Buffett fans are ready to meet their man

A record crowd of Berkshire Hathaway shareholders is hanging on every word from Warren Buffett at this weekend's annual meeting in Omaha.

|

| Warren Buffett is expected to host 35,000 shareholders at Saturday's annual meeting. |

|

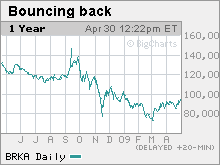

| Berkshire shares have joined in the financial sector rally of March and April. |

NEW YORK (Fortune) -- Warren Buffett's Berkshire Hathaway had its worst year ever in 2008. But for the throng gathering in Omaha on Saturday for the annual shareholder meeting, that's ancient history.

Berkshire fans are far more interested in learning how Buffett sizes up the investing opportunities arising out of the global economic slowdown, and how the downgrade earlier this month of Berkshire's credit rating might affect the firm.

Mostly, they are wanting to hear how Berkshire (BRKA, Fortune 500) will get back on track following a year in which its net worth dropped by $11.5 billion and its shares gave back five years of gains.

"There are lots of opportunities out there right now," said Mohnish Pabrai, the managing partner at Berkshire shareholder Pabrai Investment funds in Irvine, Calif. "I'd love to see Warren give us some color on things like where they have been active in the debt markets."

There should be ample time for color this year, even with attendance at the meeting expected to reach a record 35,000. One key is a shift in the format for the question-and-answer session with Buffett and Berkshire Vice Chairman Charlie Munger.

The Berkshire meeting has long been a bit of a free-for-all, with Buffett and Munger fielding questions from anyone who took the microphones on the floor. In 1997, a year in which annual meeting attendance was estimated at 7,000, he dubbed the event "our capitalist's version of Woodstock" -- a label that has stuck.

But this year's event should be a bit more orderly. The early morning rush to line up at the microphones has been replaced by a lottery, and Buffett and Munger will answer some questions that were submitted online and filtered by three journalists - including Carol Loomis of Fortune.

The idea, Buffett has said, is to cut down on the non-Berkshire-related questions that had grown more prevalent as Buffett's profile rose.

Last year he fielded one question on whether he believes in Christ ("I am agnostic") and three on environmental issues tied to the dams that Berkshire's Pacificorp unit operates on the Klamath River in Oregon. Buffett said regulators would have the final say there.

"In recent years, we have received only a handful of questions directly related to Berkshire and its operations. Last year there were practically none," Buffett said in the guide to this year's annual meeting. "So we need to steer the discussion back to Berkshire's businesses."

The story there, Berkshire shareholders say, is largely upbeat, despite the downgrades earlier this month that stripped Berkshire of its triple-A credit rating. One of the downgrades came from Moody's (MCO) - the New York-based bond rater of which Berkshire owns 20%.

Many investors brushed off the downgrades, coming as they did from ratings agencies that failed to warn investors of the credit meltdown. Still, some will be paying attention to any comments Buffett might make on the subject.

"I'd be interested to hear how the ratings actions could affect the business," said Glenn Tongue, managing partner at Berkshire shareholder T2 Partners.

Meanwhile, there's little doubt that the third of Berkshire's industrial portfolio that focuses on economically sensitive businesses like retail and homebuilding will be hit hard by the recession.

But as Buffett pointed out in February's release of his 2008 letter to shareholders, two-thirds of the company's businesses are in utilities and insurance -- which are less apt to suffer in an economic downturn.

Berkshire holders such as Pabrai say the insurance business, which has been strong in recent years, could be in for even bigger gains as capital-impaired rivals raise prices to restore their financial health.

"There could be some real tailwinds in some of the insurance lines," said Pabrai.

Others note the regular income Berkshire shareholders stand to reap from the flurry of investments Buffett has made in blue-chip companies such as Goldman Sachs (GS, Fortune 500), General Electric (GE, Fortune 500) and Tiffany (TIF).

They also see room for a substantial rise in Berkshire shares. At a recent $94,000 each, the class A shares have jumped more than 30% since the financial sector hit a recent low in early March -- but remain 38% below their all-time high from December 2007.

The company's less-expensive Class B shares, which have far fewer voting rights, have also bounced back lately. But at about $3,100 a share, they are also well below their peak from December 2007.

At last month's low, Tongue says investors in the A shares were essentially paying for the value of Berkshire's investment portfolio and getting the company's operating businesses -- such as insurer Geico and ice cream chain Dairy Queen -- for free.

"Would you pay $70,000 for an envelope that contained $70,000 in cash and $50,000 worth of businesses?" he asked. "I think you would."

This weekend in Omaha, it may be difficult to find anyone who wouldn't. ![]()

-

The retail giant tops the Fortune 500 for the second year in a row. Who else made the list? More

The retail giant tops the Fortune 500 for the second year in a row. Who else made the list? More -

This group of companies is all about social networking to connect with their customers. More

This group of companies is all about social networking to connect with their customers. More -

The fight over the cholesterol medication is keeping a generic version from hitting the market. More

The fight over the cholesterol medication is keeping a generic version from hitting the market. More -

Bin Laden may be dead, but the terrorist group he led doesn't need his money. More

Bin Laden may be dead, but the terrorist group he led doesn't need his money. More -

U.S. real estate might be a mess, but in other parts of the world, home prices are jumping. More

U.S. real estate might be a mess, but in other parts of the world, home prices are jumping. More -

Libya's output is a fraction of global production, but it's crucial to the nation's economy. More

Libya's output is a fraction of global production, but it's crucial to the nation's economy. More -

Once rates start to rise, things could get ugly fast for our neighbors to the north. More

Once rates start to rise, things could get ugly fast for our neighbors to the north. More