Redbox: Media's public enemy No. 1

The $1 DVD rental service is making some studios anxious -- and investors in Redbox owner Coinstar rich. But could Hollywood put Redbox out of business?

|

| Redbox, which allows people to pick up DVDs at drug stores, supermarkets and other retailers, is attracting customers thanks to its $1 a night rental fee. |

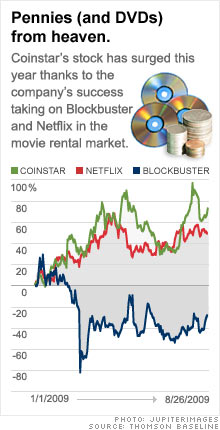

NEW YORK (CNNMoney.com) -- You might be surprised to know that Coinstar, the company that operates those coin counting machines in your local grocery store, is one of the better performing stocks this year. Shares are up more than 70%.

Sure, it makes sense that the company would thrive as more penny-pinching consumers turn coins sitting in an old coffee cans into actual dollars they can use to buy stuff.

But the real reason behind Coinstar's success has little to do with people hoarding nickels and dimes. Coinstar has another business that is exciting investors -- and making big media companies nervous.

Meet Redbox. If you haven't heard of the $1 DVD rental service, here's a quick description. Redbox kiosks, like the Coinstar (CSTR) machines, are found in many retailers, from McDonald's (MCD, Fortune 500) -- which was an initial investor -- to Wal-Mart (WMT, Fortune 500), supermarket chain Kroger (KR, Fortune 500) and drug store chain Walgreen (WAG, Fortune 500), to name a few.

People interested in renting a movie can reserve one online at Redbox's web site. They can then go pick up the DVD at a kiosk and use their credit card to pay for it. The cost is a $1 per night. The company says there are no late fees, but if you don't return the DVD the day after you rent it, you are charged an extra $1 per night that you keep it.

Needless to say, this has proven to become popular with consumers, particularly in this economic downturn. Assuming you do actually return the DVD in one day, it could be cheaper to use Redbox than a DVD rental service like Netflix (NFLX) or Blockbuster (BBI, Fortune 500).

Redbox, which was founded in 2002, had kiosks at just under 18,000 locations as of June 30. (That includes locations for another kiosk service owned by Coinstar called DVDExpress.) Redbox also recently announced the rental of its 500 millionth DVD.

This has all served as a big boost to Coinstar, which estimates that Redbox had a 13.8% market share of the DVD rental market in the first six months of the year, up from 9% last year and just 2.3% in 2007.

Coinstar had previously been a minority stakeholder in the company, but it acquired the remainder of Redbox from an affiliate of McDonald's and other investors in February.

In the first half of this year, Coinstar said that revenue from its DVD business totaled $344 million, nearly 60% of its total sales. Coinstar said its expects sales from Redbox and DVDExpress to nearly double this year.

By way of comparison, Coinstar's traditional coin transaction business has started to slow as more banks allow people to turn coins into paper money free of charge (such as TD Bank). Coinstar charges consumers a processing fee of 8.9 cents a dollar.

In the first six months of 2009, the company's coin business accounted for a little over 20% of total revenue; it is predicting that sales will essentially be unchanged from last year.

It makes you wonder if Coinstar won't eventually pull a page from the retailer formerly known as Dayton Hudson, which changed its corporate name to Target (TGT, Fortune 500), and someday be known as Redbox.

But will Redbox continue to do well? All that depends on whether or not the company can make nice with media companies, which are the main suppliers of DVDs for all those kiosks.

Right now, battle lines are being drawn as movie companies try and figure out if Redbox is friend or foe. Already they're concerned whether traditional rentals from the likes of Netflix and Blockbuster are hurting their profits.

Some movie studios, such as Sony's (SNE) home entertainment unit and Lionsgate (LGF), have signed multi-year agreements to supply Redbox with new releases of DVDs.

Viacom's (VIAB, Fortune 500) Paramount announced a trial program earlier this week that will last until the end of the year. Paramount has the option to extend the deal until 2014 after the trial expires.

But other studios have balked at allowing Redbox access to new releases on the first day they are released for sale due to worries that fewer people would be wiling to buy DVDs if they can easily get them for a $1 on Redbox.

Redbox has sued three of the companies that are holding back on DVDs -- GE (GE, Fortune 500)-owned Universal, News Corp.'s (NWS, Fortune 500) Fox and Warner Bros., which like CNNMoney.com is owned by Time Warner (TWX, Fortune 500). Redbox alleges that the studios' actions violate antitrust laws.

Redbox has maintained that it will continue to offer customers new releases from those studios, even if the company has to go buy the DVDs themselves at retail prices.

That would be good news for Redbox customers since they won't suffer from a lack of choice. But it could decimate Redbox's profits in the process and make the company's business model far less viable.

Redbox generated $54 million in operating income in the first half this year. That gives the unit a decent 17% operating margin. But that pales in comparison to the nearly 37% profit margins that Coinstar's coin business put up.

So it may not be good news for Coinstar if there is more pressure on its slow-growth, albeit extremely profitable, coin business to subsidize any potential profit hits from Redbox.

Robert Evans, an analyst with Craig-Hallum Capital, said Coinstar investors are already discounting the delay by studios and the potential impact from the lawsuits into the stock price. He adds there is a good chance Redbox could settle with those studios and eventually become partners with them.

Some big shareholders in Coinstar are sticking by the company as well.

Bradley Hinton, a portfolio manager with mutual fund firm Wallace R. Weitz & Co., wrote in a second quarter letter to shareholders of the Weitz Balanced fund that Coinstar is one of the fund's "more predictable businesses and cheaper holdings." The fund owned about 50,000 shares as of June 30 while Weitz overall owned approximately 894,000 shares.

Coinstar trades at about 22 times 2010 earnings estimates and profits are expected to grow 28.5% a year on average for the next five years, according to analysts' estimates.

And Jamie Cuellar, a portfolio manager with Brazos Mutual Funds, wrote in a second quarter report to shareholders that "Coinstar has the upper hand with the studios on DVD rental given legal precedent." Brazos owned more than 128,000 shares of Coinstar according to FactSet.

Cuellar added that "the company is dramatically ahead of competition on building a DVD kiosk brand, and the placement numbers and location agreements bear this out."

Talkback: Have you tried Redbox? If so, are you a fan? Or do you use other services to rent or watch movies at home? Share your comments below. ![]()