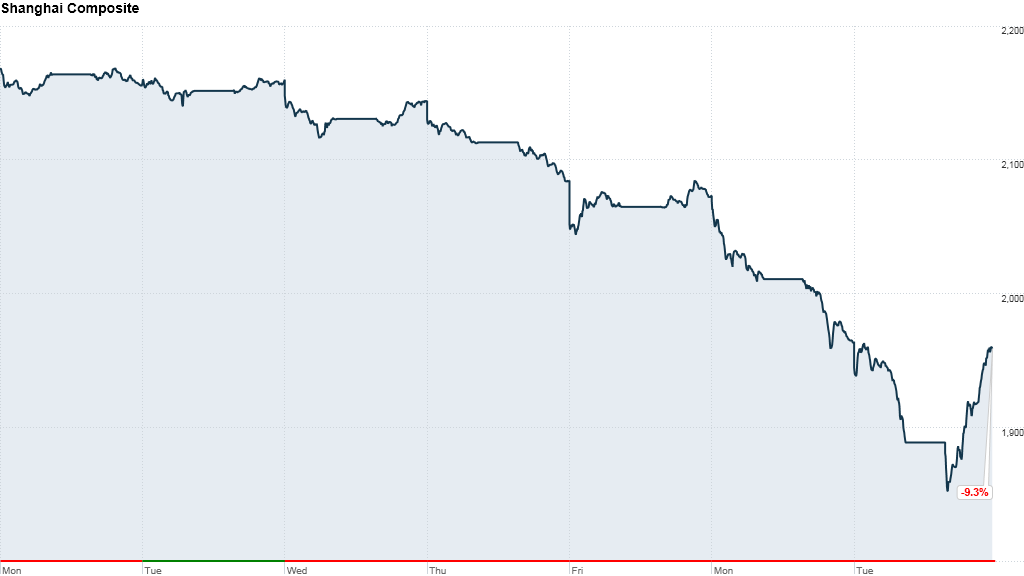

The Shanghai Composite reeled again on Tuesday, dropping as much as 5.6% -- and then gaining virtually all of it back -- as concerns over credit conditions in China continued.

The index rallied back as a China central bank official reportedly said the bank would support adequate bank lending.

Over the past week, investors have been spooked by a jump in short-term borrowing costs in the country.

The roller coaster performance is just the latest trial for China's marquee index. The struggling Shanghai Composite entered bear market territory Monday after losing 5.3% of its value, and is now down more than 13% from the start of the year. It ended slightly lower Tuesday.

Driving the market unease is bank lending. The rate at which Chinese banks lend to each other overnight hit a record high above 13% last week. Another key measure of cash in the banking system -- the 7-day "repo rate" -- peaked at 25%.

Rates have since eased somewhat, but remain above recent norms. Tight credit conditions have unnerved investors and heightened concerns over the country's banks.

The sustained spike in rates has led analysts to question why the central bank's leaders did not quickly intervene, and why the bank's intentions were not communicated to investors as rates continued to rise.

Related story: Is China's debt a crisis in the making?

Official state media unraveled some of the mystery over the weekend, reporting that the China's shadow banking system was the central bank's target. "It's not that there's no money," a Xinhua commentary said. "It's that the money is not in the right places."

Some analysts worry that China's credit boom has saddled unworthy businesses with large loans, fueled the country's shadow banking system and put local governments on the hook for billions.

A credit squeeze by the central bank would discourage risky loans, and help China's economy complete a rebalancing that most experts say is required to secure long-term growth.

Related story: Don't worry! It's not 2008

The central bank suggested Monday that its tough medicine is likely to continue.

"Commercial banks must pay close attention to the liquidity situation in the market and must strengthen their analysis and forecasts of factors affecting liquidity," the central bank said in a note posted Monday but dated June 17.