Search News

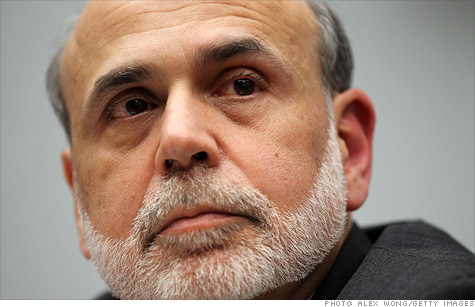

What will Federal Reserve Chairman Ben Bernanke and co. do next to stimulate the economy?

NEW YORK (CNNMoney) -- Hiring has slowed, economic growth has eased, inflation is tame and millions of Americans remain unemployed. In short, the recovery is stalling.

But after more than three years of trying to stimulate the economy, what else is the Federal Reserve to do?

That's the predicament Fed Chairman Ben Bernanke and his crew will answer Wednesday when the two-day Federal Open Market Committee meeting ends in Washington.

Should they chose to act soon, here are some options on the table:

Likelihood: High

Dubbed Operation Twist, this policy swaps $400 billion in short-term bonds for ones with a longer duration. The aim is to push down long-term interest rates, thereby making it cheaper for businesses to get loans and consumers to get mortgages and other forms of credit.

While it's unclear just how effective Operation Twist has been so far, it is true that long-term rates have come down since October, when the program started. Simultaneously, mortgage rates have fallen too.

Just how much this has helped the economy though is questionable. Even with mortgage rates at record lows, new home sales have been choppy and banks are still unwilling to lend to anyone with less-than-perfect credit. Small business owners are also struggling to get loans.

That said, the Fed is still likely to consider extending Operation Twist beyond its original June 30 end date. Unlike other methods of boosting the economy, Operation Twist doesn't add to the balance sheet and therefore won't be met with as much resistance.

Atlanta Fed President Dennis Lockhart, who just a month earlier had said he opposed the idea, told reporters last week that it's still one of several options on the table.

But the Fed doesn't have much wiggle room in this area. Should it decide to extend Twist, it has only a limited supply of short-term bonds left in its arsenal. That diminishes the potential impact this plan could have.

Likelihood: Medium

Buying more Treasuries is another possibility for the Fed, but it comes along with greater risks. The central bank has already embarked on this policy -- known as quantitative easing or QE -- twice now, and while it has pushed interest rates lower, it has yet to solve the job market's woes.

That's because low interest rates aren't effective unless banks lend out their money. That still isn't happening. The frequency at which money changes hands in the U.S. economy is now at a record low.

Adding a third round of QE is unlikely to change that, plus it comes with greater risks. It would increase the Fed's balance sheet and ignite controversy among conservatives and inflation hawks.

That said, some economists think it's still a possibility later this summer, but only if the economic outlook gets worse.

Bernanke's number two in command, Fed Governor Janet Yellen, has recently hinted to being open to such a policy if the recovery continues to struggle.

Bernanke has been unwilling to offer any hints lately, but watch for more from him in August. In the past few years, he has waited until the Kansas City Fed's key meeting in Jackson Hole, Wyo., to break news of any bold new plans.

Likelihood: Low

The Fed has kept interest rates near zero since December 2008 in an attempt to boost the economy. But the central bank can also have an impact merely by signaling to investors where it thinks interest rates should be in the future.

The Fed's most recent forecasts suggest interest rates should stay "exceptionally low" until late 2014. Extending that language to say 2015 or later could spur economic activity by eliminating some uncertainty about future interest and inflation rates.

Economists say such a move is unlikely to have much impact though. So much can change over the next two or three years. The presidential election, for one, could change expectations for future tax and spending policies.

Plus, the makeup of the Fed is scheduled to change. Bernanke's term as chairman ends in January 2014, and whoever his successor is could have different ideas.

Yellen has said "the effects of forward guidance are likely to be weaker the longer the horizon of the guidance, implying that it may be difficult to provide much more stimulus through this channel."

The Fed will release its official statement at 12:30 p.m. ET on Wednesday, followed by a press conference with Bernanke at 2:15 p.m. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Latest Report | Next Update |

|---|---|

| Home prices | Aug 28 |

| Consumer confidence | Aug 28 |

| GDP | Aug 29 |

| Manufacturing (ISM) | Sept 4 |

| Jobs | Sept 7 |

| Inflation (CPI) | Sept 14 |

| Retail sales | Sept 14 |