A flashy soda seller goes back to basics

Lesson: Even hipsters must follow the rules.

|

| Jones Soda's flavors are off the wall, but CEO Stephen Jones ensures that its business plan is down-to-earth. |

(Fortune Small Business) -- Jones Soda (JSDA), No. 76 on this year's FSB 100 list, has never done anything by the book.

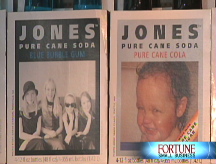

Brash and unpredictable, the Seattle beverage maker's founder and former CEO, Peter van Stolk, built a cult following over the past decade, in part by positioning Jones as the anti-Coke (KO, Fortune 500). Its offerings have included flavors such as Jelly Donut, Egg Nog, and Bug Juice, sold in bottles labeled with customer-submitted photos. The company does no traditional advertising. Instead, its two RVs ramble from town to town nationwide, stocked with sodas that are distributed free to teens in malls and schoolyards.

The strategy worked - for a while. But now, following a disastrous expansion plan that resulted in a net loss of $11.6 million last year, the firm is striving to master Business 101.

"This isn't sexy stuff," says new CEO Stephen Jones, 52, a former Coca-Cola CMO with a serendipitous surname. (Van Stolk, 44, originally wanted to call his company Smith Soda, but that name was taken.)

In the early years, few mainstream retailers sold Jones soda. Fans had to get their Jones fix in surf shops, tattoo parlors, and bookstores, adding to the brand's mystique. For a decade Jones flourished on the fringe of the multibillion-dollar beverage business. Annual revenues more than doubled to $39 million between 2002 and 2006, and profits grew steadily.

But last year Jones faltered after it introduced a line of canned soft drinks in major retail stores such as Target (TGT, Fortune 500) and Wal-Mart (WMT, Fortune 500) - a move that placed it in direct competition with beverage titans Coca-Cola and Pepsi (PEP, Fortune 500).

"Big mistake," says Suzanne Price, a consumer products analyst with ThinkEquity Partners in San Francisco. "Jones got greedy and became one of dozens of brands lining the supermarket shelves - with no infrastructure to compete there."

Van Stolk, who stepped down as CEO in December 2007, instinctively knew his niche: teens eager to define their own brands. But he was less savvy when it came to more mundane matters such as production, distribution, and finance.

"Peter built a real brand - no small accomplishment in the beverage business - but it was time for the entrepreneur to step aside and turn the company over to professional management," says John Sicher, publisher of industry trade magazine Beverage Digest. (Van Stolk, a former ski instructor who got his business start running a fruit stand in western Canada, didn't respond to requests for comment. Under the terms of his severance agreement, he is barred from discussing Jones Soda with journalists.)

In many ways the opposite of his predecessor, Stephen Jones says his top priority is to build a solid corporate infrastructure for the soda maker. He intends to recruit more distributors, strengthen the sales force, and smooth out kinks in the company's supply chain - steps that will help Jones better compete with big-name rivals. In May, he persuaded a beer and wine distributor to introduce Jones Soda in New York City. The first truckload sold out in two hours, he crows.

Over the next few months Jones and his team plan to move the firm's sodas into stores more efficiently and review its product line, which is as cluttered as a kid's toy box. (On van Stolk's watch, Jones Soda's offerings ballooned to include tea, juice, an energy drink, candy, and even lip balm.)

Jones Soda isn't out of the woods yet. First-quarter revenues were flat at $9.4 million, and the company had a net loss of $3.9 million. CEO Jones projects 25% revenue growth this year. But Jones Soda's stock, which peaked at $32 in April 2007, plunged to $3 by June 2008. The new CEO expects Jones to return to profitability in 2009.

"We're Jones and we're cool, but our challenge is to get into more convenience stores, restaurants, and supermarkets," says COO Joth Ricci, 39.

Despite the new emphasis on nuts and bolts, Jones and Ricci plan to keep their creative spark alive. This Thanksgiving the company is thinking about reintroducing a quirky holiday favorite: Pass the Brussels Sprouts soda. ![]()

Ethics in a bottle

Greener Tea

Coca-Cola takes stake in Honest Tea

-

The Cheesecake Factory created smaller portions to survive the downturn. Play

-

A breeder of award-winning marijuana seeds is following the money and heading to the U.S. More

-

Most small businesses die within five years, but Amish businesses have a survival rate north of 90%. More

-

The 10 most popular franchise brands over the past decade -- and their failure rates. More

-

These firms are the last left in America making iconic products now in their twilight. More