Will the Fed soon raise interest rates or not? That's the question that's on everyone's minds these days.

It appears to be the main reason market volatility has returned now that people have closed up their beach houses for the summer, kids are back in school and football season has started. (Go Giants!)

Stocks plunged Friday because of worries that the Fed might boost rates sooner rather than later.

The market bounced back Monday as investors applauded comments from Fed governor Lael Brainard about the Fed needing to exercise "prudence" before raising rates.

Then stocks took another tumble Tuesday as oil prices sank. The Dow was down nearly 250 points in midday trading as energy stocks took a big hit.

Related: Global glut forecast puts pressure on oil prices

Lower oil prices should mean lower inflation, though. And that could keep the Fed on the sidelines a little longer.

So when will the Federal Reserve act? It has raised interest rates just once since the financial crisis in 2008 -- a quarter-percentage-point hike last December. Rates are still very close to zero.

Some market experts -- and even Fed members -- have been talking more lately about why the Fed should soon look to "normalize" interest rates.

Here's a look at why the Fed should raise rates ... and why it shouldn't.

The job market is improving. Unemployment is low. Job gains have been steady, if unspectacular. That's a good sign for the economy, and a reason to end the crisis-era level of interest rates.

The market is stable. Stocks are not far from record highs. Corporate earnings, while not great, are expected to improve in the latter half of 2016 and into next year.

Household income is up. Consumers are finally making more. Median income rose 5.2% last year, the first increase since 2007. That's largely because the healthy job market is starting to push up wages.

These are all good signs. But there are still some compelling reasons the Fed shouldn't do anything just yet.

The rest of the world IS in crisis mode. Rates are extremely low in Europe and Japan. China's economy is slowing.

It's hard to justify why the Fed should be the lone wolf ... or, in this case, hawk ... and start pushing rates higher when other central bankers remain dovish and are keeping rates low.

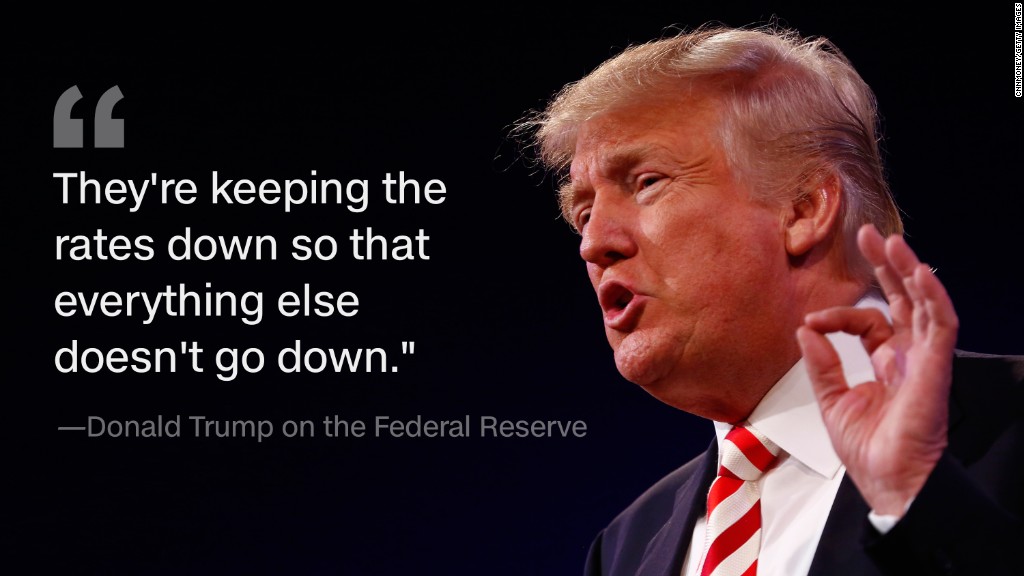

The election conundrum. Yes, the Fed is supposed to be apolitical. But Republican nominee Donald Trump has been criticizing Fed chair Janet Yellen and the rest of the central bank for keeping rates too low. Should Yellen raise rates now and risk looking like she's responding to Trump's attacks?

Wages may be up ... but where's the inflation? The Fed is supposed to only worry about two things. Employment and price stability. Managing the emotional market has become an unofficial third mandate.

The job market has improved. But wages, while higher lately, are still not up enough to spark realistic worries about inflation.

Related: Trump says Yellen should be "ashamed" for keeping rates low

Oil prices have started to pull back again as well ... and remain well below where they were a few years ago. Other commodity prices -- particularly those related to food -- have plummeted, too. That's good for consumers but it's put pressure on big grocery store chains.

Add all this up and it looks like the Fed may be warranted in holding off on a rate hike.

But make no mistake. The sleepy days of summer are over. Investors are back to reacting (and perhaps overreacting) to every piece of data and wondering what it will mean for the Fed. Just like Mr. Kotter, it's time to sing welcome back to volatility.