Turns out the middle class aren't the only ones suffering from stagnating incomes.

The income of the Top 1% is also below where it was before the Great Recession, largely because America's richest took a massive hit during the economic downturn. They have yet to recover, despite the fact that they've captured the majority of the income gains since then.

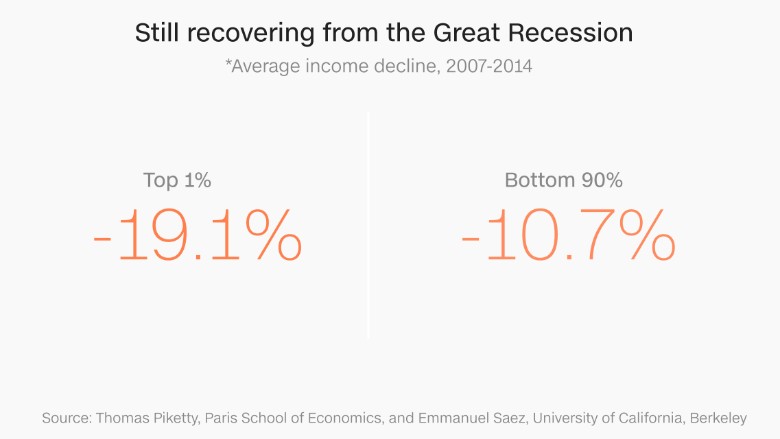

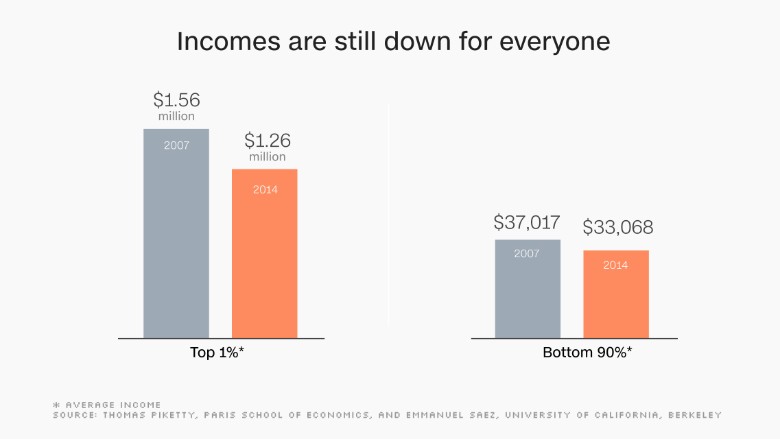

The Top 1% had an average income of $1.26 million in 2014, down from $1.56 million in 2007. That's a 19.1% drop, according to an analysis of tax data by Emmanuel Saez, University of California, Berkeley, and Thomas Piketty, Paris School of Economics.

In addition to the disintegration of the stock market, the wealthy were hurt by the weak economy. They earn much of their income from capital gains and business profits.

The Bottom 90%, meanwhile, saw their average incomes fall 10.7% to $33,068 in 2014, from $37,017 in 2007.

"It's not the case that the Great Recession had no impact on the top," said Scott Winship, senior fellow at the right-leaning Manhattan Institute. "The Great Recession crushed the top. Both groups have to get back to pre-recession levels."

The tippy top of the ladder -- the Top 0.01% -- actually have the farthest to go in order to return to pre-2007 levels. Their incomes are down 27.4% to $29 million in 2014.

Related: No one stays in the Top 1% for long

"The confusion comes because no one says that in the recession, [the rich] had a huge share of the income losses," said Gary Burtless, senior fellow at the Brookings Institution.

The presidential election has thrown the fortunes of the Top 1% back into the spotlight. Bernie Sanders, a Democrat running on a platform of reversing income inequality, has repeatedly said that almost all the new income is going to the Top 1%.

That's not quite true anymore. The Top 1% captured 58% of the income gains between 2009 and 2014, according to Saez and Piketty's latest analysis. Much of that spike came in the early years of the recovery, when the stock market rebounded. Between 2009 and 2012, the Top 1% took home 91% of the gains.

Related: Good news for the 99%...absolutely killer news for the 1%

But that still hasn't made them whole. In fact, it hasn't even returned them to 2000 levels. Back then, the average income for the Top 1% was $1.39 million. (It was $37,654 for the Bottom 90%.)