Search News

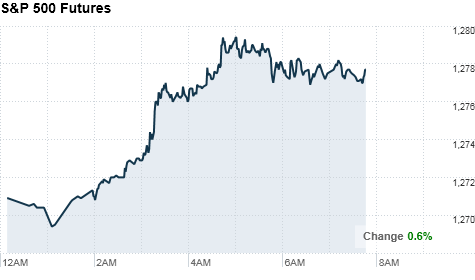

Click chart for more pre-market action.

Click chart for more pre-market action.

NEW YORK (CNNMoney) -- U.S. stocks headed for a higher open for the second day in a row Wednesday, as eurozone jitters continued to ease and investors awaited the Federal Reserve's latest snapshot of economic conditions.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were up ahead of the opening bell. Futures measure current index values against perceived future performance.

Europe continues to be a wild card as 2011 gets underway, and investors are looking for any signs that those issues are under control.

Stocks closed higher Tuesday after Japan's pledge to buy eurozone bonds eased worries about Europe's debt crisis spreading. Tuesday's uptick ended a three-day slide for the Dow and S&P 500 that had put a damper on an otherwise strong start to 2010.

As eurozone nations auction government debt and other countries offer support for the struggling region, stocks could regain momentum in the remainder of the week, Peter Cardillo, chief market economist at Avalon Partners.

"It's a dire situation, but at the end they will survive," he said. "If there were a domino effect in Europe, and the so-called PIIGS (an acronym for 5 troubled nations) were to go bankrupt, that would be a horrible situation and everyone would suffer -- so when push comes to shove, other countries will be there to assist."

World markets: European stocks rallied at midday after Portugal's successful auction of government debt. The auction came amid recent speculation that Portugal might be the next eurozone country to need a bailout.

"They sold $1.249 billion at the auction, so basically money is costly but they are selling it, so that's a relief for the market," said Cardillo. "Tomorrow is Spain's turn, and that auction shouldn't be a problem either, so the market is going to be moving higher on that as well."

The DAX in Germany climbed 1.5%, France's CAC 40 jumped 1.6%, and Britain's FTSE 100 gained 0.5%.

Asian markets ended higher. The Shanghai Composite rose 0.6%, the Hang Seng in Hong Kong climbed 1.5% and Japan's Nikkei was barely above breakeven.

Meanwhile, Bank of China is allowing customers in the United States to trade its currency, the yuan, for the first time, the Wall Street Journal reported.

Economy: Investors will be awaiting the Federal Reserve's latest reading on economic conditions across the central bank's 12 districts. The Beige Book report for January comes out at 2 p.m. ET.

"Investors will be looking for clues about what's on the minds of the Fed in terms of improving economic activity," said Cardillo. "I think we'll see the usual rhetoric of the Fed, but they might be more optimistic about growth."

The December Treasury budget is also on tap at 2 p.m. ET. Economists expect the budget shortfall to ease to $80 billion in December from $91.4 billion in the previous month.

Reports on import and export prices and weekly crude oil inventories are due in the morning.

Companies: AIG (AIG, Fortune 500) announced Wednesday that it has agreed to sell its Taiwan unit, Nan Shan Life Insurance Company, for $2.16 billion in cash. Shares of the insurer gained more than 2% in pre-market trading.

Shares of ITT (ITT, Fortune 500) surged 17% after the manufacturing company announced plans to split into three publicly traded companies by spinning off its water-related businesses and defense division.

Currencies and commodities: The dollar gained ground against the euro and the Japanese yen, but fell slightly versus the British pound.

Oil for February delivery edged up 5 cents to $91.16 a barrel.

Gold futures for February delivery fell $4.80 to $1,379.50 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 3.38% from 3.34% late Tuesday. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |