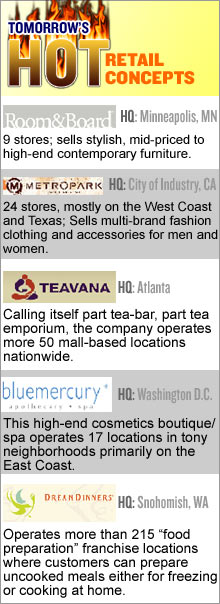

Innovation back at 'real' storesIndustry analyst picks five young, but fast-growing brick-and-mortar concepts that could soon become rising stars on Wall Street.NEW YORK (CNNMoney.com) -- Old-fashioned retailing, where shoppers actually walk into a store instead of "click" into a store, is back in vogue. That's partly because of a fresh crop of hot merchants generating buzz with their innovative concepts, and most of them are have gone the traditional brick-and-mortar route.  Among them is a chain of tea bars called Teavana and a style-conscious furniture seller called Room & Board. A chain of "food preparation" stores called Dream Dinners caters to time-starved consumer by enabling them to assemble their meals for the week at the store and take 'em back to cook or freeze at home. Neil Stern, a retail analyst and senior partner with Chicago-based retail consultancy McMillan/Doolittle, who specializes in identifying and developing new retail ideas, says he's excited about these upstart challengers and their potential to go public. The new store concepts show innovation is back in traditional brick-and-mortar retailing, said Stern. Back to the bricks Just four to five years ago, entrepreneurs were shunning the corner store option in favor of launching their business venture in the more lucrative e-commerce arena. That trend has cooled off a bit. "Retailing isn't channel agnostic anymore. Now the trend has shifted to multi-channel retailing where new businesses want a store presence, they want to be on the Internet and also sell through catalogs," said Stern. And much of the industry innovation is taking place on the West Coast and slowly making its way to the rest of the country. Why? "The West Coast has more progressive consumers who readily embrace new ideas," Stern said, adding that ideas that work on the West Coast tend to migrate well to the rest of the country. But not the other way around. "For example, New York is a very unique marketplace because of its diversity. It's more difficult to replicate successful business concepts from New York elsewhere," he said. Could any of these new companies soon become IPO candidates? "Some are closer than others," Stern said as he offered his top 5 picks for the names on his radar. Teavana. Americans love coffee, as proven by Starbucks' (Charts) resounding success. But an Atlanta-based company called Teavana is betting that it can carve a niche for itself - a la Starbucks - for tea drinkers. It's a good gamble given the resurgence of tea drinks in the U.S. driven by the popularity of green tea and herbal teas. Even Starbucks quickly jumped on the tea train and introduced its Green Tea Frappuccino in 2005. Teavana operates more than 50 mall-based tea bars/ tea emporiums nationwide. Stern explained that the concept is a hybrid between a tea room, where customers can order a variety of different teas, and a retail store in the front that sells bagged tea and other merchandise. The stores do not sell food. "They've been around for over three years. It's on my hot list and they have a great working model which appeals to health conscious people," Stern said. The company does not disclose its annual sales. MetroPark: Hot Topic founder Orv Madden is the creator behind this California-based retail startup that describes itself as "part club and part street boutique." But unlike Hot Topic (Charts), mall-based MetroPark stores aren't targeting fickle teen shoppers. Said Stern, "This store is for customers who have moved beyond a Hot Topic. They're older and more mature, in the 25-to-34 age range." Although most of its 24 stores are located on the West Coast, MetroPark has been expanding elsewhere with stores in Texas and planned openings in New York and Las Vegas. MetroPark carries a variety of trendy apparel and accessories brands such as True Religion, Le Sportsac and Harajuku Lovers. It's stores also feature DJs, adding to the club-like atmosphere. Even though he's closely tracking MetroPark's expansion, Stern thinks the company is still about a year away from a potential IPO. MetroPark could not immediately be reached for comment. Room & Board. It's no secret that furniture and home furnishings retailers are facing an industry downturn. Pier 1 Imports (Charts) is one of the hardest-hit names in the sector, and continues to suffer a long string of monthly sales declines at its stores. Nevertheless, Stern is enthusiastic about Minneapolis-based Room & Board, which sells stylish contemporary furniture in the mid to high-end price range. "I think of them as a grown-up Ikea. Their furniture would appeal to first-time home buyers or people moving into city apartments. They have a non-commission selling staff and their overall customer service is very good," said Stern. The company does not disclose its annual sales. Room & Board currently operates 9 retail stores both on the East and West Coast as well as Internet and catalog operations. Dream Dinners. What the heck is a "meal assembly store?" Well, this is how the Snohomish, Wash.-based company best describes its business. Dream Dinners operates more than 215 food preparation franchise locations around the country where customers can put together uncooked meals to take home to freeze or cook later. According to the company, customers preview a monthly menu online at dreamdinners.com and then register for a meal assembly session at the store. At the store, customers have a choice of scooping together refrigerated or fresh raw ingredients into bags with the appropriate cooking instructions. The cost is about $3.00 a serving. "This is another really hot trend right now, especially with busy parents," said Stern, adding that the company, which started in 2002, is growing stores about 40 percent a year. The company last year logged revenue of more than $10 million. "The Dream Dinner experience combines two things. It simplifies cooking. Then there's the social aspect of bringing together a group of strangers or friends to put dinner together," Stern said. Blue Mercury. Its stores are a hybrid between an upscale cosmetic store and a spa. Stern said Blue Mercury is doing a good job of developing a niche clientele of customers in tony neighborhoods who may not want to go to a mall to pick up their grooming products. Blue Mercury currently has 17 locations but Stern said the company has been getting more venture capital funding to boost its expansion. Blue Mercury would be a realistic IPO candidate although Stern doesn't anticipate the company going public in the near future. Gap shares surge on sale speculation Hot in '07: Google, Vegas. Not: Paris, Britney |

|