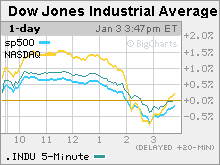

Fed kills market's Happy New YearDecember minutes show central bank still worried about inflation but also about a slowdown; investors boo.NEW YORK (CNNMoney.com) -- The market was in a festive mood to start 2007 until the minutes from the last Federal Reserve meeting of 2006 were released. The Dow industrials, S&P 500 and Nasdaq composite all gave up big gains and headed lower after the release of the minutes, which showed that the nation's central bankers were worried about a slowdown in economic growth late last year but at the same time concerned about inflation. Later in the afternoon, the Dow and Nasdaq scratched back into positive territory while the S&P 500 ended nursing a slight loss.

The Fed's mixed message clearly alarmed some on Wall Street, who had been betting that the central bank would cut interest rates a couple of times this year to ensure the proverbial "soft landing" for the economy. So some investors may be expressing fears that the economy is in worse shape than previously thought. "The Fed seemed a bit more focused on the weakness in growth than I had thought they would be. Stock investors had come to the conclusion that this would be a perfect landing and that the economy would be back on track soon," said Mark Zandi, chief economist with Moody's Economy.com. Another economist suggested the market may be worried that the Fed won't be cutting interest rates as soon as some had hoped. To that end, the Fed said in its meeting minutes that inflation remained "the predominant concern." The Fed's next meeting is at the of this month. But John Norris, chief economist and senior fund manager with Morgan Asset Management, said the Fed may not look to lower rates until its May meeting at the earliest. "Most folks will agree that we will get a rate cut at some point this year. But the minutes suggest the Fed could be on pause for a while. That puts off the good news that the market has already built in." The Fed has held a key short-term rate steady for the past four meetings after raising it seventeen straight times dating back to June 2004. The rate, known as the fed funds rate, is an overnight bank lending rate that helps set rates for many consumer and corporate loans. The fed funds rate now stands at 5.25 percent. That's the highest that interest rates have been since January 2001, though they're still relatively low by historical standards. Weakness in the housing market last year led many on Wall Street to speculate the Fed would have to cut rates this year to ensure that further declines in home prices did not lead to a severe pullback in consumer spending. Such a drop, many investors reasoned, could prompt a recession. Consumer spending fuels more than two-thirds of the nation's economy. Some have also expressed concerns since long-term rates are lower than short-term rates - the yield on the 10-year U.S. Treasury is about 4.65 percent - and the so-called inverted yield curve has often been a predictor of recessions in the past. Rate cuts could help push short-term rates back below long-term rates. Investors have been also hoping for rate cuts in 2007 since lower rates cut borrowing costs for companies, leading to higher corporate profits. But one veteran market watcher said that stocks were due for a breather after the strong year-end rally, fueled largely by growing expectations for a Fed rate cut relatively soon, appeared to be carrying over into the first trading day of 2007. "It's pretty clear that there's a ton of exuberance out there. People were buying this morning like there was going to be no other chance to buy stocks," said Barry Ritholtz, chief market strategist with Ritholtz Research & Analytics, an independent market research firm in New York. Ritholtz added that the market may have been premature to think that a rate cut would take place in the first half of the year. "It appears people have become a bit complacent. It could be another six months before the Fed cuts unless the economy really rolls over and dies. This is the slow-motion slowdown," he said. And in recent months, Fed Chairman Ben Bernanke and other Fed members have said in speeches that the worst may be over for the housing market and that housing will stabilize in 2007. As such, other economists have said the Fed still needs to be more concerned about inflation, especially since the job market has been strengthening in recent months. Wages make up the biggest chunk of corporate costs and as such, have the biggest impact on whether companies feel a need to raise prices. Still, the Fed also said in its minutes that it expected "growth in employment would probably slow over the next quarter or so." With that in mind, Norris said the Fed probably would not need to remain on an inflation vigil for much longer. "To say the primary concern is inflationary pressures while admitting that the economy is slowing down seems like an oxymoron to me. Where is the inflation going to come from if the economy is slowing?" he said. That's exactly the delicate balance the central bankers are trying to find. |

| |||||||||||