Search News

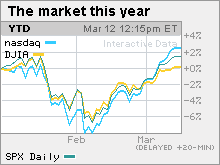

NEW YORK (CNNMoney.com) -- Stocks ended little changed Friday, as investors welcomed a report that showed a surprise rise in retail sales, but showed caution as the Dow, Nasdaq and S&P 500 lingered below 18-month highs.

The Dow Jones industrial average (INDU) added 12 points or 0.1%. The S&P 500 index (SPX) and the Nasdaq composite (COMP) were little changed. Both ended the previous session at their highest levels in a year and a half.

Stocks have risen modestly over the last two weeks as investors have struggled to balance expectations for a broader economic recovery with the reality of more modest signs of improvement.

Through Friday's close, the Dow, S&P 500 and Nasdaq have all risen in nine of the last 11 sessions.

"It's been quiet the last few weeks, but there's still been this upward bias in the market," said Kenny Landgraf, founder at Kenjol Capital Management.

That bias should enable stocks to continue to drift higher over the next few weeks, he said, but any gains are going to be capped by continued concerns about the economic outlook both in the U.S. and overseas.

He said that the Dow, currently at 10,624.69, could drift as high as 11,000, but that at that point its likely to meet some heavier selling pressure.

Economy: Retail sales rose 0.3% last month, according to a Commerce Department report released Friday morning. Sales rose a revised 0.1% in January and were expected to fall another 0.2% in February, according to a consensus of economists surveyed by Briefing.com.

Sales excluding autos rose 0.8% in February after rising 0.5% in January. Economists thought sales would rise 0.1%.

The University of Michigan consumer sentiment index fell to 72.5 in early March from 73.6 in the previous month. Economists thought sentiment would rise to 74.

Business inventories were unchanged in February, after falling 0.2% in the previous month. Economists thought inventories would rise 0.1%.

In other economic news, President Obama wants to nominate San Francisco Federal Reserve Bank president Janet Yellen to become the next Federal Reserve vice chairman. If nominated and confirmed, Yellen would replace Donald Kohn, who is retiring as of June 23rd.

Lehman Brothers: The collapse of Lehman Brothers was largely attributable to actions by its executives and auditor, according to a report by a U.S. bankruptcy court released Friday.

The collapse of Lehman in September 2008 played a critical role in turning an already precarious financial market environment into a full-blown crisis.

The dollar and commodities: The dollar fell versus the euro and gained against the yen.

U.S. light crude oil for April delivery fell 87 cents to settle at $81.24 a barrel on the New York Mercantile Exchange.

COMEX gold for April delivery fell $6 to $1,102.20 per ounce.

Bonds: Treasury prices rose, lowering the yield on the 10-year note to 3.71% from 3.72% late Thursday. Treasury prices and yields move in opposite directions.

World markets: In overseas trading, European markets were mixed. The London FTSE rose 0.2%, the French CAC 40 was unchanged and the German DAX lost 0.4%. Asian markets were mixed, with Japan's Nikkei rising 0.8% and the Hong Kong Hang Seng ending lower.

Market breadth was mixed. On the New York Stock Exchange, winners beat losers eight to seven on volume of 1.05 billion shares. On the Nasdaq, decliners beat advancers by seven to six on volume of 2.04 billion shares. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |