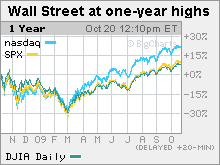

Stocks slide, but Dow holds 10,000

Mixed profit reports, a stronger dollar and a weaker housing market report are among the factors dragging on Wall Street.

NEW YORK (CNNMoney.com) -- Stocks dipped Tuesday as a stronger dollar and some disappointment about DuPont and Coca-Cola's results gave investors a reason to retreat from the recent rally.

A weaker-than-expected housing market report added to the downward pressure.

The Dow Jones industrial average (INDU) lost 50 points, or 0.5%, according to early tallies, after ending the previous session at the highest finish since Oct. 3, 2008.

The S&P 500 (SPX) index lost 7 points, or 0.6%, after ending Monday's session at the highest point since Oct. 2, 2008. The Nasdaq composite (COMP) fell 13 points, or 0.6%, after ending the previous session at the highest point since Sept. 26, 2008.

After the close, Yahoo (YHOO, Fortune 500) reported higher quarterly earnings that beat forecasts on weaker revenue that also beat forecasts.

Also after the close, Sun Microsystems (SUN, Fortune 500) said it was cutting 3,000 jobs related to its purchase by Oracle (ORCL, Fortune 500).

Tuesday brought quarterly results from five Dow components: DuPont, Pfizer, Coca-Cola, Caterpillar and United Technologies. Apple and Texas Instruments were among the names who reported after the closing bell Monday.

Stocks gained Monday, with the Dow reclaiming 10,000 in response to a weak dollar, higher commodity prices and some earnings optimism. But the path higher over the last week has been choppy as investors have sifted through a mix of profit reports. That choppiness put pressure on stocks Tuesday.

"I'm impressed we've managed to stay above 10,000 as I would have expected a bigger pullback after the last few days," said Gary Webb, CEO at Webb Financial Group.

Webb said that after better-than-expected quarterly results last week from the likes of Goldman Sachs (GS, Fortune 500), JPMorgan Chase (JPM, Fortune 500) and Intel (INTC, Fortune 500) raised investors' expectations for the reports this week. As such, even companies that have reported strong results this week have seen a mixed stock reaction.

"When we see an economy that's going in the right direction at a stronger pace, we'll see a more positive reaction to the profit reports," he said.

Since bottoming at a 12-year low on March 9, the S&P 500 has risen more than 62%. But some worry that the Dow's move above 10,000 has been a ruse and that investors should beware.

"We've traded up on some optimism about the global recovery and there are technical reasons why the market could keep rallying," said Brian Battle, vice president at Performance Trust Capital Partners.

However, he said that a lot of the improvement in the economy and profits is being clouded by the enormous amounts of government stimulus. "Once you remove all the stimulus, the underlying economy is not as strong."

Wednesday brings reports on crude inventories, state-by-state unemployment rates and the release of the Fed's "beige book" report on the economy. Fed Governor Daniel Tarullo speaks about the economy in Washington D.C., starting around 1 p.m. ET.

Wells Fargo (WFC, Fortune 500) and eBay (EBAY, Fortune 500) are the biggest companies reporting quarterly results Wednesday.

Blue-chip results: DuPont (DD, Fortune 500) reported higher third-quarter earnings that topped estimates on weaker revenue that missed forecasts. The chemical maker used cost-cutting to temper the impact of weak sales and surging crude and energy costs.

Looking forward, DuPont narrowed its full-year earnings guidance to a per-share range of between $1.95 and $2.05. Shares fell 2.2%.

Coca-Cola (KO, Fortune 500) reported modestly higher third-quarter earnings that met estimates on weaker revenue that missed forecasts. The company was hit by weaker sales amid the impact of the recession.

Coke was also hurt by the comparatively strong dollar, at least versus a year ago. A stronger dollar hurts companies like Coke because the majority of its profit comes from sales overseas. Those sales then convert back to less U.S. dollars. Coke shares fell 1.3%.

