Search News

NEW YORK (CNNMoney.com) -- Stocks ended with modest losses Thursday, fighting off a bigger decline that surrounded the latest worries about Greece's debt crisis and weaker-than-expected reports on the economy.

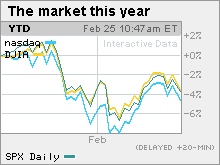

The Dow Jones industrial average (INDU) lost 53 points or 0.5%. The S&P 500 index (SPX) fell 2 points, or 0.2%. The Nasdaq composite (COMP) lost 2 points or 0.1%.

Stocks tumbled out of the gate after both Standard & Poor's and Moody's said they may have to cut Greece's debt rating if the country doesn't implement its so-called austerity measures, meant to rein in its deficit.

But after a bigger selloff through the early afternoon, stocks cut losses heading into the final hour of the session.

Greece has said it will raise the retirement age and have civil servants take bonus cuts, among other measures. A workers' strike Wednesday added to questions about the nation's ability to cut its debt. Investors are concerned about the broader implications for other euro zone countries, and the euro, should Greece default.

"It seems like the market doesn't know how worried it should be about Greece, which is why we're rallying off the lows of the day," said Ryan Atkinson, market analyst at Balestra Capital.

While the Greek debt situation is a serious one for the market, it's probably going to come in waves over the next six to nine months, Atkinson said. "Maybe they'll cut a deal initially [with officials], but longer term there are going to be more issues."

He said that investors were likely just as concerned about the day's economic news, including worse-than-expected reports on jobless claims and factory orders.

Market breadth was mixed. On the New York Stock Exchange, losers and winners were roughly even on volume of 1.15 billion shares. On the Nasdaq, decliners topped advancers five to four on volume of 2.1 billion shares.

Greece: The threat of a Greek default rattled global markets earlier in the month, pushing U.S. stocks to three-month lows and causing the S&P 500 to lose over 9%, just shy of the technical definition of a correction.

Investors worried that Greece's problems could reflect a broader euro zone debt crisis that could impact Portugal, Spain, Ireland, Italy and other debt-challenged European nations.

But European officials said earlier this month that they were ready to step in and help Greece if need be, and that seemed to calm investors for a few weeks. S&P and Moody's downgrade talk revived the worries.

In addition, stocks have been rising for the last two weeks, setting the market up for a little pullback, particularly in the aftermath of last year's big rally.

Bernanke: Federal Reserve Chairman Ben Bernanke told Senators Thursday that the central bank is looking into whether Goldman Sachs and other big banks worsened Greece's debt crisis.

News reports have said that Goldman and other banks helped arrange deals that may have disguised the extent of Greece's debt problems. In addition, the banks have made bets that Greece will default on loans it took from U.S. financial institutions, according to a New York Times article.

Bernanke spoke before the Senate Banking Committee Thursday in his second day of Congressional testimony on the economy.

On Wednesday he told a House committee that while the economic recovery is chugging along, the job market remains weak. Against that backdrop, interest rates will stay low for the foreseeable future. That seemed to reassure investors worried about the outlook for the economy and stocks rallied Wednesday.

Jobs: The number of Americans filing new claims for unemployment jumped last week to 496,000 from a revised 474,000 the previous week. Economists surveyed by Briefing.com expected 460,000 new claims.

Claims have jumped 12% over the past two weeks, due in part to the impact from the severe winter storms on the east coast.

Durable goods orders: Orders for big-ticket items meant to last three years or more jumped in January, with aircraft demand fueling the rise.

Durable goods orders rose 3% in January, the biggest increase since last summer and better than the 1.5% jump forecast by economists. Orders rose 1.9% in the previous month.

Orders excluding transportation fell 0.6% after rising 2% in December. Economists expected a rise of 1%.

Coke: Coca-Cola (KO, Fortune 500) said it will buy the North American operations of its biggest bottler, Coca-Cola Enterprises (CCE, Fortune 500) (CCE) in a deal that would cut costs and give it more control of its distribution.

The multi-layered deal has Coca-Cola giving up its 34 percent stake in CCE, worth about $3.4 billion, and taking on $8.88 billion in debt.

Additionally, the companies agreed that CCE will buy Coke's bottling operations in Norway and Sweden for $822 million and that it has the right to buy Coke's 83% stake in its German bottling operations.

The deal comes as rival PepsiCo (PEP, Fortune 500) is about to close a $7.8 billion deal to buy Pepsi Bottling Group and PepsiAmericas, its largest bottlers.

Coke shares plunged 4% and CCE shares rallied 33%.

Palm: Palm (PALM) said it expects revenue to fall far below current forecasts due to worse-than-expected sales of its new smartphones. Shares plunged 19% on the forecast.

Health care: The Obama administration's health care summit was underway Thursday, with Republican and Democratic leaders from both houses of Congress debating ways to reform the system.

The president said that both sides agree that costs need to be contained, but they remain bitterly divided over whether to press through with the current bill or start over.

World Markets: In overseas trading, major European and Asian markets ended lower.

The dollar and commodities: The dollar gained versus the euro after seesawing versus the European currency throughout the session. The greenback fell versus the yen.

U.S. light crude oil for April delivery fell $1.83 to settle at $78.17 a barrel on the New York Mercantile Exchange.

COMEX gold for April delivery rose $11.30 to settle at $1,108.50 per ounce.

Bonds: Treasury prices rallied, lowering the yield on the 10-year note to 3.63% from 3.69% late Wednesday. Treasury prices and yields move in opposite directions. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |