Search News

FORTUNE -- For most Americans, their home is the largest and most important investment they will ever make. Ensuring that they have the right kind of mortgage is critical to their financial well-being and -- as we've seen recently -- critical to our entire economy.

That means we have to solve the Fannie Mae and Freddie Mac problem and eventually figure out the proper role of the federal government in supporting a secondary market for home mortgages. Doing that right is one of the most important issues facing Congress and the Obama administration.

Some people ask, Why do we even need a secondary market for home mortgages? Why don't we just go back to the good old days before those markets existed and require banks to hang on to all the mortgages they create?

Let me tell you why. When I went to buy my first house in 1976, mortgage money was hard to find. In fact, it was rationed. Banks simply didn't have the deposits on hand to meet the demand. That was 35 years ago, and we don't want to go back to those "good old days." Mortgage rationing is not the future we want for our customers, their children, or their grandchildren.

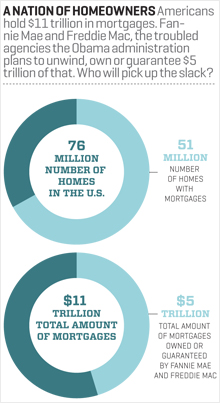

Consider these facts: There are 76 million homes in the U.S., of which 51 million have mortgages. Taken together, those mortgages represent a debt of $11 trillion. That's a level of debt that banks can't afford to hold on their balance sheets alone. As a nation, if we want to make home ownership broadly available and affordable, we need a secondary mortgage market that operates fairly and efficiently for all parties.

Freddie Mac and Fannie Mae were created in part to help achieve those goals, but they've run into big trouble along the way. They now own or guarantee nearly 31 million home loans, worth more than $5 trillion. Their role is so critical in mortgage finance that the federal government bailed them out in 2008 to the tune of what might end up to be more than $250 billion.

So as Fannie and Freddie unwind, as they certainly will, what principles should shape the future of home financing? I believe the answer comes in three parts. First, all parties involved in making and investing in mortgage loans need to share a financial interest in the quality of those loans. That includes the customer taking out the loan, the financial institution or broker originating the loan, and the investor who ultimately owns the loan. All parties need to have skin in the game. If originators don't have a financial interest in the loan, they will have less concern for its quality, and poor lending decisions will happen and be passed along to investors. That creates a house of cards.

A healthy debate is already taking place about how much a homeowner should put down and how much a bank should keep on its balance sheet when it bundles and sells mortgage loans. There is no magic number out there, but I can tell you one thing: The more the risks and rewards of a mortgage loan are shared by all parties -- and the better those risks and rewards are understood -- the better the quality of the loan will be.

Will this mean higher down payments for homeowners and more financial skin in the game for banks? Probably so, but the long-term costs for homeowners, bankers, and the economy will be dramatically lower. Just look at what past mortgage lending practices have cost all of us.

Second, whatever role the federal government assumes in mortgage finance going forward, its role needs to be explicit, not implicit. Currently federal backing for Fannie and Freddie is implied because they are "government-sponsored enterprises." It needs to be crystal clear for investors around the world whether GSE loans are backed by the full faith and credit of the United States. If they are, consumers would benefit from worldwide liquidity for mortgage products. To protect taxpayers, adequate levels of private capital should be required to take the risk of loss. In this way, the federal government would only act as a "catastrophe risk" backstop much like the role the FDIC plays in protecting bank deposits up to a certain limit. Banks would pay a fee, just as they do for FDIC insurance, and the homeowner's mortgage would be guaranteed up to a certain amount by the federal agency providing the insurance.

And third, as we move forward in a post-GSE marketplace, we need to make sure we have uniform underwriting and servicing standards for mortgage loans, and more common products for what are called conforming mortgage loans. An efficient secondary market depends on relatively standard products and processes. Otherwise every batch of loans has to be examined in detail for its unique qualities, an examination that results in higher transaction costs and ultimately less attractive investments. The lack of standardization drains the lifeblood out of secondary market operations.

Mortgage financing is a big deal for millions of Americans and for our economy overall. All sides should be looking for solutions that will help all Americans. The path forward will not be easy, but I truly believe the solutions can be found. It will require hard work, courage, and cooperation across the board. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |