Obama touts tax breaks for small biz hiring

In yet another attempt to help small business, President Obama wants to shift funds from Wall Street bailouts to instead help Main Street create jobs.

|

| President Obama called on Congress to create tax incentives for small businesses to hire and retain employees. |

|

| Funding for government-backed small business lending incentives ran out in late November, leaving more than 600 loan applications stuck in limbo. |

NEW YORK (CNNMoney.com) -- President Obama is trying yet again to throw a lifeline to small companies, this time zooming in on tax cuts for small business hiring and investment as a way to spark job creation.

In a speech delivered Tuesday at the Brookings Institution in Washington, Obama outlined in broad brush strokes a plan to accelerate job growth. Helping small businesses was one of three key areas that Obama targeted, alongside investing in America's infrastructure and in green energy.

The government recently announced that the Troubled Asset Relief Program (TARP), established at the height of the financial crisis last year to recapitalize the nation's banking system, will cost $200 billion less than expected. Obama wants that money redeployed into additional stimulus initiatives: "This gives us a chance to pay down the deficit faster than we thought possible and to shift funds that would have gone to help the banks on Wall Street to help create jobs on Main Street," Obama said Tuesday.

Getting Main Street hiring again is key to job recovery: Small businesses have created 65% of new jobs in the past 15 years, according to government estimates. Obama's latest set of proposals includes several brand-new measures, as well as extensions of existing stimulus acts.

Tax breaks for new jobs: President Obama threw his support behind a controversial proposal to provide tax incentives for small businesses to hire, but he didn't offer any details as to how he would implement the program.

"I believe it's worthwhile to create a tax incentive to encourage small businesses to add and keep employees, and I'm going to work with Congress to pass one," Obama said.

On a conference call with reporters prior to Obama's speech, senior administration officials said that they are still tossing around a slew of options, including tax credits for creating jobs or a temporary payroll tax holiday.

The plan is controversial because it's rife with potential for scams and for spending taxpayer dollars to "create" jobs that would have been filled even without the government incentives.

Another option under consideration is a payroll tax holiday, which would temporarily waive the 12.4% tax levied on workers' first $106,800 of wages. Typically, employers pay half of that tax and their workers pay the other half.

A tax holiday would especially benefit business owners and sole proprietors, because they foot the full 12.4% tax bill. It would also put more cash in the hands of business owners, which lawmakers hope would be used to hire additional workers.

However, a payroll tax would be very expensive, and the current political environment is unfriendly to the idea of expanding the already record and growing deficit.

The National Federation of Independent Business, an influential trade group, has been has been advocating for months for a payroll tax holiday. It would offer businesses an immediate and much-needed cash infusion, said Bill Rys, the NFIB's tax council. In his view, a tax credit would be of more limited use.

"You have to have an economic reason to bring a worker onto your payroll," said Rys. "Just giving you a $3,000 tax credit isn't going to be a whole lot of incentive to hire someone if you don't have $30,000 worth of business coming through the door."

Lending support: President Obama asked Treasury Secretary Tim Geithner to redeploy TARP funds to a popular program that makes it cheaper for small businesses to get government-backed loans and safer for banks to make those loans.

February's Recovery Act allocated money for the Small Business Administration to boost its lending programs. The money was used to temporarily waive fees and increase the guaranteed portion of the loans to as much as 90%: If a business owner defaults, the government pays the bank back for the insured portion.

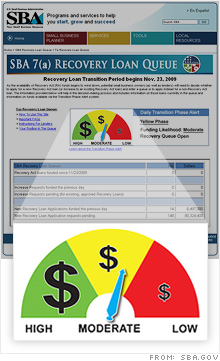

The initiative was popular among bankers and small business advocates, but its $375 funding pool ran out two weeks ago. A Recovery Loan Queue the SBA launched to track those still seeking funding currently has 679 pending applications for loans totaling $313 million.

The House and Senate have each kicked around proposals to extend that funding, but haven't yet come to agreement on them.

Boosting investment: The third branch of the White House's set of proposals to pump up Main Street hiring involves a trifecta of tax cuts aimed at small business investment and capital spending.

Investors who buy stock in qualifying small businesses already benefit from a favorable tax treatment. If they hold the stock for at least five years, they can skip paying capital gains tax on a portion of their profits. The Recovery Act boosted that exclusion to 75% for investments made in 2010 and most of 2009.

President Obama called Tuesday for increasing that exclusion to 100% for a one-year period. The hope is that investors will take advantage of the window to plow more capital into small companies, even though they won't be able to take advantage of their tax breaks for at least five years.

The White House also proposed extending two other Recovery Act tax provisions, one that allows small businesses to expense up to $250,000 worth of qualified capital investments and another that accelerates the rate at which businesses can deduct capital expenditures.

What comes next: One industry advocacy group said it supports the administration's effort, but the clock is ticking. "The time for talk has long since passed," National Small Business Association CEO Todd McCracken said in a prepared statement. "We need the administration and Congress to act now on these proposals -- they simply can't wait."

Rys of the NFIB said that the constant fluctuation in legislation is itself making business owners skittish: they need to know what costs to anticipate, from taxes to health care to energy costs.

"Coming off what has been a really bad economic year, business owners are going to be even more hesitant to come back and make an investment when they don't know what the rules will be a year from now," he said. ![]()

-

The Cheesecake Factory created smaller portions to survive the downturn. Play

-

A breeder of award-winning marijuana seeds is following the money and heading to the U.S. More

-

Most small businesses die within five years, but Amish businesses have a survival rate north of 90%. More

-

The 10 most popular franchise brands over the past decade -- and their failure rates. More

-

These firms are the last left in America making iconic products now in their twilight. More