the past year to 920 people, are all in Arizona, many in the same business park as the company's headquarters. When Parsons was doing the pre-IPO dance with Wall Street, he was repeatedly asked if his call center would "scale." Creating buzz "I said, 'What do you mean, scale?'" Parsons recalls. He disagreed with investment bankers' suggestions that, among other things, he should keep headcount low even as he grows. "People think that because we're an Internet company, we should be less people-intensive. I believe the exact opposite. When it comes to the Internet, people like dealing with people." Which is why Parsons has worked so hard to give Go Daddy a personality that, like it or not, sells. Parsons alone, for instance, decided to plaster the Go Daddy name on Michelle's chest in the 2005 Super Bowl ad. And for the 2006 Super Bowl, he recut the commercial, featuring Michelle appealing to an arbiter of TV decency standards, 13 times before winning approval from ABC - each time taming it down, and each time watching business climb after news reports revealed that he was having to pull back to placate censors. Says Tucows's Noss, "He played that thing like a maestro." For proof, consider this: There are now 860 ICANN-accredited domain-name registrars. Other than Go Daddy, how many can you name? Parsons is looking over the lineup for his radio program, and he's disappointed. The show is promoting an interview with French Maid TV, an Internet production company that makes how-to videos, such as the one for Go Daddy in which three maids pop out of the same bed, rush to a laptop, and give a quick lesson in how to register a domain name. "What? We don't have the French maids?" Parsons says when he discovers that he'll be interviewing the company's executive producer. "I find that depressing." The importance of lobbying Parsons and his co-host, Nima Jones, also a Go Daddy exec, banter with the French Maid guest about how he launched the company and, more important, how he finds women who know how to move a vacuum and wiggle a feather duster. Every now and again, Parsons clicks an icon on his computer and a chorus of female voices says, "Ooh-la-la." Life Online isn't all silliness, however. Parsons has turned himself into a kind of industry watchdog, and he uses his blog and his radio show, which airs live on Wednesday nights on Sirius (Charts) and XM Radio (Charts), as his soapbox. He rants about issues that he argues are critical to the Internet overall but obviously are of huge importance to his company. Go Daddy's top attorney, Christine Jones, is a regular guest. As the Internet and Go Daddy have grown, Parsons has learned the importance of lobbying. Jones is just back from testifying before Congress about a proposal between VeriSign and ICANN to boost prices of dotcom names as much as 7 percent a year. The deal, she explains, doesn't require VeriSign to justify the price hikes, was reached "behind closed doors," and will result in a $1.3 billion windfall for VeriSign the first year it goes into effect. Parsons chimes in: "This is like the great train robbery if they pull it off." (VeriSign spokesman Tom Galvin calls the $1.3 billion figure a "silly" and "unknowable number." Plus, he says, VeriSign's costs are rising as Internet traffic explodes and security issues increase. "Bob Parsons is taking no responsibility for the security and stability of the Internet. VeriSign is.") While this topic has mobilized a variety of big domain investors, Parsons has been alone in calling attention to other issues. One was the European Union's messy launch of .eu names last spring. Every company that became a registrar with Eurid, the European equivalent of VeriSign, had an opportunity to go after .eu names. Companies were given connections to the central registry, and at the moment of launch on April 7, computers the world over starting pinging its servers in an effort to snag names. Crying foul Parsons was looking over the results of the so-called land rush when he noticed that Go Daddy had failed to get many good names for its customers. With a little digging, he found that some U.S.-based speculators had set up scores of phantom registrars to game the system. He didn't claim that anything illegal had occurred, just that the process was badly run. Parsons says he called Eurid officials but was told everything was proper. So he turned to his blog to spell out exactly what he'd uncovered. The Eurid auction has spawned massive litigation in Europe, about which Eurid won't comment. "It was so obviously bogus," Parsons says, "and I was the only guy in the world - the world! - who was saying anything." The soapbox crusades make him a hero to some; to others they are just more of the grandstanding that has made Parsons a sometimes polarizing figure. His ads generate hate mail accusing him of promoting pornography. He knows full well that the safari to Zimbabwe he went on in October, in which he killed an elephant, will cause some outcry. But does he really need bodyguards? When Parsons attended a conference called the Domain Roundtable in May 2005, he showed up with two beefy guys. They even came a week in advance to case the joint. "They were looking for where to rush the man if anything went wrong," says Jay Westerdal, who runs research firm Name Intelligence and puts on the Seattle conference. Parsons says people mistook his guests for guards, but they certainly left an impression with the 300 attendees. "It was like they didn't get him in 'Nam so they were going to get him at Domain Roundtable," recalls Frank Schilling, one of the largest domain investors in the world. "That was weird." A bigger battlefield Parson's list of enemies will soon include some bigger and more potent entries. His battlefield is expanding to include all sorts of giant companies competing to meet the soaring demand from individuals and companies to build an online presence. Microsoft (Charts), for instance, recently introduced Office Live, which offers hosting and domain names to businesses with fewer than 10 employees. Parts of Google's business overlap with Go Daddy's. And Yahoo has long been trying to build a presence in this area. Just a couple of years ago, Yahoo sent a team to Scottsdale to try to persuade Parsons to sell. Parsons balked. A few months later, he says, Yahoo's small-business unit launched an array of offerings very similar to Go Daddy's. "They called me the night before to tell me there was no connection," Parsons says, flashing a skeptical glance. Parsons feared that Yahoo might crush him. Yet today Yahoo (Charts) boasts that its small-business unit has more than 1 million customers, roughly a quarter of Go Daddy's. (Yahoo won't comment about talks between the two companies.) At this point, Parsons isn't fazed by the prospect of going up against the big boys. They'll discover, he contends, that what Go Daddy does is difficult and requires top-notch customer support that they simply don't know how to give. Parsons is still Go Daddy's only investor, so he calls all the shots. When he was preparing to go public, he says, other suitors showed up in Scottsdale. But he's not interested in selling, at least not now. He's focused on adding products that make sense to anyone who wants an online presence via a domain name, and on continuing to pump up the Go Daddy brand. Parsons is sitting at his conference table, beneath a poster for Stanley Kubrick's Vietnam epic Full Metal Jacket, pecking away at his keyboard. He pulls up a few charts to show off Go Daddy's finances. Then he turns his head to watch a giant flat-panel screen and clicks on something that makes him really happy: an unreleased commercial featuring Michelle sporting a Go Daddy T-shirt and cutoffs and doing a striptease-type dance around a chair. Parsons lets forth a slow growl, "Y-e-a-h." Then he asks with a smile, "You think I'd get in trouble for this one?" |

|