1. Xiaomi price: Xiaomi, a smartphone maker that has rocketed to success in China and India, has reportedly priced its Hong Kong IPO.

The tech company priced nearly 2.2 billion shares at the low end of its target range of 17 to 22 Hong Kong dollars ($2.17 to $2.80), according to media reports.

The Beijing-based electronics firm is known for its affordable iPhone alternatives and internet-enabled rice cookers.

Investors may be worried about the company's growth potential and its margins.

2. Another blow for Deutsche: Deutsche Bank (DB) was the only major financial institution to fail annual stress tests carried out by the US Federal Reserve.

The central bank objected to the capital plan of the German bank's US subsidiary, citing "widespread and critical deficiencies across the firm's capital planning practices."

Although the stress test showed the bank's US arm would survive a recession, it also found "material weaknesses," including over its data capabilities and controls, how it forecasts losses under stress and risk management functions such as internal audit.

In a statement, the bank said its US subsidiary has made "significant investments" to improve its capital planning, controls and infrastructure.

It's the latest in a series of setbacks for Deutsche, which has been losing money for years, lagging its global peers and struggling to find direction following the global financial crisis.

Shares in Germany's largest lender opened 1.7% higher on Friday.

3. Novartis spin: Novartis (NVS) has announced plans to spin off its eye care devices business Alcon. The pharmaceutical giant said the move would allow it to focus more on its core business.

Novartis bought Alcon from Nestle in 2011, in a deal that valued the company at over $50 billion.

Shares in Novartis jumped 3% in Zurich. The company also announced a plan to buy back shares worth $5 billion by the end of 2019.

4. Half time: The second quarter wraps up on Friday.

It's been a mixed year so far for US stocks: The Nasdaq has gained nearly 10% in 2018, while the S&P 500 has added almost 2%. The Dow has dropped 2%.

Fears over a global trade war have stoked volatility. The Dow plunged 1,000 points twice during the quarter.

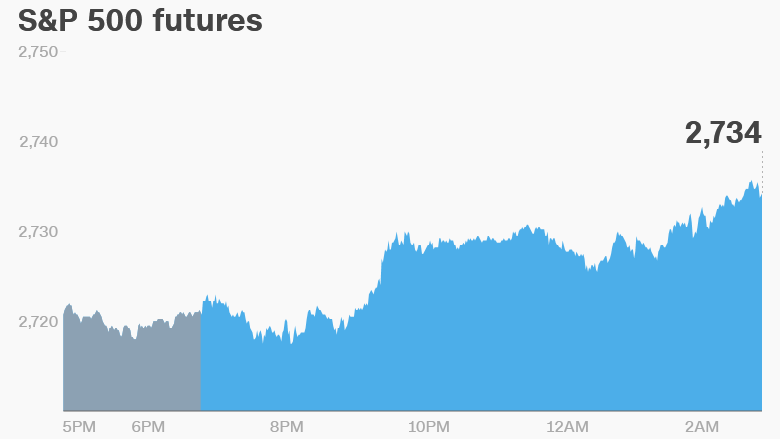

5. Global market overview: US stock futures were pointing higher.

European markets opened higher after EU leaders struck a deal on migration. Asian stocks also gained.

The Dow added 0.4% on Thursday. The S&P 500 gained 0.6% and the Nasdaq increased 0.8%.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

6. Earnings and economics: Constellation Brands (STZ) will release earnings before the open.

The Bureau of Economic Analysis will publish personal income and spending reports for May, along with the latest inflation data, at 8:30 a.m. ET.

The University of Michigan consumer sentiment report for June will follow at 10:00 a.m.

Markets Now newsletter: Get a global markets snapshot in your inbox every afternoon. Sign up now!

7. Coming this week:

Friday — University of Michigan consumer sentiment report, Inflation data