Search News

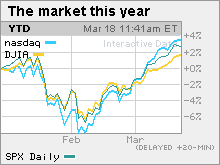

NEW YORK (CNNMoney.com) -- Buying in select blue chips Thursday propelled the Dow to its eighth straight gain and the highest close in nearly 18 months, but the broader market churned as investors showed some reluctance after the recent rally.

The Dow Jones industrial average (INDU) added 45 points, or 0.2%, ending at the highest point since Oct. 1, 2008. The Dow has now ended higher for eight straight sessions -- matching the winning streak that ended on Aug. 27 of last year.

The S&P 500 index (SPX) ended just below unchanged after finishing the previous session at its highest point since Sept. 26, 2008. The Nasdaq composite (COMP) added a few points and ended at the highest point since Aug. 28, 2008, nearly 19 months.

Stocks seesawed midday Thursday as investors welcomed reports that suggest pricing pressure remains mild and that jobless claims fell last week.

The Dow, S&P 500 and the Nasdaq have risen in four of the last five weeks and all currently on track to end higher for this week. The Dow has ended higher in 15 of the last 16 sessions through Thursday, while the Nasdaq and S&P have closed higher in 14 of the last 16 sessions.

After such a run, stock investors showed reluctance to make much of a move on Thursday.

Stocks rallied Wednesday, with the three major indexes all closing at new 2010 highs, after the U.S. and Japanese central banks chose to keep interest rates low. The gains were also driven by the Senate's passage of a $17.6 billion jobs bill that President Obama is expected to sign into law Thursday.

Jobs market: The number of Americans filing new claims for unemployment fell to 457,000 last week from 462,000 the previous week, the government said. Economists had been expecting 455,000 new claims.

Continuing claims, a measure of those who have been receiving benefits for a week or more, rose to 4,579,000 from 4,567,000 the previous week. Economists expected 4,522,000 in continuing claims.

Inflation: The Consumer Price Index (CPI) was unchanged in February after rising 0.2% the month before, according to a government report released before the start of trading. Prices were expected to have risen 0.1% in the month.

The so-called core CPI, which removes volatile food and energy prices, rose 0.1% in February after falling 0.1% in January, meeting expectations.

Other economic news: The Conference Board released its index of leading economic indicators (LEI) shortly after the start of trading. LEI rose 0.1% in February, as expected, after rising 0.3% in the previous month.

The Philadelphia Fed index, also released after the start of trading, rose to 18.9 in March from 17.6 in February. Economists thought it would rise to 18.

Greece: The nation warned Thursday that it will have to tap the International Monetary Fund for help if the European Union can't agree next week to a plan of attack that will help it cut its borrowing rates. Going outside the 16-nation euro zone would be seen as a blow to the group and could further weaken the euro.

Greece has already implemented so-called austerity measures to cut back some of its debt, including lifting the retirement age and asking government workers to take pay cuts. However, these measures are being countered by rising borrowing rates, as lenders fear that Greece will ultimately default on its debt.

FedEx: FedEx (FDX, Fortune 500) reported higher fiscal third-quarter sales and earnings that topped estimates, thanks to higher shipping volume. Shipping volume is a key measure for FedEx and the improvement is seen as a good sign for the economy.

The package delivery firm also lifted its forecast for full-year earnings to a range that meets analysts' estimates. But the company said fiscal fourth-quarter earnings will fall in a range that could miss analysts' estimates, leaving shares little changed.

On the move: A variety of bank shares slipped with analysts at Citigroup and a few smaller brokerages cautioning that the sector is vulnerable to a pullback after having bounced so much off the market lows a year ago.

Since the broad stock market bottomed on March 9, 2009, the Financial Select Sector (XLF), which tracks the biggest financial stocks, has gained over 150%.

On Thursday, regional banks such as KeyCorp (KEY, Fortune 500), SunTrust Banks (STI, Fortune 500) and Fifth Third Bancorp (FITB, Fortune 500) all fell. Larger financial firms including Morgan Stanley (MS, Fortune 500) and Bank of America (BAC, Fortune 500) also fell.

Market breadth was mixed. On the New York Stock Exchange, losers narrowly edged winners four to three on volume of 922 million shares. On the Nasdaq, decliners beat advancers five to four on volume of 2.1 billion shares.

The dollar and commodities: The dollar gained versus the euro and the yen.

U.S. light crude oil for April delivery fell 73 cents to settle at $82.20 a barrel on the New York Mercantile Exchange.

COMEX gold for April delivery rose $3.30 to settle at $1,127.50 per ounce.

Bonds: Treasury prices fell, raising the yield on the 10-year note to 3.66% from 3.64% late Wednesday. Treasury prices and yields move in opposite directions.

World markets: In overseas trading, European markets slipped. The London FTSE ended little changed, the French CAC 40 fell 0.4% and the German DAX lost 0.2%. Asian markets tumbled, with Japan's Nikkei losing 0.1% and the Hong Kong Hang Seng falling 0.3%. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |