Stop the 'jobless recovery' madness!

An economy that isn't creating employment opportunities simply isn't doing its job.

NEW YORK (Fortune) -- It's time to stop glorifying our economic doldrums with this "jobless recovery" nonsense.

Yes, the economy did grow in the third quarter, for the first time in a year. Fewer Americans are filing new claims for unemployment insurance, and giant financial institutions appear less apt to collapse and send us into another stupor. The stock market has recovered much of its winter decline.

But so far there is no sign of an employment turnaround -- and without one, and soon, all the other gains could prove fleeting.

The U.S. has lost jobs in 22 straight months, and Friday's news that 10.2% of the labor force is out of work -- the highest reading since 1983 -- shows just how far we have to go.

Without better job prospects, the consumers whose spending makes up the lion's share of economic activity will remain tightfisted. That will slow the healing of deep wounds in the housing and financial markets.

"To have a real recovery you need to put people to work," said John Harrington, who runs Harrington Investments, a socially responsible asset management firm in Napa, Calif. "Right now we aren't doing that."

The term jobless recovery was used mostly as a pejorative when it came into circulation in the 1990s. But in the wake of last year's meltdown, it has taken on a new sense: If you give it time, economic growth will come. That has been the mantra throughout 2009.

Yet Friday's headline unemployment number was worse than economists expected, and it wasn't the only bad news. The average workweek remains short by historical standards -- suggesting many employed people are working fewer hours than they'd like. People are staying unemployed longer and losing their benefits, in spite of recent government action to extend them.

A short work week isn't just a sign of distress for cash-strapped workers. It also says it will be some time before employers start hiring again.

"Particularly with future uncertainty as high as it is, firms are more likely to increase the hours of underemployed workers before hiring unemployed workers," wrote Janney Montgomery Scott economist Guy LeBas in a note to clients Friday.

Because output fell so sharply following the oil shock and Lehman Brothers collapse of 2008, some pundits are banking on a sharp rebound.

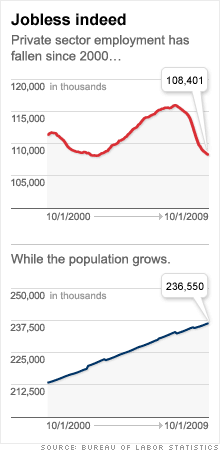

But job and wage growth have been weak for a decade. Total private sector employment has dropped since the Yankees held their previous victory parade, in 2000.

That means there has been no net private sector job growth over a nine-year span where the U.S. population expanded by 11%, according to the Bureau of Labor Statistics.

Meanwhile, financial institutions remain unhealthy, with 140 banks having failed since the start of 2008. The few that seem to have avoided the worst hits, such as Goldman Sachs (GS, Fortune 500) and JPMorgan Chase (JPM, Fortune 500), have made a mint on their trading desks -- which thickens traders' wallets but doesn't do much for those seeking credit to start or expand a business.

"All that stuff just adds to the speculation and the market volatility," said Harrington. "I'd like to see them do more things that actually add to the economy."

Another sign that the pain isn't about to disappear comes from Sean Bisceglia, CEO of TalentDrive, a Chicago-based job search technology startup.

He says almost half of the companies he surveyed in August and September either had cut their hiring budget or didn't have one. Bisceglia concedes that number is a "fungible" one and says he expects that hiring will pick up when the economic outlook improves.

But companies like Bisceglia's may be a reason why it will take so much longer for job growth to return. Better, more efficient technology is replacing workers in many industries. That is one reason productivity has been rising -- and why jobs have been harder to come by.

"A lot of companies are using technology to streamline the hiring process, and that can hold down the headcount even when things get better," said Bisceglia, whose company employs 16 people and hopes to add four positions next year. "We're just trying to ride that wave." ![]()

-

The retail giant tops the Fortune 500 for the second year in a row. Who else made the list? More

The retail giant tops the Fortune 500 for the second year in a row. Who else made the list? More -

This group of companies is all about social networking to connect with their customers. More

This group of companies is all about social networking to connect with their customers. More -

The fight over the cholesterol medication is keeping a generic version from hitting the market. More

The fight over the cholesterol medication is keeping a generic version from hitting the market. More -

Bin Laden may be dead, but the terrorist group he led doesn't need his money. More

Bin Laden may be dead, but the terrorist group he led doesn't need his money. More -

U.S. real estate might be a mess, but in other parts of the world, home prices are jumping. More

U.S. real estate might be a mess, but in other parts of the world, home prices are jumping. More -

Libya's output is a fraction of global production, but it's crucial to the nation's economy. More

Libya's output is a fraction of global production, but it's crucial to the nation's economy. More -

Once rates start to rise, things could get ugly fast for our neighbors to the north. More

Once rates start to rise, things could get ugly fast for our neighbors to the north. More