Pfizer (PFE, Fortune 500) reported higher third-quarter earnings and weaker revenue, both of which surpassed analysts' estimates. Although the maker of Lipitor, Viagra and other drugs saw a decline in sales due to the recession, that was offset by aggressive cost-cutting. Shares fell 0.3%.

Caterpillar (CAT, Fortune 500) reported weaker quarterly earnings that topped estimates on weaker quarterly revenue that missed forecasts, due to lower sales. But the heavy-equipment maker also lifted its full-year earnings forecast to a range of $1.10 to $1.30 per share, versus its previous guidance of 95 cents per share. Caterpillar gained 3%.

United Technologies (UTX, Fortune 500) reported weaker quarterly earnings and revenue that missed estimates. Looking forward, the company said it expects earnings of $4.10 per share, in the middle of its previous guidance. UTX runs jet engine maker Pratt & Whitney, Otis elevators and other businesses. Shares were little changed.

Tech results: Late Monday, Apple (AAPL, Fortune 500) reported fiscal fourth-quarter revenue and earnings that easily beat analysts' estimates, thanks to strong sales of Macintosh computers and iPhones.

Apple also forecast current-quarter revenue in a range of between $11.3 billion and $11.6 billion, versus the $11.4 billion analysts are forecasting. Apple forecast earnings per share of between $1.70 and $1.78 versus the $1.91 analysts' predict.

Shares rallied as high as $204 in after-hours trading Monday, an all-time high. On Tuesday, shares gained $8.90 or 4.7% to close at $200.60 per share.

Texas Instruments (TXN, Fortune 500) also reported results after the close Monday. The chipmaker reported weaker quarterly earnings and revenue that topped estimates. Shares gained 0.6% Tuesday.

Other results: Boston Scientific (BSX, Fortune 500) reported a profit versus a year-ago loss, but results were shy of forecasts. The medical device maker also cut its full-year 2009 earnings forecast due to slower sales of defibrillators and other products.

Shares fell 15.7% in very active NYSE trading.

Economy: Housing starts rose to a 590,000 unit annual rate in September, versus a revised 587,000 in the previous month. Economists expected starts at a 610,000 unit annual rate.

Building permits, a measure of builder confidence, rose to a 573,000 unit annualized rate in September from a revised 580,000 unit annualized rate in August. Economists surveyed by Briefing.com thought starts would rose to 595,000 unit annualized rate.

The Producer Price Index (PPI), a measure of wholesale inflation. PPI slipped 0.6% in September versus forecasts for a flat reading. PPI rose 1.7% in the previous month. The core PPI, which strips out volatile food and energy prices, fell 0.1% after rising 0.2% in the previous month. Economists thought it would rise 0.1%.

World markets: Global markets were mixed. In Europe, London's FTSE 100 lost 0.7%, France's CAC 40 lost 0.5% and Germany's DAX lost 0.7%. Asian markets ended lower.

Bonds: Treasury prices rallied, lowering the yield on the 10-year note to 3.34% from 3.38% late Monday. Treasury prices and yields move in opposite directions.

Currency and commodities: The dollar gained versus the euro and the yen, reversing the direction after its recent slide versus a basket of currencies.

U.S. light crude oil for November delivery fell 52 cents to settle at $79.09 a barrel on the New York Mercantile Exchange, after ending the previous session at the highest level in a year.

COMEX gold for December delivery rose 50 cents to settle at $1,058.60 an ounce. Gold has surpassed records repeatedly this month due to the weak dollar and longer-term worries about inflation.

Market breadth was negative. On the New York Stock Exchange, losers topped winners two to one on volume of 1.24 billion shares. On the Nasdaq, decliners topped advancers by over two to one on volume of 2.15 billion shares. ![]()

Home prices still haven't seen the bottom

Holiday shoppers to spend 3% less

Is the market rally a hoax?

Economists: slow, painful recovery ahead

Fighting off the Bear: Seven stories

50 Most Powerful Women

Bernanke: Fed's unlikely risk taker

100 Fastest-growing companies

50 years of profit swings