Search News

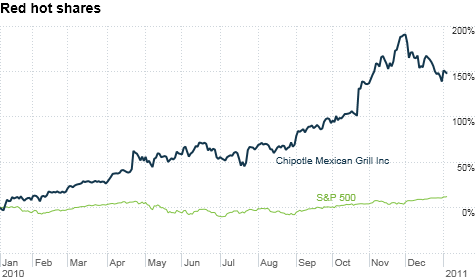

FORTUNE -- Chipotle Mexican Grill is the hottest restaurant around. With organic produce, fast service and a simple menu, the chain has doubled earnings over the past two years. Sales are expected to hit $1.8 billion this year. And the stock is up 150% over the last year.

That success is making Chipotle (CMG) one the most debated growth stocks: Can it keep up the torrid pace? And will investors continue rewarding the stock with a rich price to earnings ratio? We asked two analysts covering the restaurant to give us their cases to buy or sell.

Bull: David Tarantino, analyst, Robert W. Baird & Co.

We raised our 2011 price target on Chipotle to $300 in December, a 33% increase from its current price. Today quality growth stocks are scarce. In 2011 we expect Chipotle to post 15% revenue growth and 20% earnings growth. In the S&P 500 consumer discretionary index, only three companies are expected to grow revenues 15% or greater in both 2010 and 2011.

This puts Chipotle in an elite class of companies. The stock's growth story can command a premium valuation, the same way Starbucks (SBUX, Fortune 500), Lowe's (LOW, Fortune 500), and Coach (COH) delivered above-market P/Es for extended periods in the late '90s and 2000s. PEG ratios [P/E to growth] for those types of growth stocks in the decade before the financial crisis averaged 1.7. That's the ratio at which we're buying Chipotle. That largely reflects, in our opinion, investors' willingness to pay a premium for high-quality growth when there are not a lot of alternatives.

The reason you would buy any restaurant company is that they can put capital to work and achieve returns that you're not able to get elsewhere. And Chipotle is the definition of that. They generate very robust returns on capital when they build a new location, and given that we think the company is in the relatively early stages of their growth, there's a lot of opportunity to take that capital and achieve excellent returns building new locations. We think the runway for that is long and can create a lot of economic value over the next 5 to 10 years by building out the concept across the U.S. and potentially into international markets.

The thing about Chipotle that gives me confidence longer-term is how simple the concept is: The menu doesn't change much, and there are relatively few ingredients.

Bear: Erik Kolb, equity analyst, Standard & Poor's

We downgraded the stock to sell in November. It's a valuation call. Even though we believe in Chipotle's long-term growth strategy, our near-term view is tempered by the stock's drastic run-up over the past two years. It currently trades over 35 times our 2011 earnings estimate. Our target price of $190 for the stock is based on a 29 price-to-earnings ratio for 2011, which we consider lofty enough to contain for the growth story that is Chipotle. At the same time, we feel like it's gotten ahead of that. It is much higher than its competitors' average P/E of 23.

This is a valuation call, but we see a couple of other factors that indicate perhaps its bounding run-up will be slowly down in the near future. On the third quarter earnings call, management suggested 2011 same-store sales to be in the low single-digits. Based on our modeling, we still expect mid-to-high single digits through the first quarter. That implies very low comparable sales in the back half of 2011. We think they've peaked.

Shares experienced a large run-up over the past couple years as consumers eased back into Chipotle's upscale casual fast food marketplace. We see that as largely plateauing as consumers buy in their normal habits again.

There's no question investors are willing to pay for this name at times, but we feel it's unwarranted right now. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |