About half of American workers don't get any help saving for retirement. No pension. No 401(k).

But many CEOs are getting tax benefits and special pension payments that aren't offered to workers outside the C-suite.

These perks, along with their huge paychecks, allow executives to amass some pretty big nest eggs.

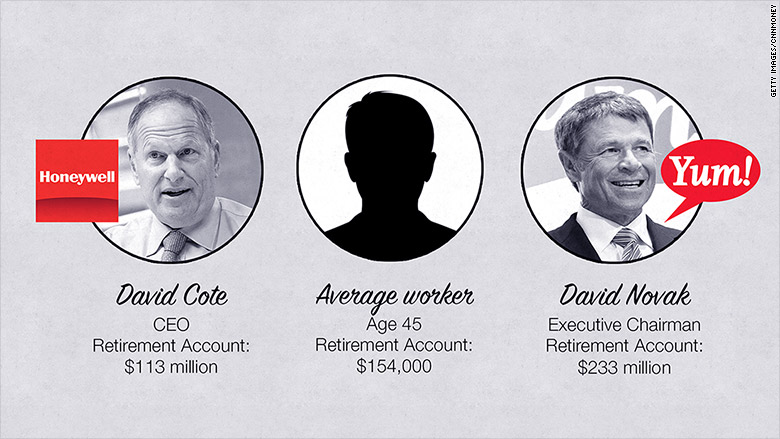

The largest personal retirement account among Fortune 500 CEOs tops $234 million, according to an analysis from The Center for Effective Government and the Institute for Policy Studies. It belongs to David Novak. He's the executive chairman and former CEO of Yum Brands (YUM), which owns fast food restaurants Taco Bell, Pizza Hut and KFC.

Meanwhile, the company stopped offering pensions to new hires in 2001. It does offer a 401(k) plan to every worker, with a generous 6% match. About 8,800 of Yum's workers had at least something in their 401(k) at the end of last year, with the average at about $70,000, according to the study.

While Novak will get a pension, most of his retirement income will come from what he's saved in a tax-deferred compensation plan set up by the company. It's similar to a 401(k) account.

He saved about $940,000 in that account last year alone. It currently has a cumulative balance of $233 million.

Overall, the average account balance for Americans in their 40s who have worked at their company for more than 20 years is about $154,000, according to the Employee Benefit Research Institute.

Related: 401(k) contribution limits won't be going up next year

Novak has been a senior executive with the company for 29 years, 15 of which he was CEO.

"His deferred compensation was directly linked to the performance of the company and primarily consists of bonuses he earned and deferred into YUM stock, which appreciated 900% during his leadership," said Jonathan Blum, chief public affairs officer at Yum.

Even if Yum workers made millions of dollars, they still wouldn't be able to put that much money into their retirement account.

That's because annual contributions typical workers make to their 401(k) accounts, are capped at $18,000 a year for those under the age of 50 and at $24,000 for those who are older. (IRA accounts have a much lower cap on annual contributions than 401(k) plans.)

The special tax-deferred accounts that some companies make available to their top execs, however, typically don't limit the size of an annual contribution. Fortune 500 CEOs have nearly half of their retirement assets in deferred compensation plans, the study said.

Related: Why 8,737 UPS retirees are bracing for pension cuts

Other CEOs stashed away even more in these accounts last year than Yum's Novak. Progressive CEO Glenn Renwick invested $26.2 million in his tax-deferred account, Comcast (CCV)CEO Brian Roberts saved $23.5 million and Morgan Stanley (MSPRG) CEO James Gorman put away $10.2 million, according to the study.

Like 401(k) investors, they'll have to pay taxes on that money when they retire. Without that benefit, they'd have to pay income taxes on the money when they receive it and on any investment returns in the future. But unlike a 401(k), money in the exec's tax-deferred accounts isn't guaranteed by the government. And the money typically can be used for things other than retirement.

While fewer workers are being offered any kind of pension anymore, the CEOs at 252 Fortune 500 companies are offered a special pension, sometimes called a supplemental executive retirement plan or SERP. How they work varies widely, but the company often promises to pay out a certain amount to the exec once they retire. But pensions tend to make up a small part of an exec's overall retirement nest egg.