Never too old to own stocks

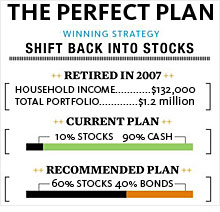

The perfect plan: His pension pays most of his bills. But with plans to leave an estate, Dave Cowley shouldn't give up on equities.

|

| Even at 61, Dave Cowley needs the growth that only stocks can provide. |

NEW YORK (Money Magazine) -- Pilots are accustomed to turbulence, but even longtime Delta Air Lines veteran Dave Cowley has been unsettled by the number of bumps along the route to retirement.

Cowley, who flew for the carrier for more than three decades, had to stop working last year when he reached 60, the mandatory retirement age for commercial pilots at the time. "I didn't feel like I was ready to retire," he says.

What's more, Cowley saw his pension eliminated as part of Delta's bankruptcy restructuring (most of that income, though, is being replaced by the government).

And he suffered yet another blow after he rolled his 401(k) over to an IRA late last year and put his retirement account into a portfolio consisting of 70% stocks.

As the market plummeted, Cowley lost some $50,000 in a matter of months. Shaken by mounting losses, Cowley took drastic action at the start of the year: "I pulled everything out of the market, and I put everything that was in my IRA into cash."

He's waiting to get back into the market, but with more than $1 million on the sidelines, his planning is, well, up in the air.

The first few years of retirement are a critical period for most investors. Fortunately, Cowley, a divorced father of two, has other assets and income sources to rely on.

For example, he gets $90,000 a year from his pension. While not the $120,000 he was expecting, it's still enough to cover most of his living expenses. In addition, he has several real estate holdings, including his home in Newbury, N.H., and a place in Sarasota. And an eight-unit apartment building generates $42,000 a year in rental income.

So why even worry about his portfolio? Because he'll need it later on.

While Cowley's $90,000 pension is plump enough now, it's not inflation-adjusted.

Also, Cowley wants to travel and ultimately leave money to his two grown kids, so he can't quit investing, says adviser Jill Boynton of Cornerstone Financial Planning in Newington, N.H.

Cowley had been planning to wait to get back into equities (down the road he wants to pick up some beaten-down financial shares). But trying to time the market can prove costly.

If Cowley wants to dabble in bank stocks, Boynton recommends setting aside just $50,000 or so for that purpose. The rest of his portfolio should be diversified and conservative, with enough money in stocks to give him the growth he needs.

If he's worried about the market, she suggests he put 60% of his portfolio into no-load stock funds such as Dodge & Cox Stock (ticker: DODGX) in routine installments, dollar-cost averaging in order to limit risk.

Be featured in Money Magazine: Do you (and your spouse) make more than $170,000 annually and worry about tax-efficient retirement planning? If so, send your name, age, occupation, income and questions, along with a recent photo, to makeover@moneymail.com. We will be providing advice to a family in this situation in an upcoming article - and it could be you! ![]()