Tuition hikes, stagnant growth in federal aid and increases in other expenses have pushed public college costs to new heights yet again this year, according to a College Board report out Wednesday.

To attend an in-state public college for the 2012-13 academic year, the average overall cost (or "sticker price") for students who don't receive any financial aid rose 3.8% to a record $22,261, according to the report.

Tuition accounted for about half of that increase. Public university tuition and fees alone rose 4.8% to $8,655. In addition, higher dorm, cafeteria, books and other expenses added significantly to the overall increase.

While about two-thirds of full-time students receive grants or federal tax breaks, many are likely to have to foot more of the bill themselves this year. The College Board's economists estimate that financial aid budgets stayed flat, leaving students less money to cover rising college costs.

As a result, the net price (the cost after scholarships, grants and federal tax benefits) that in-state students at public colleges will pay this year rose 4.6% to an average of $16,510.

That's more than twice the rate of inflation, which rose just 2% over the last 12 months.

Related: How much will that college really cost?

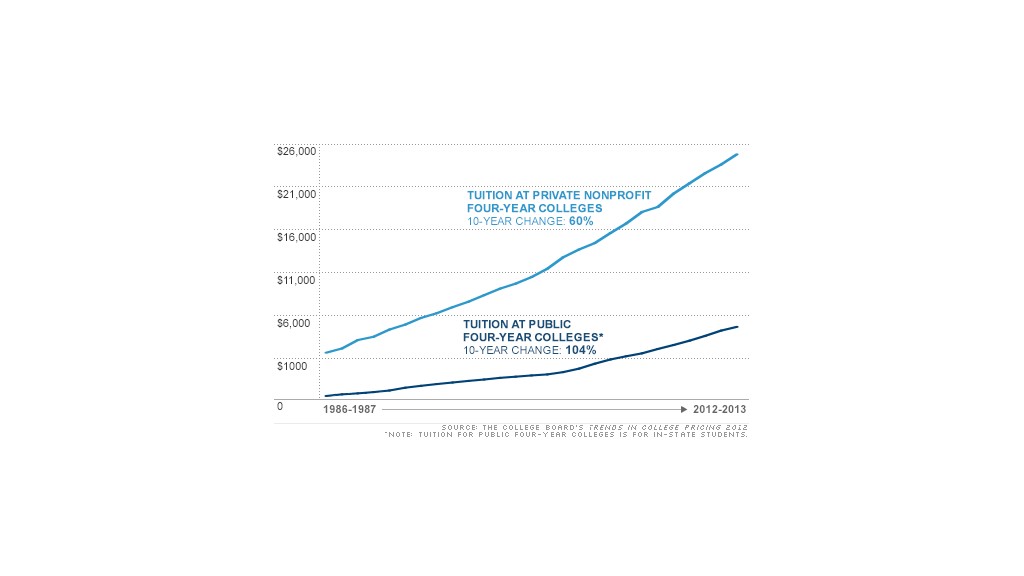

While the rate of public college tuition hikes has steadily fallen from the 9% rate seen in 2008, Sandy Baum, an economist and lead author of the College Board's report, said not to expect much more of an improvement. "Tuition is going to keep rising faster than inflation," she said.

The College Board crunched the numbers to explain why college prices keep rising faster than just about everything else in the economy.

States have cut the amount of money they are giving to colleges by a total of $15.2 billion since 2007, or 17.4%. At the same time, the number of students enrolled in college has risen 12%. That means the average public college gets a tax subsidy of only $6,600 per student, down from $9,300 just five years ago.

The dramatic increases in public college tuition over the years have made up only about two-thirds of those subsidy losses, the College Board said.

Related: Extreme ways to pay for college

Private colleges haven't had to make up for state budget cuts, but have been raising prices to cover increased expenses.

Tuition and fees climbed 4.2% at four-year private schools to an average of $29,056 this year. Overall prices were 4% higher at $43,289. But with more than 80% of students receiving scholarships or grants, the average private college student will pay a net price of about $27,600 -- a 5.6% increase from last year, the College Board estimated.

Some of the fastest rising costs on private college campuses are employee health care, insurance premiums and technology, said David L. Warren, president of the National Association of Independent Colleges and Universities. Colleges have also been investing in student services, like mental health counseling, and programs aimed at boosting graduation rates, he said.

In addition, both public and private universities have been raising dorm and cafeteria prices at a rate of about 2% more than inflation each year for the last decade. A year's room and board at a typical public university has risen 65% over the last 10 years to an average of $9,200. Meanwhile, private college living costs have climbed 54% to an average of $10,460.

Vennie Gore, assistant vice president for residential and hospitality services at Michigan State University and president of the Association of College and University Housing Officers -- International, says schools like his have to raise dorm costs to fund repairs, upgrade older dorms and build new residence halls that meet today's students' expectations for technology, privacy and space.

Gore says students don't like the old-style dorms with big shared bathrooms. In new dorms, two rooms typically share a single smaller bathroom, he says. New dorms also typically provide more common areas for cooking, studying and other activities. Finally, "things we used to see as luxuries, such as Internet, and cable, they see as basic necessities or utilities," he said.

Related: How does your community college stack up?

One bright spot in the College Board report were the findings from community colleges, which enroll 26% of full-time college students. While tuition at community colleges climbed an average of $168, or 5.6%, this year to $3,131, students appear to be getting enough aid to cover most of their costs.

The College Board estimated that the average community college student received enough grants and tax breaks to cover the typical tuition and all but $10 of the average $1,230 bill for textbooks and school supplies.

Despite rising costs and resulting student loan debt, a college education is still worth it, said the College Board's Baum. "There's a really high return" to investing in a good college education, she said.

The average cost of college: 2012-13

| | Public two-year (in-state) | Public four-year (in-state) | Private four-year |

|---|---|---|---|

Tuition & fees | $3,131 | $8,655 | $29,056 |

Room, board, books, etc. | $12,453 | $13,606 | $14,233 |

Total cost | $15,584 | $22,261 | $43,289 |

Net price (after scholarships, grants, aid) | $4,350 | $5,750 | $15,680 |