Time for Time Warner CableNation's second-largest cable company plans to start publicly trading by early March.NEW YORK (CNNMoney.com) -- Time Warner, the world's largest media company, announced Tuesday that its Time Warner Cable unit has become a publicly traded firm and that shares should start trading as early as March 1. Time Warner, which also owns CNNMoney.com, had planned to take Time Warner Cable public since Time Warner (Charts) and cable rival Comcast (Charts) jointly agreed to purchase the assets of bankrupt cable provider Adelphia last year.

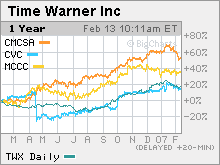

As a result of that deal, Adelphia creditors were set to receive approximately a 16 percent stake in Time Warner Cable, shares that they could sell in the public markets. Time Warner Cable, with 14.6 million customers, is the nation's second largest cable firm behind Comcast. The Adelphia bankruptcy reorganization plan was confirmed by a U.S. district bankruptcy court on January 5 and became effective on Monday, paving the way for Adelphia's stake in Time Warner Cable to be distributed. Time Warner said that shares to Adelphia bondholders would begin to be distributed within the next few days. Last year, Time Warner had also filed an S-1 statement, which is what companies usually do when planning to sell shares to the public. That statement was withdrawn on Tuesday morning. Time Warner had hoped to avoid taking its cable unit public through the more traditional route since it would take longer and also be more expensive than through the bankruptcy reorganization. Time Warner Cable shares will be listed on the New York Stock exchange under the ticker symbol "TWC." The stock is currently trading on a so-called "when issued" basis at $41 per share. The when-issued market tracks the trading of a stock that has yet to begin official trading and helps to determine the eventual opening price. Based on a price of $41 for Time Warner Cable, the company would have an approximate market value of $40 billion. Time Warner, which will own the remaining 84 percent of Time Warner Cable, has a market value of about $82.5 billion. Shares of Time Warner rose more than 1.5 percent in early morning trading on the New York Stock Exchange Tuesday. "We are very pleased that Time Warner Cable has become a public company and are excited about its stock soon being listed on the New York Stock Exchange. We believe Time Warner Cable is positioned to compete successfully in the fast-growing cable sector and to increase value for the shareholders of Time Warner and Time Warner Cable," said Time Warner chairman and chief executive officer Dick Parsons in a statement. Time Warner Cable is the biggest and best performing division of Time Warner. In 2006, Time Warner Cable's sales surged 33 percent, fueled by subscriber gains in businesses such as high-speed Internet access, digital cable and Internet phone services, as well as the addition of Adelphia customers. Operating profits at Time Warner Cable increased 22 percent. Analysts have speculated that a publicly traded Time Warner Cable could have more flexibility to pursue other acquisitions, with some suggesting that Time Warner Cable could make a run for its New York cable rival, Cablevision (Charts). Cable stocks, in general, have been strong performers on Wall Street lately as the companies have been doing a good job of adding customers for newer offerings such as Internet phone and digital cable service. And this is taking place despite the fact that the industry is facing a tougher challenge for customers from phone companies Verizon (Charts) and AT&T (Charts), which are both rolling out TV services to compete with cable firms. Shares of Comcast have gained more than 50 percent during the past 12 months while shares of smaller cable firms Mediacom (Charts) and Charter Communications (Charts) have gained 35 percent and 160 percent respectively. The reporter of this story owns shares of Time Warner through his company's 401(k) plan. |

Sponsors

|