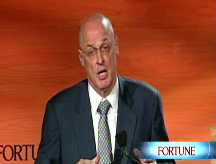

Bernanke: Economic weakness to continue

Fed chief says economic outlook remains weak, and the Fed will continue to use its tools to fight the crisis - but rate cuts may not be coming.

NEW YORK (CNNMoney.com) -- Federal Reserve Chairman Ben Bernanke said on Monday that the nation's economic weakness will persist for some time, even if the government's efforts to boost lending help restore the credit markets to normal.

"The likely duration of the financial turmoil is difficult to judge, and thus the uncertainty surrounding the economic outlook is unusually large," said Bernanke.

Bernanke, addressing business leaders in Austin, Texas, said the Fed will continue to use the tools it has been given to fight the financial crisis. He hinted at further aggressive actions like the ones taken recently to prop up the short-term commercial paper market or buy $600 billion in securities and debt held by Fannie Mae and Freddie Mac.

In fact, Bernanke said that cutting rates may not be the Fed's most effective method for tackling the financial crisis.

"Although conventional interest rate policy is constrained ... the second arrow in the Federal Reserve's quiver -- the provision of liquidity -- remains effective," he said.

The Fed cut its key funds rate to an all-time low of 1% in October in response to deterioration in the global financial system. Rate cuts tend to drive up inflation, but falling prices have given the Federal Reserve more wiggle room to lower interest rates. Core inflation is now at its lowest point since October 2007, according to a recent Department of Labor report.

Bernanke said that while further reductions in the Fed's benchmark rate are "certainly feasible," the central bank doesn't have much left to trim.

Still, many economists expect the Fed to cut interest rates again when it meets Dec. 15-16.

"I wouldn't count out a half-percentage point cut," said former Federal Reserve Governor Lyle Gramley. "It may be a good thing to do at this point, because you want to tell the public you're using all the tools at your command."

Instead of cutting rates, the Fed could take further steps to unfreeze credit markets, Bernanke said.

Since last December, the Fed has lent out trillions of dollars to banks, businesses, mutual funds and foreign central banks in an effort to boost liquidity in the financial markets and keep the economy from collapsing.

In addition, Bernanke said the Fed could help achieve financial stability by continuing to buy up asset-backed securities and by backstopping liquidity in financial markets.

"Such programs are promising because they sidestep banks and primary dealers to provide liquidity directly to borrowers or investors in key credit markets," Bernanke said.

But there is a downside to all of the Fed's programs. Fed lending has ballooned. Bernanke said that the central bank's balance sheet will need to be brought back to a sustainable level in the future. The government does not want financial institutions to become reliant on the Fed for liquidity, and an enormous balance sheet could result in high inflation down the road.

"That is an issue for the future," Bernanke said. "For now, the goal of policy must be to support financial markets and the economy."

Though some economists believe the Fed is lending recklessly, others say the current problems merit unconventional solutions.

"The worry for now is too little inflation, not too much," said Gramley. "They'll face problems when this is over, but nowhere near what they're facing now."

Bernanke said the economy will be slow to recover, as the economic cycle needs to play out, allowing the housing market to correct and the the economy to rebound from a recession. Still, he noted the long-term economic outlook remains strong. He said President-elect Barack Obama's proposed stimulus package could help, and the government's current liquidity programs could bring about a faster recovery.

"Both monetary and fiscal policy are working together to prevent a depression," said Gramley. "The Fed isn't going to sit idly by and let that happen again."

Some economists have accused Bernanke and the Fed of trying to do too much, risking taxpayer money on companies that they should have let fail. But Bernanke, a scholar on the Great Depression, said the Fed has learned from errors policymakers made in that era.

"So what we have tried to do, in contrast, is be aggressive as possible, to use all the tools we have to try to stabilize the financial system, to try and prevent the system from - from breaking down," he said.

He noted the Fed made two critical mistakes in the 1930s - maintaining overly tight monetary policy and allowing the financial system to collapse. As a result, the Fed proactively reduced rates from 5.25% in September 2007 to its current historic low and injected unprecedented amounts of liquidity into the financial system.

"I may make my own mistakes, but I don't want to make somebody else's mistakes," he added. "And I've tried to learn that from the historical experience." ![]()