Donald Trump may love bashing hedge fund managers, but his tax plan would still be a big windfall for the rich.

Trump wants to reduce the current seven tax brackets to four, bringing the top rate on the wealthy down to 25%, from 39.6%. That would be a hefty tax cut for the rich.

Certainly, Trump is proposing to eliminate perks for the wealthy like getting rid of certain deductions and closing some loopholes. And his plan also contains treats for the middle class and lower-income Americans.

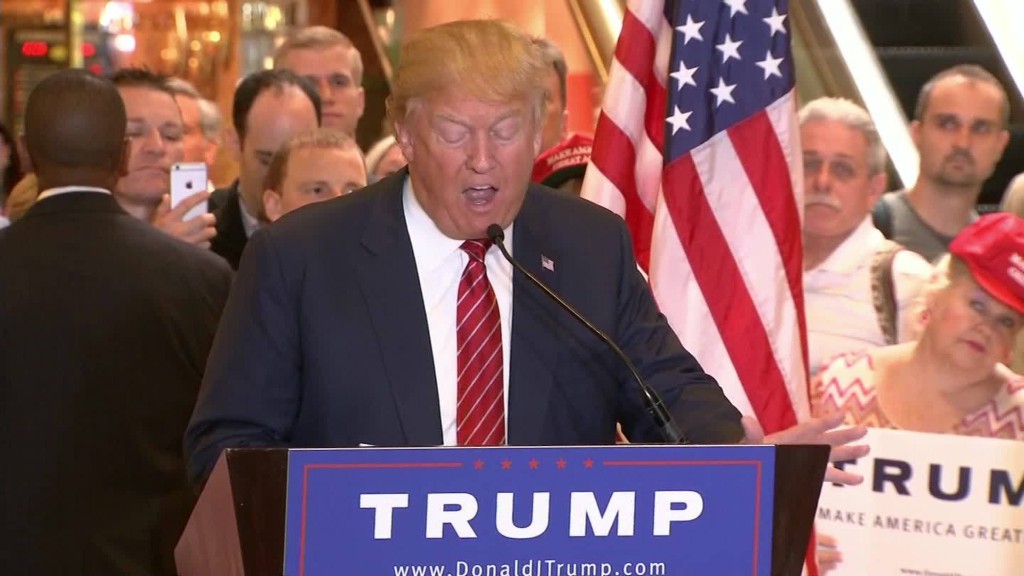

"It will provide major tax relief for middle income and for most other Americans. There will be a major tax reduction," Trump said as he unveiled his plan on Monday.

But despite all his populist speeches, Trump is still taking care of his peers.

"It's hard to imagine a way it would not benefit the rich," said Roberton Williams, senior fellow at the Tax Policy Center.

Here's how Trump's plan would affect Americans up and down the income ladder:

The wealthy: Under Trump's plan, singles earning more than $150,000 and couples earning more than $300,000 would pay only 25% on their income above those thresholds. But they would also benefit from the lowering of the other tax rates to 0%, 10% and 20%.

Trump would also eliminate the estate tax, which affects only the very wealthy with more than $5.43 million in assets when they die. He would get rid of the Alternative Minimum Tax, which ensnares many affluent families but also hits some in the middle class. And he would eliminate the marriage penalty, which lowers the bill for some wealthy folks since their combined income pushes them into higher tax brackets faster than if they were earning the same amount as a single taxpayer.

As for long-term capital gains, another favorite target of Republican politicians, Trump appears to leave it at 20%. He does not mention the 3.8% surcharge on investment income for taxpayers with adjusted gross incomes exceeding $200,000 for singles and $250,000 for couples.

It's not a total giveaway, though. Trump says he would reduce or eliminate most deductions and loopholes available to the very rich. He would limit their ability to itemize deductions and to claim the personal exemption. And he would phase out the tax exemption on interest from life insurance policies and eliminate the tax preference on carried interest for hedge fund managers.

"We're reducing taxes, but believe me, there will be people in the very upper echelon that won't be thrilled with this," he said.

Trump's not touching two favorite itemized tax deductions: charitable giving and mortgage interest. While the middle class claim these too, they mainly benefit top filers. Only 30% of taxpayers itemize and most of them are wealthy.

But he doesn't provide further details, making it difficult to calculate just how much the rich would benefit.

The middle class: Those in the middle class would likely pay less in taxes than they do now. For instance, a single filer earning $50,000 would pay nothing on half his earnings and only 10% on the second half. Currently, about a quarter of his income would be taxed at a 25% rate.

"In order to achieve the American Dream, let people keep more money in their pockets and increase after-tax wages," Trump's proposal reads.

As for deductions, Trump says those in the 10% bracket would keep all or most of their deductions. Taxpayers in the 20% bracket -- singles earning up to $150,000 and married couples earning up to $300,000 -- would retain more than half of their deductions. He doesn't give more details.

Some in the middle class will benefit from the elimination of the Alternative Minimum Tax. The Tax Policy Center estimates that 953,000 households making between $50,000 and $200,000 had to pay the AMT this past tax season.

The low-income: Trump is proposing a 0% tax rate for singles earning less than $25,000 and couples with incomes below $50,000. His plan says that this will remove nearly 75 million households from the income tax rolls.

He will also make it easier for them to file by introducing a single-page form.

Trump says that all these tax cuts are paid for in large part by eliminating deductions and loopholes on the rich and on corporations, as well as by levying other taxes on businesses.

But until he provides some more details, it's difficult to know if that's true.