1. Investment restrictions: The Trump administration has decided against imposing outright limits on Chinese investment in the United States.

Instead, it will rely on Congress to strengthen an existing government body that evaluates individual corporate deals for national security risks, senior administration officials told reporters Wednesday.

Reports that new restrictions were coming triggered a sell-off in tech stocks earlier this week.

The Chinese yuan reversed some of its losses against the dollar after the announcement. The benchmark Shanghai Composite, which closed before the announcement, shed 1.1% on Wednesday.

2. Oil jumps on Iran: US crude futures increased 0.4% on Wednesday to trade at $70.80 per barrel.

Prices jumped by over 3.5% on Tuesday after the US State Department said it expects all countries to end imports of Iranian oil by November 4.

The news suggests the Trump administration is holding a hard line as it withdraws from the 2015 Iran nuclear agreement under which Iran rolled back its nuclear program in exchange for broad sanctions relief.

A new report on US crude inventories will be released at 10:30 a.m. ET.

3. Financial health check: The Bank of England will publish its Financial Stability Report on Wednesday, offering its views on risks to the UK financial system.

Central bank governor Mark Carney will speak about the report at 6:00 a.m. ET.

4. GE spikes: Shares in General Electric jumped 8% on Tuesday, the biggest gain in three years, after the company announced plans to sell off more businesses.

Cash-strapped GE (GE) said Tuesday it will spin off its health care business and sell its stake in oil and gas company Baker Hughes (BHGE).

The announcement came on the same day that GE was removed from the Dow Jones Industrial Average, ending its 110-year run in the elite 30-stock index.

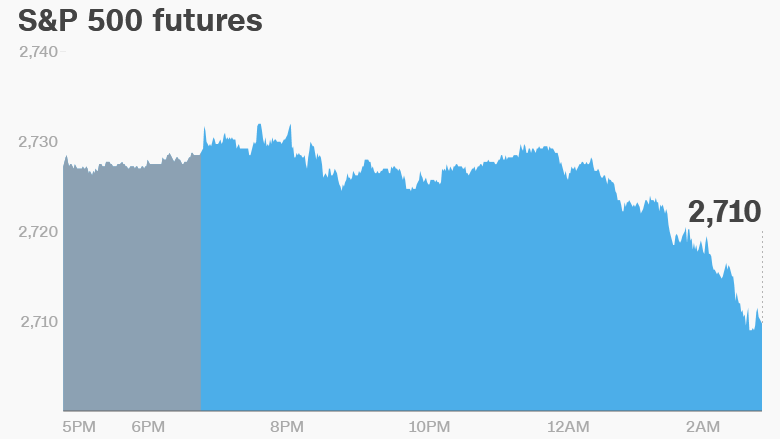

5. Global market overview: US stock futures were lower.

European markets opened down, following a negative trading session in Asia.

The Dow closed 0.1% higher on Tuesday. The S&P 500 gained 0.2% and the Nasdaq added 0.4%.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

6. Earnings and economics: General Mills (GIS) will release earnings before the open. Bed Bath & Beyond (BBBY), Pier 1 Imports (PIR) and Rite Aid (RAD) will follow after the close.

Markets Now newsletter: Get a global markets snapshot in your inbox every afternoon. Sign up now!

7. Coming this week:

Wednesday — Bed Bath & Beyond (BBBY), General Mills (GIS), Rite Aid (RAD) earnings

Thursday — Nike (NKE), Walgreens Boots Alliance earnings; Foxconn (TPE) breaks ground in Wisconsin; Stress test results

Friday — University of Michigan Consumer Sentiment report, US inflation data