Search News

NEW YORK (CNNMoney.com) -- Stocks rallied Tuesday as growing bets that European officials will rescue Greece from its debt problems reassured investors after a four-week selloff.

After the close, Dow component Walt Disney (DIS, Fortune 500) reported higher-than-expected quarterly earnings and revenue. Shares rose 2% in extended-hours trading.

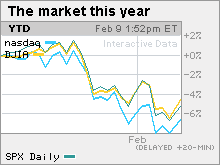

The Dow Jones industrial average (INDU) added 150 points, or 1.5%, after having risen as much as 230 points earlier in the session. It was the Dow's biggest one-day point advance since Jan. 4, when it gained 155.91.

The S&P 500 index (SPX) rose 14 points, or 1.3% and the Nasdaq composite (COMP) gained 25 points, or 1.2%.

"The prospect of the EU helping out Greece is a sigh of relief, but I really think today is mostly a bounce after the selloff," said Scott Armiger, portfolio manager at Christiana Bank & Trust.

He pointed out that last week, stocks rallied the first two sessions of the week before sliding later in the week. "Today is a good day, but it's only Tuesday," he said. "We need to see how the week plays out."

The threat of a default in Greece has sparked fears of a broader crisis that could impact Portugal, Spain, Ireland, Italy and other debt-challenged European nations. U.S. investors have been trying to gauge what kind of impact such a crisis would have on financial institutions as well as the still-fragile global economic recovery.

News that European Union leaders will meet Thursday to discuss how to manage a growing debt crisis reassured investors. Additionally, Greece said it's raising the retirement age and asking civil servants to accept bonus cuts.

European Central Bank president Jean-Claude Trichet is reportedly leaving a conference in Australia early to join the Thursday meeting. And the Wall Street Journal reported Germany is considering a plan to work with other EU members to offer loan guarantees to Greece and other troubled euro zone countries.

The December trade balance from the Commerce Department is due in the morning, while the January Treasury budget is due out in the afternoon. The weekly crude oil inventories report from the government is also due in the morning.

The House Financial Services Committee holds a hearing on the unwinding of Federal Reserve liquidity programs that were put in place at the height of the financial crisis. Fed Chairman Ben Bernanke testifies.

Pop after the fizzle: Stocks have fallen for four weeks straight on worries about China curbing bank lending, Washington cracking down on bank trading practices, and more recently, Europe's debt woes.

Between rally highs hit on Jan. 19 and Monday's close, the Dow lost 7.6%, the S&P 500 lost 7.3% and the Nasdaq lost 8.4%.

"I don't see this as much more than a reflex rally after the downtrend," said Mike Stanfield, chief investment officer at VSR Financial Services.

"There's still a lot of uncertainty about the economic and political environment going forward," he said. "It wouldn't be surprising to see the first half of the year be something of a consolidation period."

On the move: Financial shares bounced Tuesday, with the KBW Bank (BKX) index rising 1.3%. The index slipped nearly 5% between the market rally peak on Jan. 19 and Monday's close.

Big energy stocks including Exxon Mobil (XOM, Fortune 500) and Chevron (CVX, Fortune 500) rallied as the dollar slipped versus the euro. Barrick Gold (ABX), Goldcorp (GG) and Alcoa (AA, Fortune 500) were among the other big commodity shares rising.

Caterpillar (CAT, Fortune 500) gained after it was reportedly upgraded to "overweight" from "underweight" by Morgan Stanley.

Economy: Wholesale inventories fell by 0.8% in December after rising 1.6% in November, according to a government report released in the morning. Economists surveyed by Briefing.com thought inventories would rise 0.5%, on average.

"The weak inventories number shows you that businesses are not ready to restock their shelves," said Armiger. "They don't feel confident enough yet."

Toyota: The troubled automaker announced a global recall of 437,000 hybrids, including the 2010 Prius, due to problems with the anti-lock brakes.

Toyota (TM) has recalled 8.1 million vehicles due to brake problems. Shares gained 2.4%.

The House Oversight Committee holds a hearing on the company's recall Wednesday.

Quarterly results: Coca-Cola (KO, Fortune 500) reported fourth-quarter earnings of $1.54 billion or 66 cents per share, up 55% from a year earlier and in line with analysts' estimates, according to Thomson Reuters' estimates. The Dow component reported revenue of $7.51 billion, up 5% from a year ago and better than expected.

Shares of Coca-Cola rose 2.6%.

With 335 companies, or 67% of the S&P 500, having reported results, earnings are on track to have risen 207% versus a year ago and revenues to have gained 8%, according to Thomson Reuters. The jump is largely attributed to a combination of cost-cutting efforts and easy comparisons to a year ago.

Financials are expected to benefit more than any sector. Striping out financials leaves earnings growth at 16% and revenue growth at 3%.

Results have largely been positive, with 74% of companies beating earnings forecasts and 71% beating revenue forecasts.

Commodities: U.S. light crude oil for March delivery rose $2.56 to settle at $73.75 on the New York Mercantile Exchange.

COMEX gold for April delivery rose $11 to settle at $1,077.20.

Bonds: Treasury prices tumbled, raising the yield on the 10-year note to 3.63% from 3.56% late Monday. Treasury prices and yields move in opposite directions.

Market breadth was positive. On the New York Stock Exchange, winners topped losers three to one on volume of 1.24 billion shares. On the Nasdaq, advancers beat decliners by over nine to four on volume of 2.24 billion shares. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |