Stocks rally on jobs report

Wall Street gains after a choppy day in which investors welcomed a better-than-expected jobs report but pulled back after the Dow hit a new 14-month high.

NEW YORK (CNNMoney.com) -- Stocks ended higher Friday, as investors redoubled their efforts after an afternoon selloff, following a better-than-expected November jobs report.

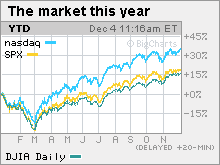

The Dow Jones industrial average (INDU) rose 23 points, or 0.2%, to close at 10388.90 after hitting a 14-month high of 10,516.70 in the morning. The S&P 500 index (SPX) rose 6 points or 0.6%. The Nasdaq composite (COMP) rose 21 points, or 1%. All three indexes gained for the week.

Stocks rallied across the board in the first two hours after the open, leaving the Dow and S&P 500 at fresh 14-month highs and the Nasdaq just short of one. But the new highs caused some investors to step back.

A strong dollar sent gold prices tumbling and also hit commodities and stocks that benefit from a weaker greenback. Bond prices slumped, boosting the corresponding yields.

The jobs report "blew us away," said Phil Orlando, chief equity market strategist at Federated Investors. "It confirms that the recession ended in the middle of the year and that we are moving ahead, even with some choppiness."

However, he said that while the labor market is healing, it still has a long way to go. That realization, combined with a little end-of-the-week fatigue, may have limited stock movement Friday.

"The jobs report was definitely positive and we are moving in the right direction, but it's important not to get too excited yet," said Michael Bapis, managing director at HighTower Advisors.

He said that while the economic news has been improving, it's hard to know what that improvement means in such an unusual economic environment.

A stronger dollar also put some pressure on the market, with gold prices plunging and commodity stocks slipping as well. Alcoa (AA, Fortune 500), DuPont (DD, Fortune 500) and Exxon Mobil (XOM, Fortune 500) were among the Dow's big losers. Tech leader IBM (IBM, Fortune 500) and financial firm Travelers (TRV, Fortune 500) were among the other losers.

Chemical company DuPont slumped 7% after it said its seed business will delay the release of several products.

Wall Street ended an uneven session lower Thursday ahead of the November jobs report, giving up early gains sparked by Bank of America (BAC, Fortune 500)'s decision to pay back the $45 billion in government bailout money it took.

Jobs: Employers cut 11,000 jobs from their payrolls in November, the Labor Department reported Friday morning. It was the smallest number of job losses since the start of the recession in December 2007 and a surprise to economists who were looking for employers to cut 125,000 jobs in the month.

Job losses in September and October were also revised lower by a total of 159,000.

The unemployment rate, generated by a separate survey, fell to 10% from 10.2% in October. It was the biggest one-month decline in more than three years. Economists thought the unemployment rate would hold steady at 10.2%.

The report shows the battered labor market is recovering, yet job growth is not expected to pick up until later next year. In addition, some of the improvement in the unemployment rate in November is attributable to job seekers giving up and dropping out of the market entirely.

The report showed 15.4 million Americans are out of work and seeking jobs. Meanwhile, another 6 million have given up looking and another 9.2 million have only found part-time work when they want full-time work.

Factory orders: Orders rose 0.6% in October after climbing 1.5% in the previous month. Economists surveyed by Briefing.com thought orders would hold steady.

Gold dips after new record: COMEX gold for February delivery fell $48.80 to settle at $1,169.50 an ounce after ending the previous session at a record high of $1,218.30 an ounce. Dollar-traded gold tumbled as the dollar firmed up.

The dollar and oil: The dollar gained versus the euro and yen. The stronger dollar caused dollar-traded oil to give up most of its morning gains.

U.S. light crude oil for January delivery fell 99 cents to settle at $75.47 a barrel on the New York Mercantile Exchange.

World markets: Overseas markets were mixed. European markets gained, with London's FTSE 100 up 0.2%, Germany's DAX up 0.8% and France's CAC 40 up 1.3%. Asian markets were mostly lower, with the exception of Japan's Nikkei.

Bonds: Treasury prices tumbled, raising the yield on the 10-year note to 3.47% from 3.37% late Thursday. Treasury prices and yields move in opposite directions.

Market breadth was negative. On the New York Stock Exchange, winners beat losers three to two on volume of 1.57 billion shares. On the Nasdaq, advancers topped decliners by almost two to one on volume of 2.33 billion shares. ![]()