Search News

NEW YORK (CNNMoney) -- Stocks ended a dismal quarter with heavy losses Friday as investors remain worried about the debt crisis in Europe and the outlook for global economic growth.

The Dow Jones industrial average (INDU) fell 240 points, or 2.1%, to close at 10,913. The S&P 500 (SPX) slid 30 points, or 2.5%, to 1,131. The Nasdaq Composite (COMP) fell 65 points, or 2.6%, to 2,415.

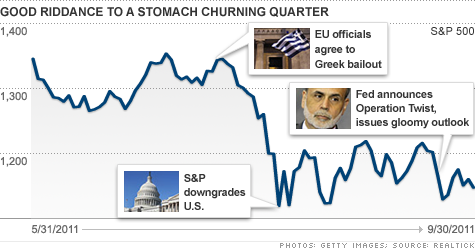

The losses capped the biggest quarterly drop for the S&P 500 and the Nasdaq since the fourth quarter of 2008. The S&P 500 lost 14% and the Nasdaq fell 13% over the last three months.

The Dow fell 12% in the quarter, marking its worst quarterly performance since the first quarter of 2009.

On Friday, Alcoa (AA, Fortune 500) was the worst performing Dow stock. Shares of the aluminum producer sank 5% amid concerns about a slowdown in global manufacturing.

The banking sector was hit by worries the sovereign debt crisis in Europe could spill over into the financial system. Morgan Stanley (MS, Fortune 500) plunged over 10%. Bank of America (BAC, Fortune 500), JPMorgan (JPM, Fortune 500),and Citigroup (C, Fortune 500) also fell sharply.

The few gainers were concentrated in defensive sectors such as consumer staples and health care. Merck (MRK, Fortune 500) and Walmart (WMT, Fortune 500) both rose modestly.

The debt crisis in Europe is "all that anybody cares about," said Dan Greenhaus, chief global strategist at brokerage firm BTIG. "The worst-case scenario is a disintegration of the European banking sector."

Concerns about government debt problems in Europe intensified in the third quarter. Investors are afraid that Greece could default on its debts, setting off a banking crisis similar to the one that occurred after Lehman Brothers collapsed in 2008.

In addition, economic activity in the United States and around the world has slowed. The Federal Reserve and the International Monetary Fund both warned of increasing risks to the global economic recovery.

"It's been a very uncomfortable quarter for investors as news from Europe and now China has filtered into equity valuations," said Lawrence Creatura, a portfolio manager with Federated Clover Investment Advisors.

Looking ahead, traders said the market could find some support next month as the quarterly corporate reporting period gets underway.

But a number of potential pitfalls are on the horizon, including a crucial impasse over additional bailout funds for Greece.

Given the uncertain outlook, trading will remain volatile and investors will continue to focus on events overseas, said Creatura.

"People are starved for information, and their hyper-sensitivity is on display when any snippet of information can cause 100-point swings in the market," he said.

Stocks went on a roller-coaster ride Thursday, as investors parsed through positive news in the U.S. and Europe.

Economy: Personal spending increased 0.2% in August, while incomes eased 0.1%, according to U.S. government statistics. The figures matched economists' expectations.

The Chicago PMI, a regional reading on manufacturing activity, climbed to 60.4 in September from 56.5 in August, signifying further expansion in the sector.

The University of Michigan's final reading on consumer sentiment in September was revised up to 59.4 from the preliminary reading of 57.8.

Companies: Trading in shares of Eastman Kodak (EK, Fortune 500) was halted following reports that the company could declare bankruptcy. The stock plunged 58% to 70 cents per share before a circuit breaker was triggered.

Bank of America (BAC, Fortune 500) will begin charging a $5 monthly fee at the beginning of next year for customers who make debit card purchases.

World markets: European stocks fell after Eurostat, the European Union's statistics agency, released a report that showed inflation rose to 3% from 2.5% in August -- its highest level in three years.

The inflation data called into question a widely held assumption that the European Central Bank is planning to lower interest rates in October or November. The ECB will make its next policy statement Thursday.

Britain's FTSE 100 (UKX) slipped 2%, the DAX (DAX) in Germany dropped 2.7% and France's CAC 40 (CAC40) shed 2.1%.

This was a dismal quarter for the European markets. The FTSE is down 14.5% over the last three months. The CAC and the DAX are both down 26% for the quarter.

Asian markets ended lower. The Shanghai Composite (SHCOMP) fell 0.3%, the Hang Seng (HSI) in Hong Kong tumbled 2.3% and Japan's Nikkei (N225) ended little changed.

Currencies and commodities: The dollar gained strength against the euro and the Japanese yen and the British pound.

Oil for November delivery fell $1.46 to $80.68 a barrel.

Gold futures for December delivery rose $14.50 to $1,631.90 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 1.93% from 2% late Thursday. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: