You may have heard that insurers are hiking Obamacare premiums by 30%, 40% or even more next year.

Certainly, some companies have requested hefty rate increases for certain policies. But that doesn't mean that everyone will be writing a much bigger monthly check to their insurer.

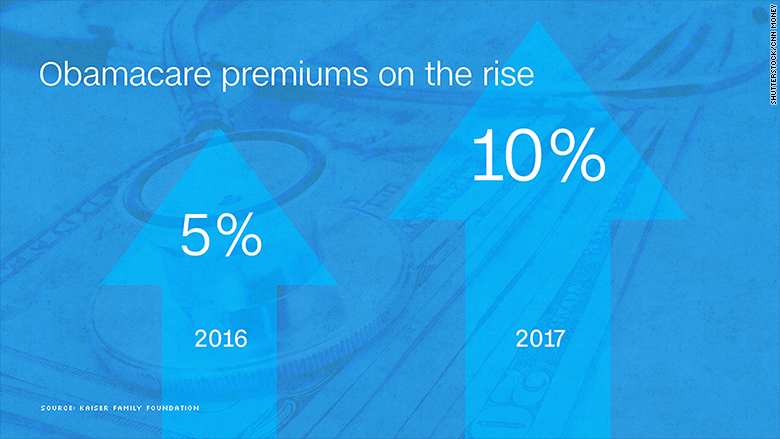

The benchmark silver plan premiums are projected to rise 10% for 2017, on average, according to a new Kaiser Family Foundation report that looked at insurers' proposed rate increases for a 40-year-old consumer in 14 major cities. That's double the 5% increase for 2016 policies, but it could change since state regulators often reduce insurers' rate requests.

The average figure, however, belies the wide range of requested premium increases in different cities. For instance, in Providence, Rhode Island, the benchmark plan would cost $229 a month, down 13% from this year. But in Portland, Oregon, it would cost $308, or 18% more.

Related: Obamacare premiums in California may rise 8% next year

The pricing of the benchmark plan -- the second lowest cost silver policy in an area -- is important because it is one of the most popular choices and federal subsidies are based on it. Enrollees who qualify for subsidies and pick the benchmark plan don't feel the impact of the rate hikes since the federal payments cover all but 9.66% of the cost. Some 82% of enrollees received subsidies last year.

The Obama administration said premiums on the exchange increased just $4 a month, on average, in 2016 after consumers shopped and received subsidies, also known as tax credits.

"This is just the beginning of the rates process, and despite headlines suggesting double digit increases, proposed rates aren't what most consumers actually pay...," said Ben Wakana, a spokesman for the Department of Health and Human Services. "The vast majority of consumers qualify for tax credits that reduce the cost of coverage below the sticker price, and people can shop around and find coverage that fits their needs and budget."

This means that consumer must review their options when enrollment opens in the fall. The benchmark plan could change year-to-year so policyholders who allow themselves to be automatically re-enrolled could be in for a nasty shock when they get their first 2017 bill.

Insurers are raising their rates for several reasons, said Cynthia Cox, Kaiser's associate director of health reform. First, two federal programs to minimize insurers' exposure to high-cost enrollees are ending. Also, health care costs rise every year.

And perhaps most important, many Obamacare enrollees are turning out to be sicker and more expensive than insurers predicted. So the premiums didn't cover the claims.

Related: Obamacare patients sicker and pricer than expected

"Several insurers have to raise rates to more accurately reflect the cost of the people in those plans," Cox said.

The unexpectedly high costs are prompting some insurers to exit or minimize their presence on the exchanges. One of the highest profile insurers is UnitedHealth (UNH), which is drastically scaling back its offerings after announcing it expected to lose nearly $1 billion on Obamacare.

Related: UnitedHealth expects to lose nearly $1 billion on Obamacare

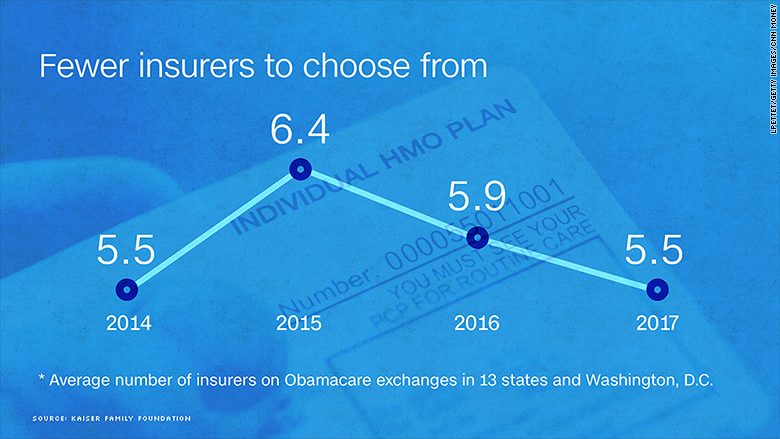

Overall, the number of insurers in the 13 states and District of Columbia that Kaiser examined is dropping to 5.5 for 2017, down from 5.9 this year and 6.4 a year earlier.

But again that depends on where one lives. Seven states will have fewer insurers to choose from, but three states are seeing at least one new company join the exchanges.

The number of insurers varies widely by state and local area. There are only two insurers to choose from in Vermont, Rhode Island and D.C., for instance, but 15 in New York.

While Obamacare is going through an adjustment period, Cox does not believe it is in a death spiral. The premium increases were less than what Kaiser was expecting for this year and there are still enough insurers participating on the exchanges to make them a competitive market.