Saudi Arabia is one year into a plan to break its addiction to oil. It's been an uphill struggle so far.

Under pressure from a collapse in oil prices, Deputy Crown Prince Mohammed bin Salman last April unveiled his Vision 2030 to transform the kingdom's economy.

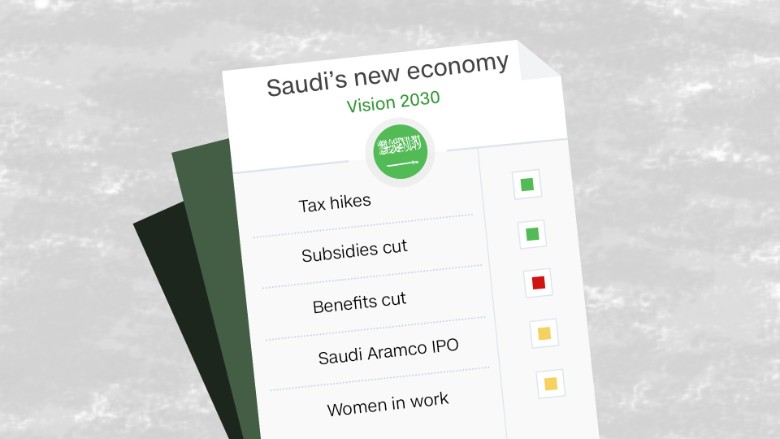

Progress has been made. Taxes are being introduced, and subsidies cut to plug a huge budget hole. And officials are preparing the center piece of bin Salman's strategy -- selling part of Aramco, the world's top oil producer.

But much more work is needed to open the kingdom to foreign investors, develop other areas of the economy, and wean Saudis off lavish state support.

Some observers questioned the government's commitment to kicking the oil habit when benefit cuts for officials were reversed last month.

Bin Salman said the cuts were a temporary measure.

"They were reviewed at the appropriate time after oil revenue improved," he said late Tuesday in a rare interview on Saudi television. The price of oil has nearly doubled since early last year.

Budget deficit falling

Rising oil revenues have helped ease the pressure on Saudi Arabia's budget deficit, which ballooned to 366 billion riyals ($98 billion) in 2015, and 297 billion riyals in 2016.

"2016 was a tough challenge... for a country that is heavily heavily dependent on oil for revenue, it was a big shock," said Mosaed Al-Ohali, chief financial officer at Saudi Arabia's giant petrochemicals company Sabic. "The good thing about it is the response, the 2030 vision came at the right time."

To plug the gap between revenue and spending, Saudi tapped international investors for the first time ever. It raised $17.5 billion in October, and then $9 billion by selling Islamic bonds last month.

The government is trying to make its finances more transparent, and plans to balance the budget by 2020. Bin Salman said the deficit in the first quarter of this year came in 44% below forecast.

Related: Citi returns to Saudi Arabia with a woman in charge

Slower growth

Oil prices have been jacked up by output cuts adopted by Saudi Arabia, OPEC, and other producers. But the cuts are hurting growth in the kingdom, because other areas of the economy are unable to pick up the slack.

The International Monetary Fund expects Saudi growth to slump to 0.4% this year, down from 2% in 2016.

"The slowdown in growth is to be expected," said Timothy Callen, the IMF's assistant director for the Middle East. "On the global perspective, across oil exporters, Saudi Arabia still did relatively well."

Now the Saudi government is trying to find ways to spur a recovery -- and listing Aramco on the stock market next year is central to that goal. Many details of the IPO have yet to be confirmed.

Saudi officials have said they expect an IPO to value Aramco at around $2 trillion. Independent analysts say it may be worth closer to $1.4 trillion. Either way, selling just 5% would raise $70-$100 billion to invest in other areas.

Up to 70% of the proceeds from the IPO will be plowed into the domestic economy, with a focus on mining, retail and logistics, Bin Salman said.

"It's not just to create jobs, it's to enhance the environment of productivity," said Mazen Al Sudairi, head of research at Al Rajhi Capital in Riyadh. "We have so many sectors that are unproductive."

Related: Saudis take 100% control of America's largest oil refinery

More foreign cash needed

No matter how huge the Aramco IPO, Saudi Arabia desperately needs more foreign companies to set up shop in the kingdom, not only to boost growth but to make local business more efficient.

"The challenge is to attract more foreign direct investment," said Al Sudairi, adding that the country has one of the lowest levels of foreign investment in the world.

Saudi Arabia may seek more foreign cash in the short term too.

Finance Minister Mohammed Al Jaddan said the kingdom could tap international investors again this year as it tries to reduce its dependence on oil.

"We need to think totally differently about how we are going to get our revenue," Al Jaddan said.