Stimulus cash runs out for small business loans

The Small Business Administration has run through the money Congress allocated to enhance the agency's most popular loan programs.

|

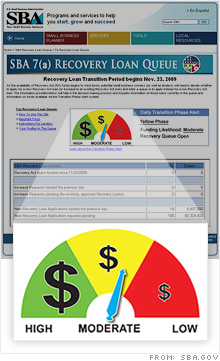

| The SBA's Recovery Loan Queue shows backlogged applicants how likely they are to be approved for a loan that draws on the dwindling pool of stimulus money. |

NEW YORK (CNNMoney.com) -- The stimulus cash that helped boost small business lending this year just ran out.

The Small Business Administration said Monday that it has run through all of the $375 million Congress allocated to temporarily waive fees and boost guarantees on loans backed by the SBA's lending programs. Businesses still hoping for a slice of the pie can get in line, cross their fingers and wait.

The SBA backs loans made by banks to qualifying small businesses. If the business defaults, the government pays the bank back for the guaranteed potion of the loan. Typically, the SBA charges banks for this guarantee, but since February the agency has been using a pool of Recovery Act funds to eliminate those fees. The agency also temporarily increased its cap on the portion of a loan it will guarantee, raising it to 90%.

The move was a popular one with banks -- though not popular enough to halt the freefall in small business lending. The stimulus incentives were in place for more than half of the SBA's 2009 fiscal year (which ended Sept. 30), but the number of bank loans backed by the SBA still fell 36% compared to the previous year.

Still, SBA officials say the decline would have been even sharper without the incentives. Last week, the SBA backed more than $1 billion in small business loans. By comparison, the agency fielded $684.5 million in loans in all of January, the month before the stimulus measures kicked in.

The money running out wasn't a surprise. The SBA knew its funding was getting low, and SBA chief Karen Mills put out a statement two weeks ago cautioning banks that the well would soon run dry. At the time, she forecast that the money would last into December. But last week, the SBA notified banks that Nov. 23 would be the "transition date" on which it would revert to its old fee and guarantee structure.

The SBA would like to see Congress allocate money to extend the measures at least through February. "We are going to continue to work with Congress to appropriate funds to maintain the reduce fees and increased guarantee," said agency spokeswoman Hayley Matz.

Loan applications surged last week as lenders tried to push through as many as possible before the deadline. To allocate the last dollars left, the SBA on Monday launched a Recovery Loan Queue. Those left hanging -- both business owners and the banks processing their loans -- can check online to see where their application stands. Any applications that don't make it through before the cash is exhausted will need to be resubmitted for a non-Recovery Act loan.

The SBA currently has 148 loans in queue, totaling $80.3 million.

Small business lending has plunged since the recession set in. At a Washington forum SBA Administrator Mills and Treasury Secretary Tim Geithner convened last week to discuss the problem, bankers emphasized the important of continuing the SBA's enhanced loan guarantees.

David Rader, the head of SBA lending at Wells Fargo (WFC, Fortune 500), pushed for an extension into 2011. Wells Fargo was the top SBA lender last year.

"We absolutely have increased our lending opportunities with the stimulus programs. The fee waivers for customers, the increased guarantee, is absolutely saving cash for our borrowers -- and cash is king," said Rader at the forum. "I think it is imperative for this body to continue the fee waiver and the 90% guarantee stimulus." ![]()

-

The Cheesecake Factory created smaller portions to survive the downturn. Play

-

A breeder of award-winning marijuana seeds is following the money and heading to the U.S. More

-

Most small businesses die within five years, but Amish businesses have a survival rate north of 90%. More

-

The 10 most popular franchise brands over the past decade -- and their failure rates. More

-

These firms are the last left in America making iconic products now in their twilight. More