It costs a lot to be poor in the state of Washington.

Residents who make the least amount of money pay about 17% of their income in state and local taxes, according to a new report from the Institute on Taxation and Economic Policy. Meanwhile, Washington's highest earners cough up just 2.4% of their income for such taxes.

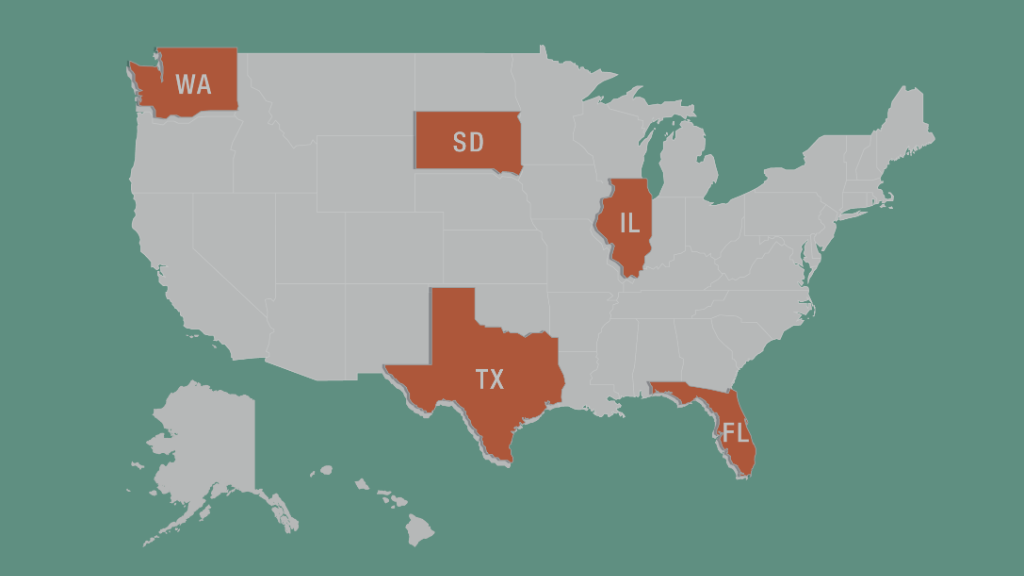

The high tax rate on the poor, coupled with that huge gap in the tax burden between the poor and the top 1%, is why Washington ranks as the most regressive-tax state in the nation, according to the liberal think tank's study.

Other states where the poor are bearing some of the heaviest tax burdens in the country, include Florida, Texas, South Dakota and Illinois. There, the poor pay between 11% and 13% of their income in state and local taxes, compared to the 2% to 5% paid by the highest earners.

These top regressive states earn their ranking primarily because they do not -- with the exception of Illinois -- have an income tax, and instead rely heavily on sales taxes for much of their state and local revenue.

The net effect: the poor pay a significantly higher percentage of their income on sales taxes than the top 1%. That's because the poor typically spend about three-quarters of their income on items that are subject to sales tax, whereas top earners only end up spending about a sixth of their income on taxable items.

Related: Kansas tax cuts on trial amid big budget deficit

"No-income-tax states like Washington, Texas and Florida do, in fact, have average-to-low taxes overall. However, they are far from 'low-tax' for poor families," the report notes.

In Illinois, there is an income tax but it's a flat rate for everyone, and the state's sales tax accounts for 7% of poor taxpayers' income relative to just 0.8% for the top 1%.

By contrast, the 5 states with the narrowest gap in tax burdens between poor and rich are Delaware, the District of Columbia, California, Oregon, and Montana. In Delaware, for instance, the lowest earners pay 5.5% of their income in state and local taxes, versus 4.8% paid by top earners.

The purpose of the ITEP study was to see how state and local taxes affect income inequality. The broad result: They worsen the divide in all 50 states, albeit to varying degrees.

That contrasts with federal taxes, which actually narrow the income inequality gap. It narrows on an after-tax basis because the federal tax code is very progressive and low-income households are often eligible for many valuable tax breaks, such as the Earned Income Tax Credit.